Those of us obsessed with the stock market — or even just our retirement funds — often tune in to watch a parade of characters standing behind a makeshift dais with their company logo proudly displayed, cheering wildly to the sounds of a ringing bell. Typically, this is the opening ceremony for when a private company starts trading on a stock exchange, so some of us will stay glued to the news coverage throughout the day, closely watching the ticker tape with the stock prices.

Of course, prices on that first day can be wildly different from the IPO price, as both the popular offerings for Beyond Meat BYND, -0.78% and Zoom Video Communications show ZM, -0.89% . But is that first day even a reasonable — let alone reliable — predictor of a company’s performance?

From the perspective of a venture capitalist, an IPO is an important milestone in a company’s journey. But it’s also a weighing station in the middle — not the beginning or end — on the long road of building a lasting and successful business.

So what to make of the IPO prices then, and of the headlines hyping their rise or fall? Here’s a little secret: Pricing an IPO is way more art than science.

This may seem counterintuitive given the focus on numbers and all the financial analysis involved, but the reality is that pricing an IPO involves trade-offs between the interests of the underwriters (usually, investment banks); the company selling its stock; and institutional investors. Even the coveted “pop” — where the price of the stock bounces up in the first day — is somewhat orchestrated as part of the pricing process.

In fact, we just recently saw the biggest pop for an IPO (since the dot-com bubble of the late 1990s) with Beyond Meat, a maker of plant-based proteins: The IPO was priced at $25, the first trade was $46, and the stock closed on the first day at $65.75.

How did that happen? And what does it all mean? First, let me share more on what really goes on behind the scenes of an IPO.

The process of going public formally begins with filing of a registration statement aka “the S-1” (which is the name of the SEC form). The S-1 is really a disclosure document intended to tell prospective investors everything they need to know — including risk factors — to help them decide whether to purchase the stock.

It also serves as a marketing document positioning the company and its role in the marketplace, because the company has to avoid public promotion during the waiting period and follow strict rules around what they can and can’t say on behalf of the company. But behind closed doors during this time, the company does pre-pitch the company story and financials to potential investors.

Before Beyond Meat went public, it increased both the total number of shares to sell, from 8.65 million to 9.63 million, as well as the price range, from $19-$21 to $23-$25 per share. Both of these moves are external signals that demand for the offering was very strong. While these signs should not be used to predict how the stock might trade post-IPO, they are interesting indicators of existing institutional investor psychology around the pricing.

Even the coveted ‘pop’ — where the price of the stock bounces up in the first day — is somewhat orchestrated as part of the pricing process.

With the order book in hand, the underwriters (banks) will allocate the shares to institutional investors. As part of this, they — and the company — want to minimize IPO allocations to investors that have a track record of selling the stock too quickly. They don’t always succeed in doing this, but that’s OK, since some selling helps make a “market”.

There’s also some asymmetry between the incentives of the underwriters and of the company. While both want to set the price low enough so that the stock will trade well on opening day and in the days to come, the banks also do business with institutional investors on a repeat basis… so they don’t want to overprice the IPO to the detriment of those institutional clients. For the company going public, however, a lower price could mean less money — and the reason to go public is to raise capital for further company building: expanding operations, making acquisitions, investing in new product lines, and so on.

But now, back to the pop and the eyes glued to that ticker tape. One of the reasons that IPO prices can vary so widely early on is because of how small the actual share of the company being sold (“float”) is.

People often assume an IPO means the entire company is going public — just because those companies are required to open their books and report their earnings on a quarterly basis — but actually no more than 10%-15% of the company is typically being sold. Such limited supply can have outsize impact in a short time frame, especially if there’s great demand.

In general, though, the main purpose of a limited float is to avoid flooding the stock market with more shares than it can digest. In the case of Zoom Video, just as with Beyond Meat, there was a small amount of float actually trading hands — but lots of investors who wanted to own it. The maker of videoconferencing solutions priced 20.9 million shares at $36 apiece. They opened at $65, traded as high as $66, and closed on the first day at $62. They now trade around $79.

Portfolio

Portfolio

So how to gauge the success of IPO after the “pop”? Beyond Meat is trading today above $100. Does that mean the company left money on the table? If you do the math, the company raised about $240 million from the IPO. Had the stock been priced at the first-trade price ($46), however, it could have raised nearly double that amount — and well more if it had priced at the closing stock price. Then again, people might not have invested as much at that price.

Finally, for those who owned stock pre-IPO, like employees and venture capitalists, most of this is a bit academic. Why? Because pre-existing shareholders in the company are typically “locked up” for six months post-IPO, which means they can’t sell their shares until that window expires. Of course, a stock that trades well in the first six months is best positioned to withstand the additional supply as pre-IPO shareholders begin to sell their shares, so in that sense it’s not entirely academic.

To be clear, none of this is investment advice (and my firm, Andreessen Horowitz isn’t an investor in the examples described here). But, these recent IPOs to do show how difficult it is to judge the success of a company on stock price alone.

Our perspective is one of long-term innovation and company building; hopefully, understanding the process behind the scenes of IPOs helps us all go beyond a short-term focus on the “scorecard” of IPOs and daily stock prices to a more long-term focus on company health, from cash flow to product; as well as economic growth and innovation. Companies that go public can not only increase employment relative to private companies, but IPOs also provide the general public with an opportunity to participate — whether directly or via mutual funds and pension plans — in potential wealth creation in the public markets.

As famous value investor Benjamin Graham put it: “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

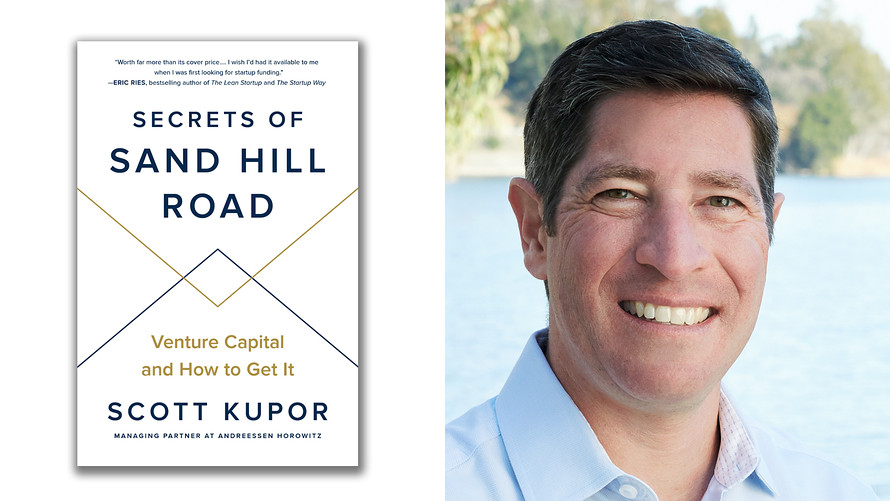

Scott Kupor is the managing partner at venture capitalist firm Andreessen Horowitz, where he is responsible for its operations, and is the author of the new book, “The Secrets of Sand Hill Road: Venture Capital and How to Get It”. Follow him on Twitter @skupor.

Add Comment