Alphabet (GOOGL) stock has recovered quite nicely from the deep selloff it endured near the end of 2022, as its advertising channels continue to consistently deliver big numbers. While Alphabet still heavily depends on ad sales, the company’s new growth engine is Google Cloud. I’m bullish on both parts of the business, but Google Cloud offers more upside potential as the tech giant continues to gain ground on its peers.

Advertising Is Still the Main Engine

Ad revenue carries the bulk of the revenue load at Google, having generated $64.6 billion for the second quarter of 2024. That’s an increase of 11.1% year-over-year. Google Search and YouTube ads revenue jumped by 13.8% and 13.0% year-over-year, respectively. A bullish investor can take comfort in these numbers.

Growth in this segment is good for Alphabet’s profit margins, as the advertising segment is known for having high margins. Alphabet wrapped up the second quarter with a 27.9% net profit margin. Those margins will likely increase as the company delivers operational efficiencies including from cost cutting. It wouldn’t be surprising to see the company record a 30% net profit margin in at least one quarter in 2025 as profitability grows.

Alphabet put itself in the spotlight when it announced its first dividend earlier this year. The yield is roughly 0.50%, and Alphabet will likely strive to make a further impression with a double-digit dividend hike in 2025.

Cloud Computing Will Fuel Future Growth

The results of Alphabet’s advertising division alone could make GOOGL stock attractive, but Google Cloud offers another reason to be bullish. This part of Alphabet’s business is growing much faster than its advertising segment, and it’s no longer a small offshoot like in previous years. Google Cloud revenue reached $10.4 billion in Q2, representing more than 12% of total revenue for the quarter.

Google Cloud’s impact on future earnings reports will grow, and that’s good news for investors. Cloud revenue jumped by 28.8% year-over-year. That growth rate has been normal for Google Cloud, and its profitability is also improving. Google Cloud’s operating income almost tripled year-over-year, going from $395 million to $1.17 billion. Cloud profit margins have the potential to soar quickly, and the accelerated growth from this part of Alphabet’s business suggests higher profit margins are awaiting patient investors.

AI Tailwinds Should Continue to Last

Alphabet has a dominant position in artificial intelligence, a critical technology that can accelerate advertising and cloud revenue. The tech giant’s AI capabilities make me bullish. Alphabet is using AI to run better ads that maximize results for its customers. This will incentivize more ad spend as companies continue to invest in the marketing channels that drive the most results. Artificial intelligence has also strengthened Google Cloud’s core offering. Additionally, the intense bandwidth necessary for AI has also prompted more businesses to use Google Cloud.

Artificial intelligence is still in its early innings. The industry is projected to achieve annualized growth of 19.3% from now until 2034, according to Precedence Research. Alphabet is one of the leaders in software for companies looking to capitalize on artificial intelligence, and that should drive accelerating revenue growth from Google Cloud.

GOOGL Valuation Is Better Than Other Cloud Giants

Alphabet, Microsoft (MSFT) and Amazon (AMZN), three of the largest companies in town, are all heavily focused on cloud computing. Together, these companies have helped pace the stock market in recent years.

In terms of relative valuation, Alphabet trades at a 23.4 P/E ratio, which is a lower valuation than for MSFT stock or AMZN stock. Microsoft carries a 36.5x P/E ratio, while Amazon’s multiple stands at 46.4x. Google’s relative valuation appeal makes it easier to be bullish on the stock. Alphabet has higher profit margins than Amazon and a higher net income growth rate than Microsoft.

Google Cloud also grew faster than Amazon Web Services and Microsoft Cloud in the second quarter. While Google Cloud revenue increased by 28.8% year-over-year, Amazon Web Services only registered 19% year-over-year revenue growth. Microsoft Cloud fared slightly better with 21% year-over-year revenue growth, but both of those growth rates trail what Alphabet delivered. If Alphabet continues to gain market share in cloud computing, I predict the stock will perform well.

Is Alphabet Stock a Buy?

