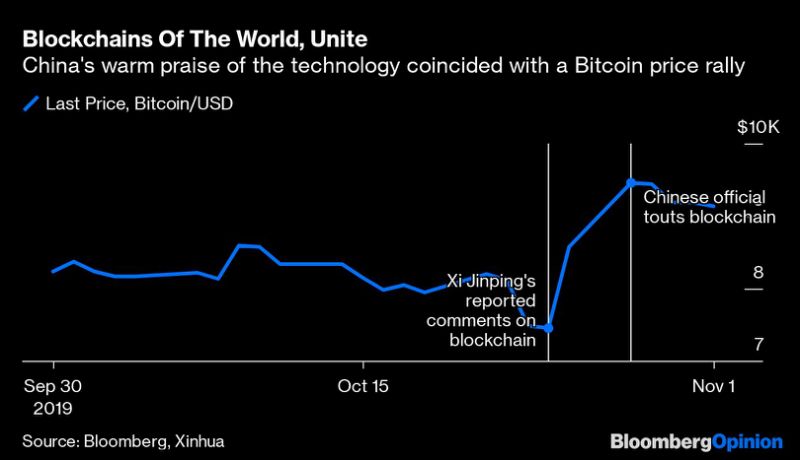

(Bloomberg Opinion) — China loves the blockchain, and the blockchain loves it back. Despite the People’s Republic having the least free internet in the world, and a ban on cryptocurrency trading, the Communist Party’s endorsement of the technology last month sent Bitcoin prices soaring almost 30% in a few days.

The irony is striking, considering Bitcoin’s anarchic origins. But there’s something broader going on here. The future of digital money is being shaped increasingly by national governments. Politicians are under pressure to make electronic payments more efficient, to neutralize the threat of cryptocurrencies to their sovereignty and to crack down on illicit money flows. None of that is good news for the blockchain’s true believers, however much a Beijing stamp of approval boosts the price of a Bitcoin.

States dabbling in blockchain technology, or planning to issue their own digital currencies, isn’t flattery – it’s competition. Some 70% of central banks surveyed by the Bank for International Settlements are examining their options in this area. In places like Sweden, rapidly going cashless, electronic “fiat” money is seen as a path to easier payments. If that works out, stateless crypto coins would lose one of their selling points.

The first central bank digital currency could be here within five years, according to International Business Machines Corp. It may be sooner given the political pressure and the financial Cold War between the U.S. and China. President Donald Trump has made clear that Facebook Inc.’s Libra will only get off the ground if it helps the U.S. dollar. Beijing is betting that its own digital currency efforts will help it resist American power. The euro zone thinks similar.

So we can assume more competition for the “legacy” cryptocurrencies from state actors. But what about the “crypto” (secret) part of digital money that attracts people? If e-dollars or e-yuan are centrally controlled and monitored (which they most certainly will be), surely that will compel privacy-craving users to stick with Bitcoin and its ilk.

Politicians are looking to destroy this competitive advantage for non-state digital currencies by making them less secure. Governments are investing heavily in a technology that could one day — in theory — crack the public-key cryptography underpinning Bitcoin: Quantum computing. The Trump administration has committed $1.2 billion to this endeavor. China is active too.

Google Inc.’s recent declaration of “quantum supremacy” doesn’t mean the tech is ready for this task; the author Olivier Ezratty notes that the kind of algorithm needed to crack Bitcoin encryption would demand much more power. But that may be available within a decade.

Already simpler tools are shining a light on cryptocurrency transactions by organized crime. Last month blockchain analysis helped U.S. and Korean authorities bring down one of the world’s largest markets for child pornography.

Crypto believers hate the idea of losing the cloak of privacy to prying government eyes. But will the general public feel the same? People are happy when states shine a light on the parts of the financial system that allow money laundering and tax-dodging. And if dollars or euros become digital assets issued by central banks, they might look more like the future of money than the power-sucking mining rigs that dominate Bitcoin.

In praising the blockchain, governments are out to bury the cryptocurrencies that gave birth to it. “Innovation in blockchain technology does not mean we should speculate in virtual currencies,” the People’s Daily newspaper wrote. Bitcoin fans take note.

To contact the author of this story: Lionel Laurent at [email protected]

To contact the editor responsible for this story: James Boxell at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Lionel Laurent is a Bloomberg Opinion columnist covering Brussels. He previously worked at Reuters and Forbes.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”32″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment