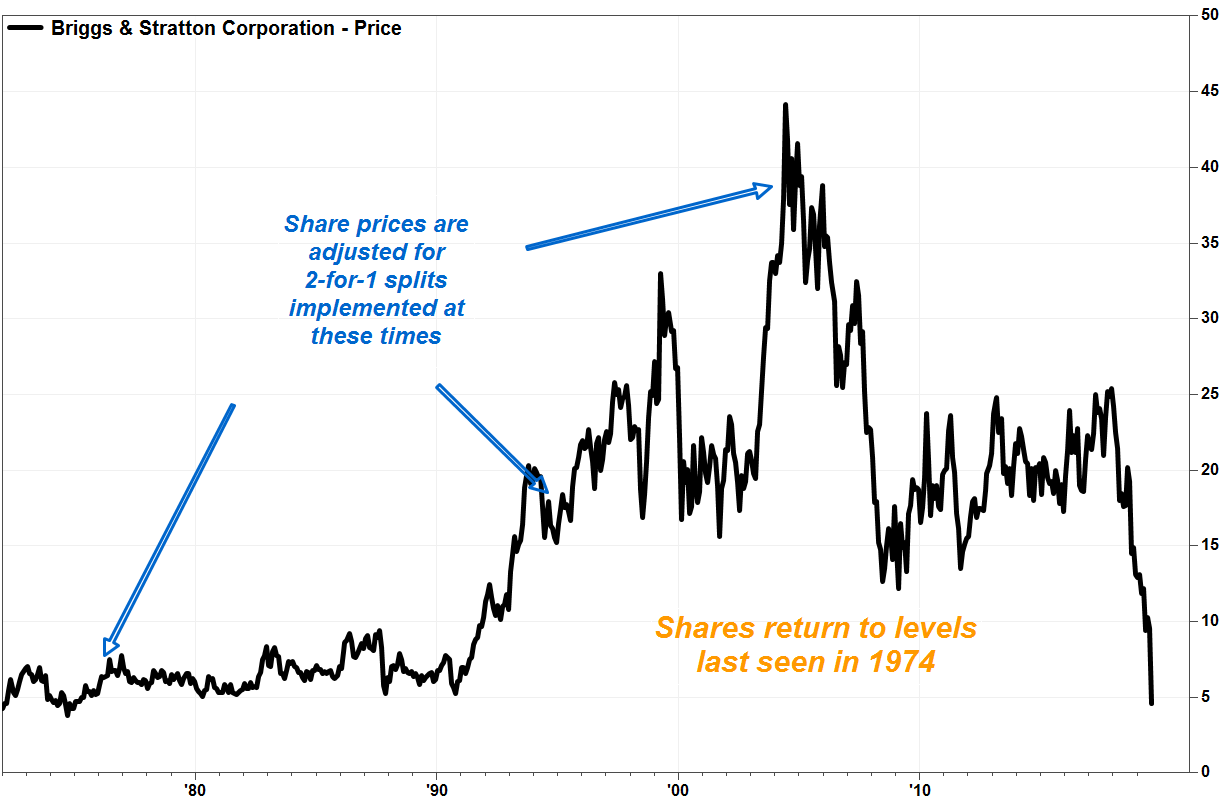

Shares of Briggs & Stratton were rocked Thursday to levels last seen in the 1970s, after the maker of gasoline engines and outdoor power equipment reported a surprise fiscal fourth-quarter loss, lowered its full-year outlook and slashed its quarterly dividend.

The company also said it will close its facility in Murray, Ky., which employs about 630 people, by the fall of 2020, as it consolidates production of its walk-behind lawn mower engines into its Poplar Bluff, Mo. facility. The company said it will offer the affected employees opportunities to relocate to the company’s other plants, which are located in Alabama, Georgia, Missouri and New York.

