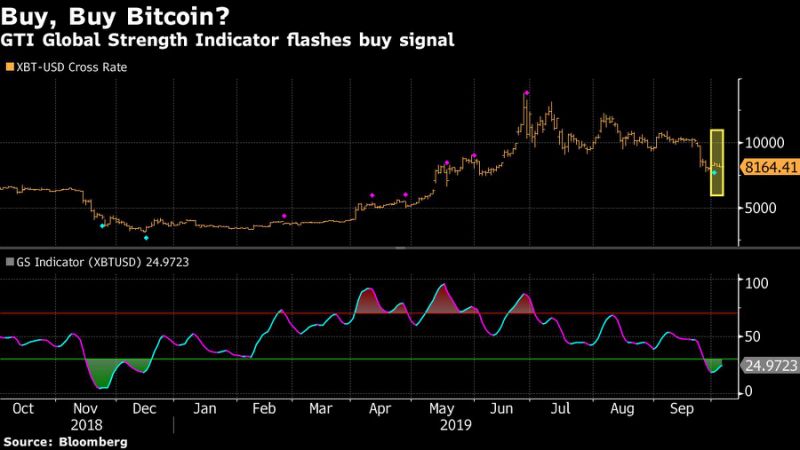

(Bloomberg) — As Bitcoin’s price continues to hold above $8,000, a technical indicator is flashing a bullish sign for the first time in nearly a year.

Based on the GTI Global Strength Indicator, a measure of upward and downward movements of successive closing prices, Bitcoin received its first buy signal since December. Its holding of the $8,000 level is adding to further optimism that could catapult the coin higher.

“The Bitcoin maturation process will accelerate into the year-end as volatility declines in a more subdued price-appreciation process,” Bloomberg Intelligence analyst Mike McGlone wrote in a note. “The initial euphoric transition to a bull from a bear market is over, which should lead to an extended consolidation period, but with positive bias for similar reasons as gold.”

The largest cryptocurrency has held steady even in the midst of some setbacks this week. The world’s most widely used digital token is Tether, not Bitcoin, according to new data from CoinMarketCap.com. Reports also showed that a number of Facebook Inc.’s backers for its stablecoin are having doubts about the project.

And a series of prominent investors have come out against the digital token this week. Billionaire investor Mark Cuban, for one, said in a YouTube Q&A session he’d rather “have bananas” than Bitcoin. Jered Kenna, an early Bitcoin millionaire, said he’s lost love for the industry.

The criticisms come after a rough couple of weeks for digital assets that saw Bitcoin drop below $10,000 and quickly lose another $2,000 in value. This week, the token’s seen an average daily move of 1.1%, data compiled by Bloomberg show. That compares with a move of 0.56% for gold, typically considered a safe asset.

For Mike Alfred, co-founder of Digital Assets Data, Bitcoin’s volatility is a natural range of possible outcomes.

“You should expect natural large swings in volatility,” he said in an interview at Bloomberg’s New York headquarters. “Otherwise the asset isn’t as interesting as everybody thinks it is.”

–With assistance from Kenneth Sexton (Global Data).

To contact the reporter on this story: Vildana Hajric in New York at [email protected]

To contact the editors responsible for this story: Jeremy Herron at [email protected], Dave Liedtka

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”29″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment