Politicians at the U.N. climate conference in Scotland dropped the ball by not cracking down harder on fossil fuels, environmentalists say.

But you can pick up where the Conference of Parties, or COP26, left off — by directing your investment dollars to companies that help conserve energy. And you don’t have to give up returns to do so.

That’s because several companies in the top-performing chip sector are good plays on energy conservation in industry, and electric vehicles (EV). We’ll get to five stocks, below.

One warning, though: The chip sector is up an impressive 17% since I last wrote bullishly on the group in August, as measured by the iShares Semiconductor SOXX, +0.28% exchange traded fund.

Stocks that make big moves tend to consolidate. But for long-term investors, chip companies are still good names to own.

“It is an excellent place to invest over the next five to 10 years,” says Motley Fool chip sector analyst John Rotonti. While consolidation is possible, the notorious cyclicality of the group has waned, he says.

Here are five chip sector stocks that look like good ESG plays because they check the first box in the “environmental, social and governance” investing theme.

Energy-efficiency plays

These are a favorite among ESG investors including Impax Asset Management.

“We are interested in semiconductor companies because of the profound energy efficiency from using chips to monitor performance data,” says David Winborne, a portfolio manager at Impax Asset Management.

Chip companies he singles out, Texas Instruments TXN, +0.87% and Analog Devices ADI, +0.38%, produce analog chips that help measure things like temperature, humidity pressure, sound or speed.

In “smart factories,” these chips help companies do predictive maintenance to keep machines running smoothly and prevent downtime. “That is a big energy saver,” says Winborne. “Chips can make processes more energy-efficient.”

Texas Instruments is also a favorite of Rotonti at Motley Fool. It’s the largest analog chip maker in the world with 18% market share, he says, selling mainly into the auto and industrial sectors. Texas Instruments has high profit margins, in part, because it is the only analog chip maker using 300-millimeter silicon wafers, which reduces manufacturing costs. The company reported a 22% third-quarter revenue gain on Oct. 26 to $4.64 billion, citing strength in the industrial, automotive and personal electronics markets.

Analog Devices reports earnings Nov. 23. It posted record sales of $1.76 billion for the second quarter, a 21% increase.

EV plays

Electric vehicles wouldn’t work without a broad array of chips that help with everything from power management to performance monitoring. They also support autonomous driving vehicles by powering position sensors, and all the compute-intensive calculations that are required.

One stock to consider here is ON Semiconductor ON, -0.19%, says Lamar Villere, who manages the Villere Balanced Fund Investor Fund VILLX, -0.71%. ON Semiconductor posted record revenue of $1.74 billion for the second quarter on Nov. 1, a 32% increase.

Another solid EV chip play is NXP Semiconductors NXPI, +0.31%, says Hendi Susanto, a portfolio manager and technology analyst at Gabelli. The company sells chips that support radar and safety features like assisted driving. Its chips also monitor performance; and help manage networks, infotainment systems and power flow.

Like ON Semiconductor, NXP benefits from strong auto demand and chip shortages. These trends support pricing power and profitability.

“NXP Semiconductors is running at full capacity,” says Susanto. “They can sell whatever they can produce.”

NXP also sells chips used in factories to support performance monitoring and connectivity. NXP delivered third-quarter revenue of $2.9 billion on Nov. 1, an increase of 26% compared to the prior year.

