As pot-stock mania gripped North America in 2018, a bidding war struck up for a relatively small marijuana-growing property in a Toronto suburb.

The 9,000-square-foot facility was only capable of growing about C$12 million ($9 million) worth of pot in a year, but that didn’t seem to matter. Marijuana companies were surging in interest and market cap as Canada planned to legalize recreational pot sales, and companies that established at least one cultivation license were receiving beneficial treatment from Health Canada, which meant snagging the property and its accompanying license could lead to a legitimate growing business in more ways than one.

RavenQuest BioMed Inc. RVVQF, +0.23% RQB, +0.00% eventually “won” the bidding, agreeing to pay nearly C$30 million. But after Health Canada stopped expediting requests from license holders, RavenQuest was unable to capitalize on its purchase in the way it had thought. At the time, the company had a recorded value of C$27.7 million, or roughly C$1,385 per square foot, on its books, well more than the going rate for such facilities.

Months later, RavenQuest recorded a C$11.7 million impairment charge for the license at the end of the company’s fiscal year — a loss that was nearly 20 times more than its most recent quarterly revenue.

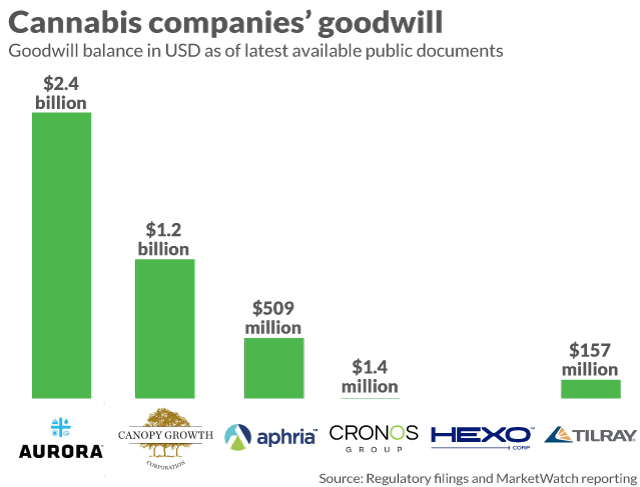

At the premier pot companies, the losses could be much larger and more important. Similar acquisitions played out across the cannabis industry, and the claimed value of those purchases now sits on cannabis companies’ books like a ticking time bomb. The six largest licensed cannabis producers in Canada have recorded more than $4 billion in goodwill — the amount allocated to certain acquisitions beyond the value of their physical assets — risking large and potentially punishing write-downs in the future.

In some cases, it doesn’t even sit on the books that long. Tilt Holdings Inc. TILT, +14.29% SVVTF, +8.45% removed $500 million from its books late last year, less than 30 days after it created the goodwill, the byproduct of a Byzantine transaction that rolled up four seemingly unrelated companies into a single entity. The Frankenstein’s monster of a company later justified the value this way: Shareholders that bought into the reverse takeover were willing to overpay for the freshly minted stock because of the opportunity and overheated environment.

Don’t miss: How a freshly grown cannabis company managed to lose $500 million in less than a month

Of the world’s largest marijuana companies, Aurora Cannabis Inc. ACB, +5.64% ACB, +3.67% has the most accumulated non-cash value on its balance sheet. It accumulated C$2.11 billion from its acquisition of Medreleaf, which closed in July 2018; C$712.1 million from its purchase of Cannimed Theraputics in March 2018; and C$137.2 million from the acquisition of ICC Labs in November 2018, according to its most recent public financial statements.

The world’s largest pot company by market value, Canopy Growth Corp. CGC, +2.82% WEED, +2.31% , says it has C$1.54 billion of goodwill, according to its latest available financial statements. Since its last fiscal year, it has added $1.23 billion from acquisitions, including C$539.3 million from its purchase of Hiku and C$327 million from the acquisition of Ebbu. Prior to its last fiscal year, Canopy Growth previously added C$207.1 million in goodwill from its Mettrum acquisition in fiscal 2017.

Canopy Growth’s acquisition of Mettrum Health Corp. values the license at C$1,100 per square foot, or C$88.2 million overall, roughly a quarter of the overall cost.

Read: Cannabis companies are having a horrible summer as scandals mount and stocks slide

Tilray Inc. TLRY, -10.85% , Cronos Group Inc. CRON, -0.49% CRON, -0.06% and Hexo Corp. HEXO, +3.74% HEXO, +3.51% have made few or modest investments, and have a fraction of the goodwill Aurora and Canopy Growth have attached to their balance sheets.

Tilray carries the majority of its goodwill from the purchase of hemp product maker Manitoba Harvest.

It’s not always clear when a company will be forced to erase the value through a finance-damaging writedown. Aphria Inc. APHA, +3.69% APHA, +3.81% has nearly C$700 million of goodwill on its books, and CIBC World Markets analyst John Zamparo wrote ahead of Aphria’s quarterly earnings that he expected the company to make a large writedown. Based on the company’s acquisition of a European company called Nuuvera, Zamparo wrote there was a “real risk (albeit of unknown probability)” of a large write down of assets Aphria bought in January 2018, near peak value for the sector.

The Sniff Test: Aphria’s $70 million cash windfall is a product of its still-unexplained past

Aphria did not write down goodwill in the earnings it released last week, but the company has dumped a large amount of value into the intangible assets portion of its balance sheet, separate from goodwill and reserved for things such as patents, contracts, brand names and the various licenses associated with growing and selling pot. The value of licenses are especially hard to gauge, but of more than a dozen transactions scrutinized by MarketWatch, Aphria’s roughly $200 million acquisition of Broken Coast yielded the highest license value per square foot: C$1,400, nearly 3% of the entire transaction.

Tilray reported earnings Tuesday after the closing bell and Canopy Growth is expected to report late Wednesday, with its conference call Thursday before the market opens. Hexo reported its fiscal third quarter in June and Aurora Cannabis has not yet said when it will release its June-quarter earnings. Cronos Group reported last week.

Follow all the news about pot stocks with Cannabis Watch

Add Comment