Shares of meal-kit company Blue Apron Inc. rallied Tuesday, after the company said it would start adding Beyond Meat Inc.’s plant-based proteins to its menus starting in August, sparking a round of short covering.

The stock APRN, +41.64% soared 55% on the news, while Beyond Meat BYND, +4.07% which has enjoyed stellar gains since going public in May, rose another 3%.

Blue Apron stock had fallen 40% in the year through Monday’s close, and the company conducted a 1-for-15 reverse stock split in June to bring it back into compliance with New York Stock Exchange listing standards, which do not allow a stock to trade below the $1 mark for a period of more than 29 consecutive days.

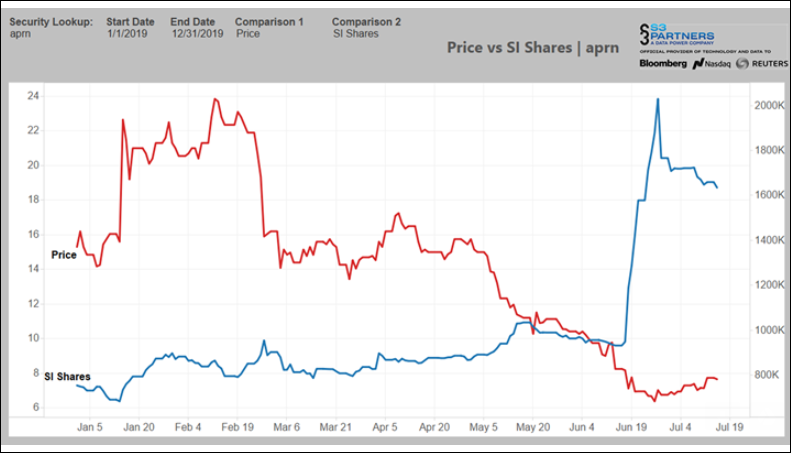

Short interest in Blue Apron has increased 117% in 2019, according to financial analytics firm S3 Partners, as the stock has tumbled. In July, the number of shares shorted declined by 132,000 as traders covered some of those positions as the stock rose 13% following the reverse split.

Overall, short sellers were up $7.2 million in mark-to-market gains in 2019, although the July rally cost them $1.7 million in losses, said S3 managing director of predictive analytics, Ihor Dusaniwsky. The stock’s move earlier Tuesday had cost another $3.99 million in mark-to-market losses, wiping out about half of the year-to-date gains.

See related: Short sellers are not evil, but they are misunderstood.

“Since we saw short covering during July’s rally, we should see additional short covering due to this spike in Blue Apron’s stock price as shorts rush to salvage and realize some of their year-to-date profits,” he said. “Beyond Meat short sellers have been bloodied by its over 100% post IPO returns, and now Beyond Meat is doing the same to Blue Apron short sellers.”

Read now: Kellogg is sitting on a ‘fake meat’ gold mine bigger than Beyond Meat

Related: As Beyond Meat soars, Conagra sees $30 billion opportunity in Gardein plant-based meat alternatives

In April, Blue Apron named Linda Kozlowski, a former chief operating officer at arts and crafts e-commerce retailer Etsy Inc. ETSY, -2.20% as its chief executive, replacing Brad Dickerson, who resigned.

Blue Apron has struggled ever since its IPO in mid-2017, hit by competitive pressures, a shrinking customer base and failed partnerships, including a deal to sell its meal kits at wholesale giant Costco Wholesale Corp. COST, +0.19%

The company has said it is on track for adjusted EBITDA profitability, but that metric is an adjustment of an already-adjusted number that has nothing to do with actual profit, as MarketWatch has reported in the past.

See now: Opinion: Blue Apron’s new CEO has a thankless task

Teaming up with Beyond Meat gives the company exposure to a company and product that is proving surprisingly popular with consumers, as well as investors. Beyond Meat’s stock is trading at about seven times its IPO price. Since going public, it has announced a steady stream of new retail and restaurant customers that now include Amazon.com Inc.’s AMZN, -0.51% Whole Foods, supermarket chain Alberstons, Kroger KR, -0.50% and Safeway, TGI Fridays, Del Taco, Bareburger, Carl’s Jr. and A&W.

Read: Beyond Meat stock climbs after it unveils new Beyond Beef product for later this week

“We know a growing number of customers are interested in plant-based proteins, whether as an alternative to meat, a desire to explore a new ingredient, or an opportunity to make more sustainable food choices,” Blue Apron Chief Executive Linda Kozlowski said in a statement.

The first recipes will include caramelized onion & cheddar Beyond Burgers with garlic green beans the week of August 19 and jalapeño & goat cheese Beyond Burgers with corn on the cob the week of August 26.

Read also: Alternative meat market could be worth $140 billion in 10 years, Barclays says

Blue Apron shares have fallen 82% in the last 12 months. The stock has an average hold rating among the few analysts that continue to cover it on FactSet.

See now: People like meal kits, but their business model is unsustainable

The S&P 500 SPX, -0.28% has gained about 8% in the last 12 months, while the Dow Jones Industrial Average DJIA, +0.02% has gained 9%.

In case you missed it: Beyond Meat goes public with a bang: 5 things to know about the plant-based meat maker

Add Comment