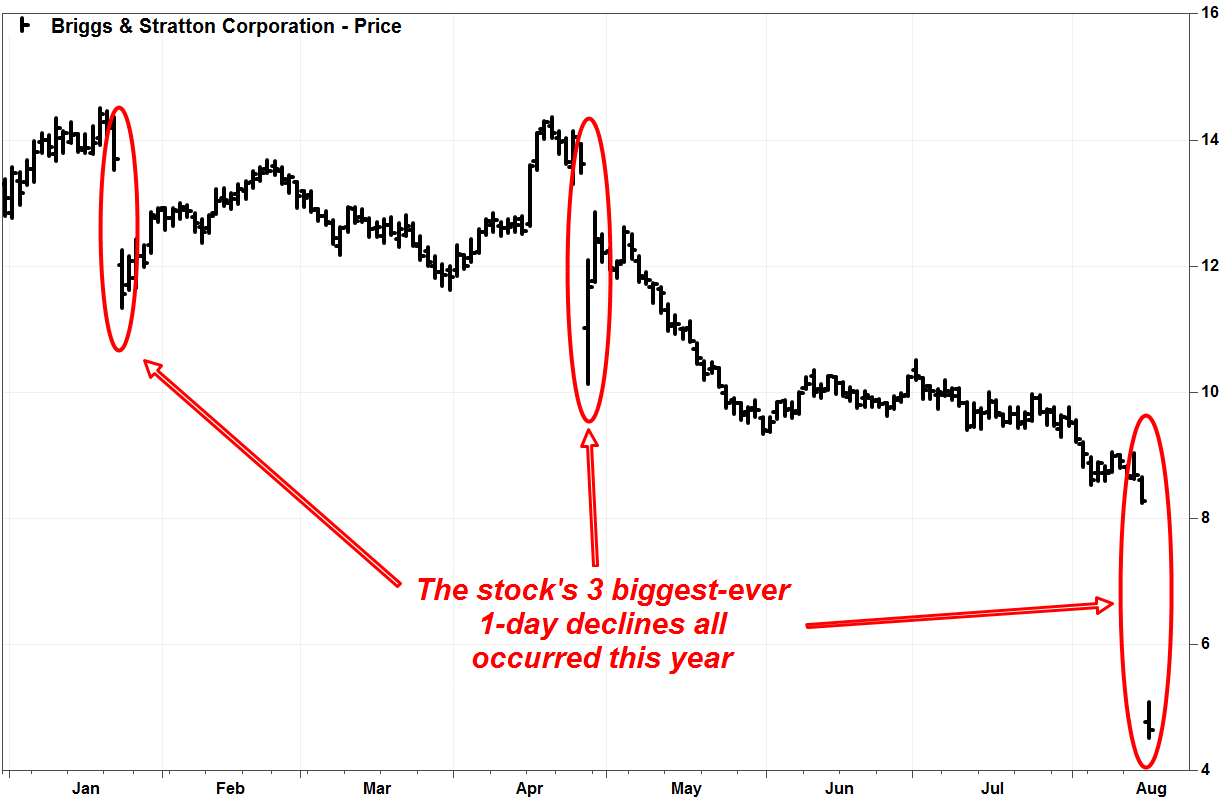

The stock BGG, +5.23% plunged 44.5% to suffer its biggest-ever, one-day percentage decline by far, and to close at the lowest split-adjusted price seen since April 1975.

The previous biggest one-day declines were 15.7% on Jan. 24, 2019 after fiscal second-quarter earnings, followed by 14.3% on April 26, after third-quarter results.

FactSet, MarketWatch

FactSet, MarketWatch

“During the year, we encountered weather-related headwinds in all three major lawn and garden markets around the globe,” said Chief Executive Todd Teske on a post-earnings conference call with analysts, according to a FactSet transcript. “This challenging and highly unusual environment was coupled with the Sears bankruptcy and several brand and [original equipment manufacturer] transitions.”

Don’t miss: Sears to start liquidation sales at these 26 stores this week.

Also read: Extreme weather could be an ‘outsized and unnoticed’ force for stock markets, analyst says.

The company reported before Thursday’s open a net loss for the quarter ended in June that widened to $18.5 million, or 45 cents a share, from $11.8 million, or 29 cents a share, in the year-ago period. Excluding non-recurring items, such as charges related to business optimization moves, acquisitions and a pension settlement, the adjusted loss per share narrowed to 36 cents from 47 cents, but that compared with the FactSet consensus for a profit of 45 cents a share.

Revenue dropped 5.9% to $472.0 million, below the FactSet consensus of $519.9 million. The company said an “unusually wet spring” in North America and market disruptions caused by channel partner transitions caused “difficult market conditions” that led to shipments that fell short of expectations.

Gross profit margin decreased to 14.4% from 21.7%, which the company said resulted from sales mix, lower production volumes and “operational inefficiencies,” which were hampered by “challenges” in labor availability.

For fiscal 2020, the company cut its adjusted earnings per share guidance to 20 cents from 40 cents from a previous estimate of approximately $1.30, and lowered its sales outlook to $1.91 billion to $1.97 billion from approximately $2.01 billion.

“The fourth quarter capped a difficult year of unprecedented market challenges and higher than expected operational inefficiencies encountered during the ramp-up of our business optimization initiatives,” said Chief Executive Todd Teske. “The North America lawn and garden market slowed considerably as the quarter progressed from unusually wet, cool spring weather compounded by near-term market disruptions with channel partners.”

FactSet, MarketWatch

FactSet, MarketWatch

Raymond James analyst Sam Darkatsh followed by calling the quarter “disastrous,” as the results fell well short of both internal and external expectations with “myriad headwinds” weighing on the outlook. He reiterated the market perform rating he’s had on the stock since January 2018.

Separately, the company cut its quarterly dividend by 64% to 5 cents a share, from 14 cents a share. The new dividend will be payable Oct. 2 to shareholders of record on Sept. 18.

Based on current share prices, the new annual dividend rate implies a dividend yield of 4.36%, down from the current dividend’s yield of 12.20% and the implied yield for the S&P 500 SPX, +1.44% of 2.05%.

With about 41.5 million shares outstanding through June, the dividend cut could save the company about $15 million a year.

“This action will help us direct more funds to debt reduction and investments in attractive commercial products and enabling technologies,” Teske said.

Regarding the facility consolidation, the company expects annualized savings of $12 million to $14 million, and total charges of $30 million to $35 million. The company said the need to consolidate the facility comes as the market for small vertical-shaft engines has not grown for several years for various reasons, including a “difficult housing market driven by the lack of affordable single-family homes in the United States.”

See related: Opinion: Why there’s no job growth in Trump’s rural heartland.

Briggs & Stratton said its Poplar Bluff, Mo. facility will need to hire 130 employees this fiscal year, and another group of employees will be hired in fiscal 2021. There will also be openings in its other manufacturing plants, which are located in Auburn, Ala., Statesboro, Ga., Sherrill, N.Y. and Lees Summit, Mo.

The stock has now shed 75% over the past 12 months, while the S&P 500 index SPX, +1.44% has gained about 1%.

Add Comment