Water-conservation play

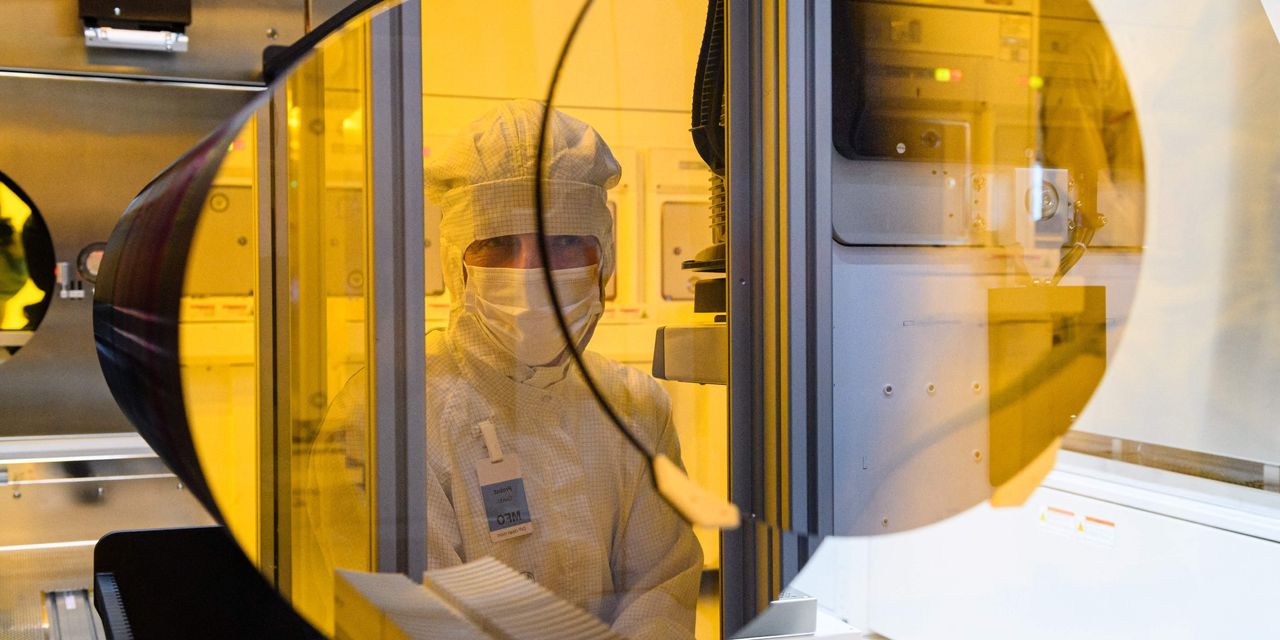

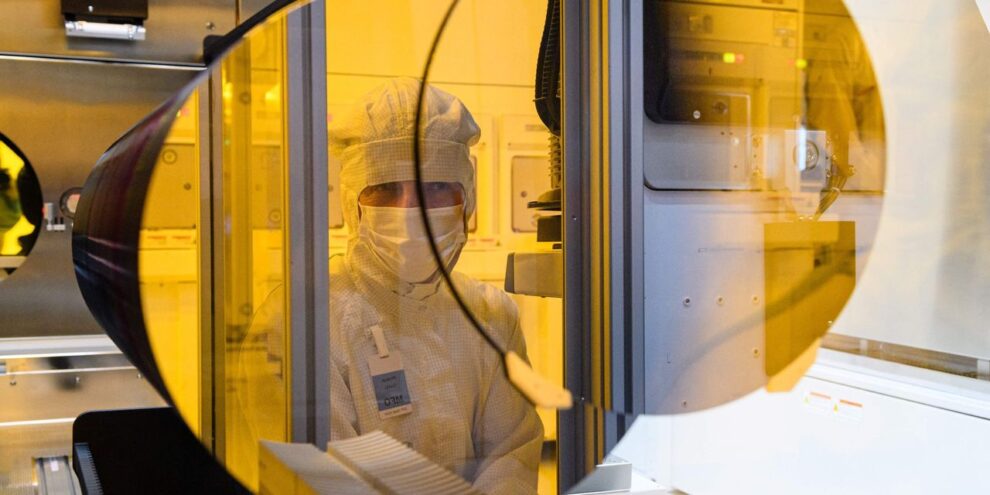

Chip manufacturers use lots of water to rinse chips between various stages of production. This makes them a frequent target of environmental activists, who point to growing water shortages over the next few decades. In response, Taiwan Semiconductor Manufacturing TSM, +0.71% is boosting its recycling efforts, and it deserves credit for this, says Winborne, at Impax Asset Management.

Last year, TSMC spent over $1.2 billion on recycling equipment and conservation efforts, the company says. The chipmaker said it saved 1.9 million metric tons of water last year via recycling and reduction of the amount of water used in production. The company has trimmed water consumption per chips produced by 8.9% since to 2010, and it targets a 30% reduction by 2030. Taiwan Semiconductor has also pledged to reach net-zero emissions by 2050.

Michael Brush is a columnist for MarketWatch. At the time of publication, he had no positions in any stocks mentioned in this column. Brush has suggested TXN, ADI and ON in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.

Add Comment