Rates hit highest since 2000 after Powell comments

Interest rates rocketed to their highest levels in over 20 years Tuesday afternoon as Wall Street finally started taking Federal Reserve Chairman Jerome Powell at his word.

Rates on one-year Treasury bonds jumped to 5.3%, their highest level since December 2000. Those on two year Treasurys surged to nearly 5%, their highest levels since 2007. Stocks and bonds tanked, and betting on another 50 basis point Fed rate hike later this month doubled. This came after Powell told the Senate he would keep interest rates higher for longer to make sure he stamped out inflation.

Weirdly, or stupidly, none of this should be new. This is pretty much exactly what Powell said at his Feb. 1 press conference—as we wrote at the time. Here at MarketWatch we were left scratching our heads back then, as Wall Street took Powell’s promise to keep interest rates higher for longer to mean that he was going to start cutting rates.

It didn’t make sense then, and subsequent events have once again disproved that crazy idea about “the wisdom of crowds.”

Turns out, higher for longer actually meant…er…higher for longer.

Who knew?

The reaction Tuesday was intense. And it’s potentially good for retirees who have a lot of cash, but not so good for those who are already fully invested in stocks and bonds.

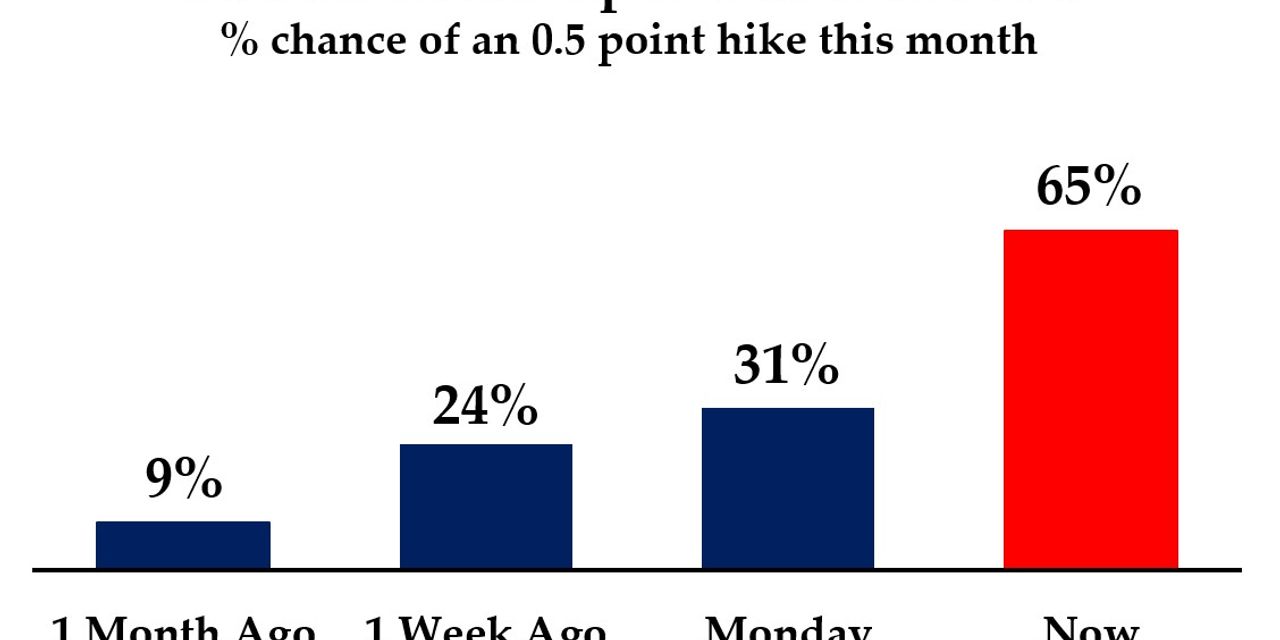

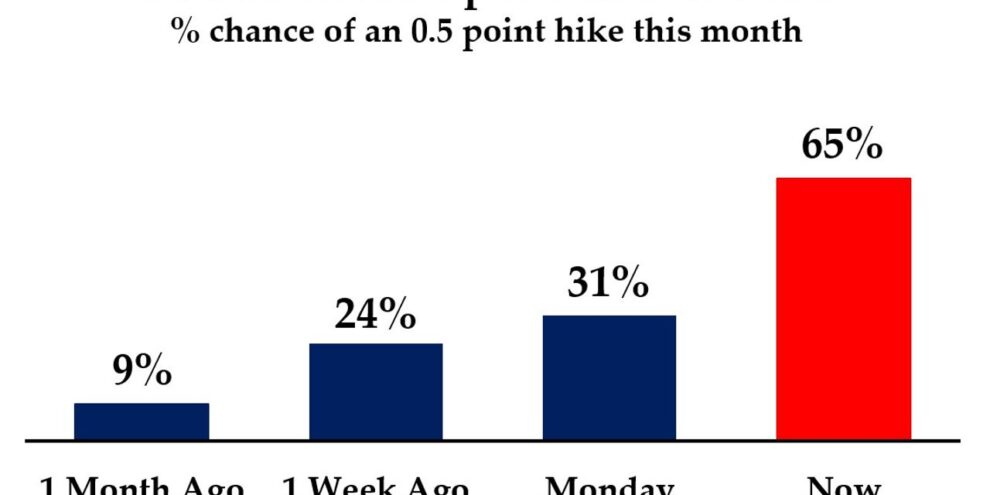

Let’s start with the most immediate and dramatic movement: Wall Street just doubled its betting that the Fed will hike rates by a full 50 basis points at the next meeting in two weeks time. The futures markets now give a 65% chance on a half-point hike.

As recently as Monday that was 34%.

And a month ago, following the Feb. 1 Powell press conference, it was 9%.

And the odds that interest rates will rise as high as 5.75% by this fall, before starting to come back down again, doubled to 33%.

