(Bloomberg) — Canopy Growth Corp. shares fell to the lowest in nearly two years after the pot company reported revenue that missed the lowest analyst estimate and a loss that one analyst called “astounding.”

The world’s largest cannabis company by market value also said it’s unlikely to meet its previous guidance of C$250 million in revenue by the fiscal fourth quarter, which ends March 31.

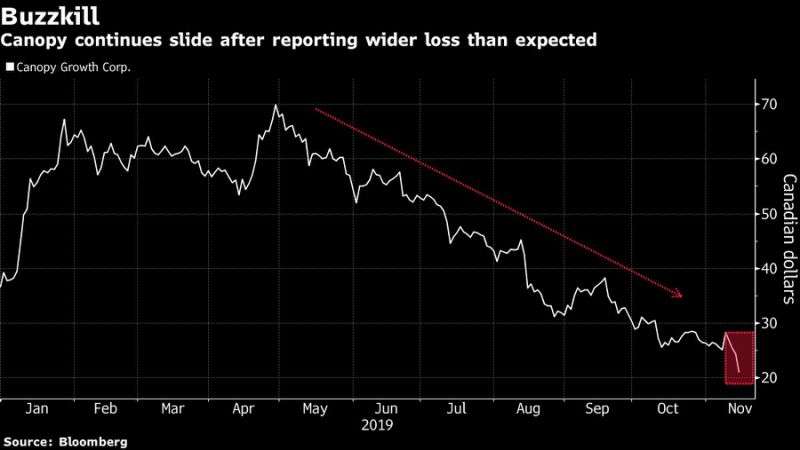

Shares fell as much as 16% Thursday to C$20.55, the lowest since December 2017. The stock has lost more than 40% since the beginning of the year.

Canopy took a restructuring charge of C$32.7 million ($24.6 million) for returns, return provisions and pricing allowances. These are primarily related to its portfolio of softgel and oil products, which haven’t been selling as well as expected. It also took an inventory charge of C$15.9 million to align its portfolio with a new retailing strategy.

“We do not consider this type of adjustment to be one-time, as it reflects returns and new pricing architecture and package assortment going forward,” Bill Kirk, analyst at MKM Partners, said in a note. He said the magnitude of the Ebitda loss was “astounding,” and Canopy’s “excessive equity comp policy” was responsible for much of it.

Overall, Canopy reported fiscal second-quarter net revenue of C$76.6 million, well below the consensus estimate of C$102.3 million, and a loss before interest, taxes, depreciation and amortization of C$155.7 million. Analysts had expected an Ebitda loss of C$96.1 million.

“We took the necessary steps to address inventory levels on our oils and softgels; looking beyond this, the fundamentals are strong,” Chief Executive Officer Mark Zekulin said in a statement. “Our retail store sales are growing on an overall and same-store basis, our Canadian medical revenues are up, and international medical sales are growing on both an organic and inorganic basis.”

(Updates to add guidance comment in paragraph 2, share move in paragraph 3 and chart.)

To contact the reporter on this story: Kristine Owram in New York at [email protected]

To contact the editors responsible for this story: Brad Olesen at [email protected], Courtney Dentch, Divya Balji

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”50″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment