Trading 77% from its highs, Block SQ stock is one investors might consider adding to their portfolios going into its Q3 earnings release on November 3. SQ’s decline is even steeper than Meta Platforms META fall, with both severely underperforming the Nasdaq.

Long-term investors may see an opportunity to get in on the innovative financial services company. SQ has suffered mightily over the last year as Wall Street threw out the stock with the bathwater. Fears of rising interest rates and slowing consumer demand counteracted the premium paid for SQ as its impressive growth started to slow.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Overview

Block, formerly Square went public in 2015 and is most known for its point-of-sale “Square Reader” which makes transactions and payments convenient for entrepreneurs and small business owners. Over the years the company has progressed with broader payment software, business loans, peer-to-peer transactions, and bitcoin transactions. The company’s IPO was at $9 per share, valued at $2.9 billion, and now trades 555% above this price with a market cap of $34.84 billion.

Q3 Outlook

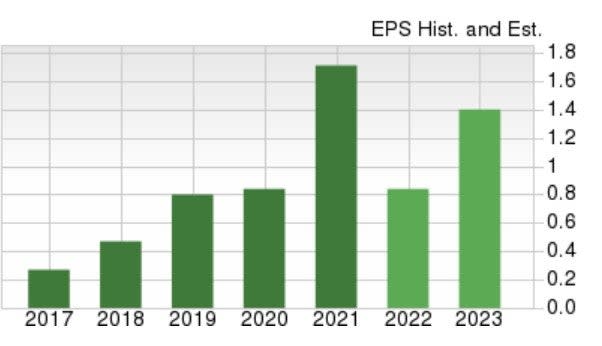

The Zacks Consensus Estimate for SQ’s Q3 earnings is $0.23 per share, which would represent a -38% decline from Q3 2021. Sales for Q3 are expected to be up 16% at $4.48 billion, a clear indication that operating costs are weighing on the company’s bottom line.

Earnings estimates for the period are still slightly up from $0.22 at the beginning of the quarter. Year over year, SQ earnings are expected to decline -49% but stabilize and climb 70% in FY23 at $1.48 per share as the company adapts to the business environment.

Performance & Valuation

Year to date SQ is down -63% to largely underperform the S&P 500’s -20% and the Nasdaq’s -30%. However, over the last five years, SQ’s performance has still beaten both the benchmark and the Nasdaq.

Image Source: Zacks Investment Research

After reaching 52-week highs of $255.95 per share last November, SQ stock has tumbled amid rising interest rates. Currently trading around $59 per share, SQ has a forward P/E of 69.2X. This is much higher than its industry average of 22.1X. SQ does trade at a significant discount to its absurd seven-year high of 7,921.3X and the median of 543.3X since going public.

Block’s prices to sales have also become more reasonable, currently at 2.1X and nicely below its P/S high of 15.5X over the last five years and the median of 8X. This is also lower than the 3.5X P/S average for the benchmark at the moment.

Image Source: Zacks Investment Research

Bottom Line

Beating expectations and more importantly giving stronger guidance could give SQ stock a nice boost right now. SQ currently lands a Zacks Rank #3 (Hold) and its Technology-Services Industry is in the bottom 42% of over 250 Zacks Industries.

The company looks poised to adapt to the tougher operating environment with FY23 earnings expected to stabilize and get the company’s growth back on course. While Wall Street may not see a reason to pay a higher premium for the stock in current economic conditions, SQ trades at a lot more reasonable levels than it has in the past. Longer-term investors may be rewarded for holding the stock and the Average Zacks Price Target suggests an intriguing 147% upside from current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Block, Inc. (SQ) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Add Comment