Anyone who actually listened to Powell during the press conference, ignored Wall Street, and bet the right way in the futures markets is now sitting on giant profits.

Treasury bonds that mature in March 2024 offered yields, or interest rates, just over 5.3% by Tuesday afternoon. A month ago it was just 4.64%.

And January, 2025 bonds edged over 5%.

Your correspondent always has a preference for inflation-protected Treasury bonds over the traditional ones, because—as we have all been reminded over the past year—in the real world it is only what you keep after inflation that really matters. Leaping out from the market data Tuesday afternoon: Savers can lock in interest rates of inflation plus 2% a year for two or even three years by purchasing the April 2025 and April 2026 inflation-protected Treasurys, known as TIPS bonds. And inflation plus 1.6% a year for 26 years by purchasing the bonds that mature in February, 2049.

There are two low-cost exchange-traded funds that focus specifically on TIPS with shorter maturities: Vanguard Short-Term Inflation-Protected Securities VTIP, -0.49% and iShares 0-5 Year TIPS Bond ETF STIP, -0.50%.

One reason so many people focus instead on “nominal” or traditional bonds may be that they still think in nominal terms. Even expert financial advisers still talk to me on the phone about nominal rates—“you can earn 5% on this,” or “you’re getting 7%,” and so on. After two generations of falling inflation and falling interest rates that may be standard. But earning 5% when inflation is 6.4% — the most recent number—is a different proposition from earning 5% when it’s 1.2%, as it was in 2020.

The bond market is now betting that inflation will average 2.9% over the next two years.

Average, not “fall to.”

If that sounds optimistic, or if you just don’t feel like gambling on inflation, you can buy inflation-protected Treasury bonds that will pay you inflation plus 2.1% for two years instead of traditional Treasury bonds that will pay you 5%, fixed, for two years with no inflation protection at all.

Add Comment