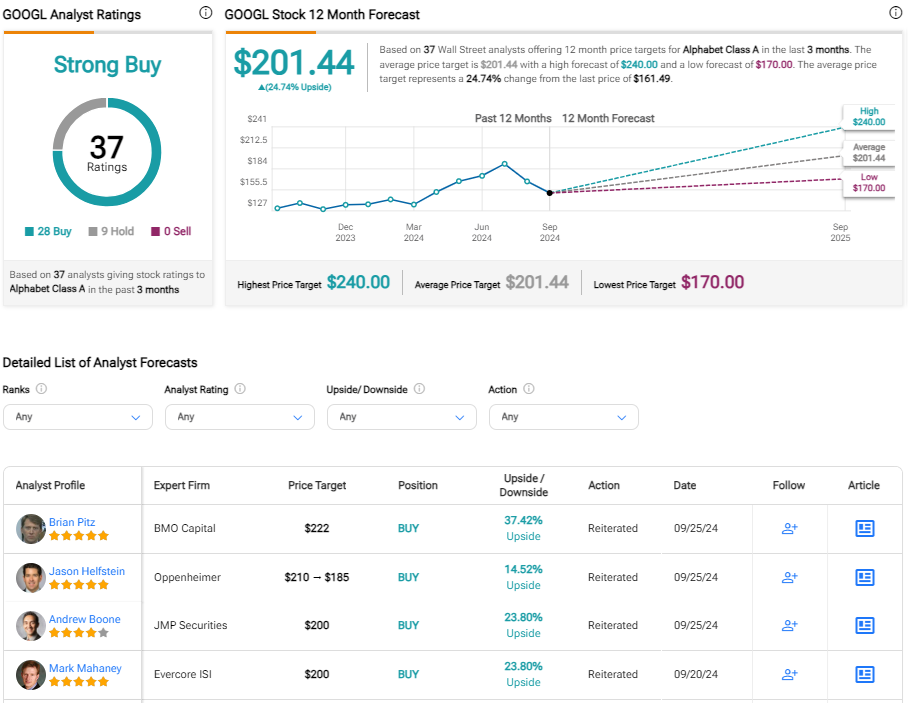

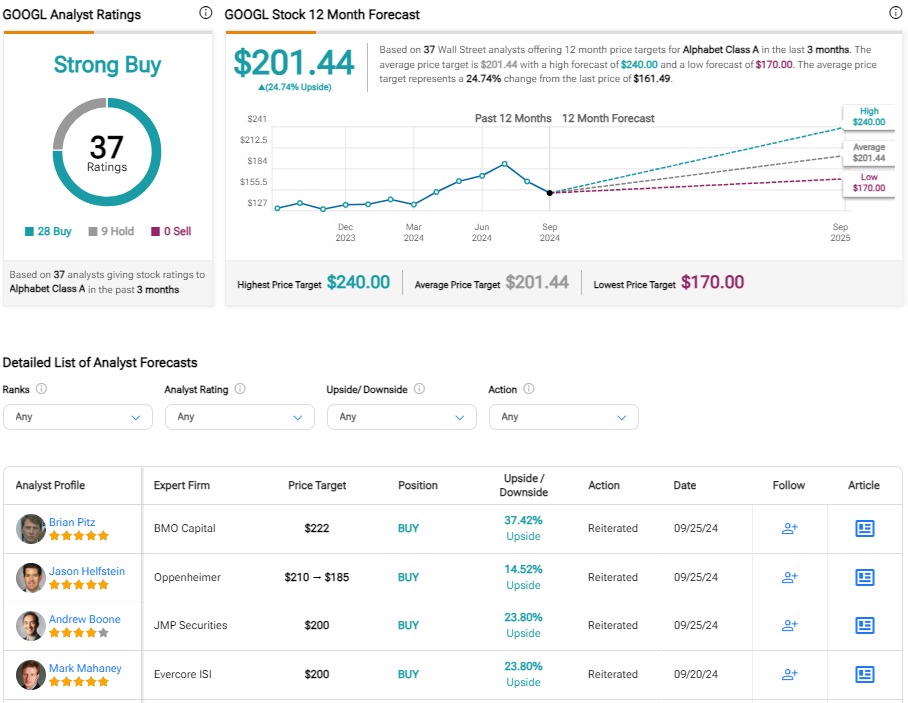

Wall Street analysts currently hold a consensus Strong Buy rating on shares of GOOGL. From the 37 analysts covering the Alphabet stock, 28 offer Buy ratings while 9 have Hold ratings. No Wall Street analysts rate GOOGL stock a Sell. The average price target for GOOGL is $201.44, implying nearly 25% potential upside.

The Bottom Line on Alphabet Stock

Alphabet has been a leading stock in recent years and has outperformed the S&P 500. While advertising revenue has historically been the driver of GOOGL, Google Cloud is the next captivating growth opportunity. Alphabet’s cloud platform growth is outpacing ad revenue growth and gaining ground on AWS and Microsoft Cloud. I’m bullish on GOOGL stock, especially with an undemanding 23.4 P/E ratio.