Netflix (NFLX) has surged around 90% off its lows as investors continue to buy the beaten-down tech giant at attractive levels. Even though NFLX has bounced back in a big way, alongside fellow titans such as Meta Platforms, Netflix still has miles of runway before it returns to its 2021 peaks.

Investors must ask themselves if now is time to buy Netflix shares ahead of its Q1 FY23 earnings release on April 18.

Netflix: 101

Netflix was the streaming TV pioneer that revolutionized the way people consume movies and shows. The company’s rise to Wall Street superstardom occurred as it rapidly racked up millions of paid subscribers in the U.S. and around the world and helped completely alter the wider TV and movie industry landscape forever.

Netflix’s head start has helped it maintain an edge over the competition which includes Disney DIS, Apple, Amazon, and countless others from NBC to CBS. Netflix is still the largest streamer, boasting 231 million paid memberships to top Disney’s 162 million. NFLX continues to invest heavily in a variety of original content in the U.S. and globally to help it attract and keep subscribers amid the possibly never-ending streaming wars.

Image Source: Zacks Investment Research

NFLX’s days of huge sales growth are likely over as it reaches a certain level of saturation in many valuable markets, including the U.S. Netflix’s 2022 revenue climbed 6.5% vs. 19% in 2021 and 24% in 2020. The natural slowdown is why Netflix has rolled out an ad-based tier and is experimenting with paid sharing, as well as other offerings such as gaming.

Other Fundamentals

Netflix posted a strong Q4 FY22 that impressed Wall Street. Zacks estimates call for its revenue to climb 8% in 2023 and 11% in FY24 to reach $38 billion.

NFLX’s adjusted earnings are projected to surge 14% and 26%, respectively. NFLX’s FY23 and FY24 earnings outlook has improved compared to where it was prior to its Q4 release, though it has remained rather stagnant recently to land a Zacks Rank #3 (Hold).

NFLX stock is up roughly 90% off its lows 2022 lows, alongside Meta META and others. The stock has climbed by around 20% in 2023, including some large swings as it reached overbought and then oversold RSI levels. Netflix climbed again on Thursday and it trades above neutral RSI levels (50) at 60. Netflix just bounce back above its 50-day moving average and it already experienced that bullish golden cross earlier this year.

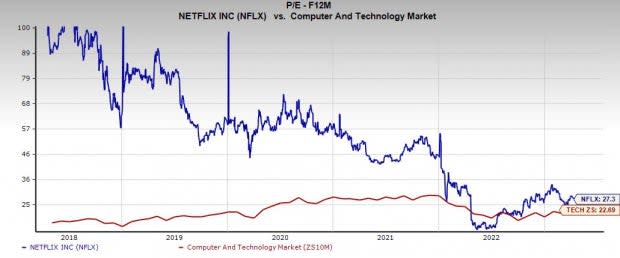

Despite the rebound, NFLX trades 50% below its peaks. On the valuation front, Netflix is at a 66% discount to its 10-year median at 27.3X earnings. In fact, Netflix is now trading at levels it was at back in 2010.

Image Source: Zacks Investment Research

Bottom Line

NFLX is no longer forecasting its subscriber growth, which is a big change since it was the figure the stock traded almost exclusively based on. Wall Street wants to see NFLX improve its balance sheet, cash flows, and margins while pursuing fresh growth avenues.

Netflix did warn last quarter that it could have a slower Q1 following what it called a significant pull forward in the fourth quarter. Some investors might not want to ‘chase’ Netflix at these levels and wait for a possible drawdown after earnings. Others, with long-term horizons, might want to consider Netflix at these levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment