Meta Platforms FB executives said Apple’s tracking changes could cost it $10 billion in lost sales in 2022 alone. FB stock tumbled following the announcement that came alongside its Q4 financial release in early February.

Meta’s diminished mobile advertising power caused Wall Street to dump the stock and its big, long-term bet on the metaverse is difficult to gauge. The huge downturn could, however, set up an attractive entry point for investors looking to buy a company that reaches 3.6 billion people a month.

Is now the time to buy Meta stock with its first quarter fiscal 2022 earnings results due out on Wednesday, April 27?

Did The Name Change Scare Wall Street?

Facebook and CEO Mark Zuckerberg announced in October that the social media company that owns Instagram and WhatsApp was changing its name to Meta Platforms. Investors were intrigued, but it appeared to make Wall Street nervous.

Meta is pouring billions of dollars and tons of resources into the metaverse. The bet is that people will eventually live some of or much of their lives in a new digital world via avatars. The hope is they will then spend their attention and real money. That reality is still years off and it might not ever come to fruition, at least not how Zuckerberg and Meta envision.

The slow pivot away from FB’s traditional social media apps came after Apple AAPL introduced software changes last spring that require apps to ask users whether they want to be tracked. Apple’s changes have impacted Snap and countless other mobile-ad focused firms. FB and its various offerings are also facing increased competition from TikTok and other apps.

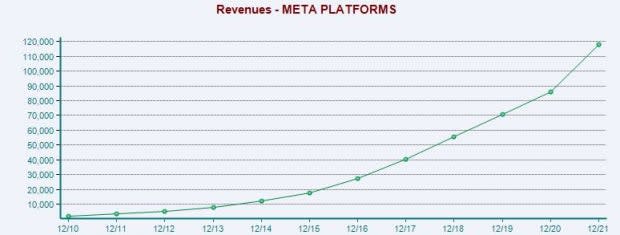

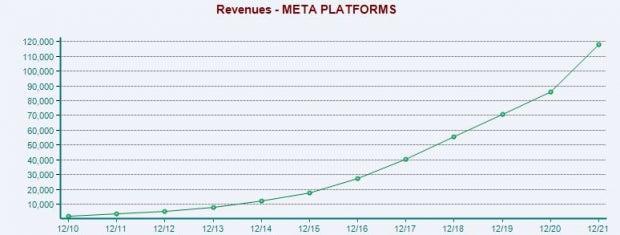

Image Source: Zacks Investment Research

FB’s Global Reach is Still Massive

In the here and now, Meta makes nearly all of its money from traditional digital advertising, with a large chunk of that coming from mobile. Companies pay to put their ads in front of users across Facebook, Instagram, and WhatsApp because of the huge global reach.

Meta’s ‘monthly active people’ popped 9% in FY21 to 3.6 billion, or roughly 70% of the entire global population with internet access—its daily active people climbed 8% to 2.8 billion. Meta’s 2021 revenue jumped 37% YoY to $118 billion and its adjusted earnings came in 36% higher.

Looking ahead, Zacks estimates call for FB’s revenue to pop 10.4% in FY22 and another 18% in FY23, both of which mark FB’s slowest YoY growth as a public company. Meta’s earnings outlook has dropped since its Q4 release and its adjusted EPS is projected to slip 12.5% in FY22 to $12.05 per share.

Meta lands a Zacks Rank #3 (Hold) at the moment and its adjusted earnings are expected to bounce back in 2023 to climb above last year’s total. Plus, its total revenue is set to hit $153 billion next year.

Image Source: Zacks Investment Research

Price, Valuation & More

At around $185 a share, FB trades 50% below its record highs, and its Zacks consensus price target represents over 70% upside to its current levels. Meta is now in the red over the trailing 36 months. The fall, coupled with its strong earnings, has also recalibrated its valuation.

FB is trading near all-time lows at 14.4X forward 12-month earnings. This marks 38% value compared to its own five-year median and a 45% discount to its industry.

Alongside its valuation, Meta boasts a stellar balance sheet, with no long-term debt and $48 billion in cash and equivalents. This provides FB ample options to expand into the metaverse and other future growth areas. The company could also eventually start paying a dividend, as many maturing tech giants eventually do.

Image Source: Zacks Investment Research

Bottom Line

FB’s user count will most likely take a hit in Q1 and Q2 as the Russian government bans access to its various platforms. Despite the downturn and legitimate fears about ad revenue, the metaverse, and beyond, 70% of the brokerage recommendations Zacks has for Meta stock are either ‘Strong Buys’ or ‘Buys.’

Meta reports its Q1 results on Wednesday, April 27 and long-term investors might want to think about buying. Yet given Netflix’s recent tumble and the overall market turmoil, it’s likely best to wait and see Meta’s report and guidance and how Wall Street reacts because it could easily be trading at an even deeper discount by the end of the week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Meta Platforms, Inc. (FB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment