In his first week in office, President Joe Biden has signed executive orders that touch on climate change, the COVID-19 pandemic, economic relief and more. Banks have been thinking it all over — including how to make money from his policies.

Bank of America strategist Savita Subramanian has come up with these three trade ideas:

- “Buy GDP-sensitive stocks, sectors and themes.”

- “Buy discount over luxury retailers.”

- “Buy the E and S in ESG” (which refers to environmental, social and governance investing).

1. GDP-sensitive stocks

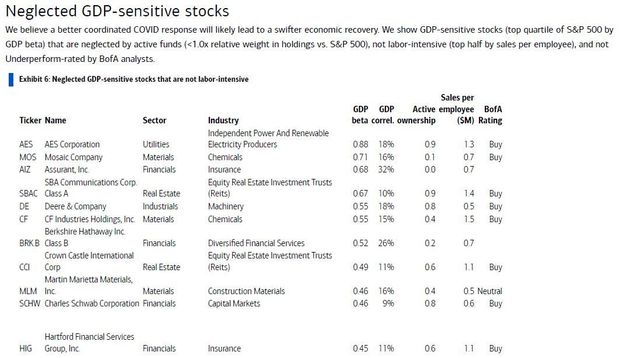

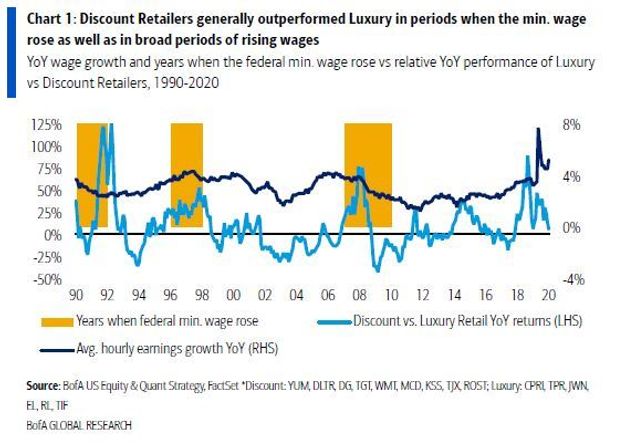

Subramanian said in a note dated Wednesday that a “better-coordinated COVID response will likely lead to a swiſter economic recovery.” So it’s worth looking at “GDP-sensitive stocks” that are “neglected” by managers of active funds and “not labor-intensive (top half by sales per employee), and not Underperform-rated by BofA analysts,” she wrote.

Those stocks, ranging from Ford F to Martin Marietta Materials MLM, are shown in the BofA table below. She also said “value stocks/cyclicals and small caps” make sense as a GDP trade.

2. Discount retailers

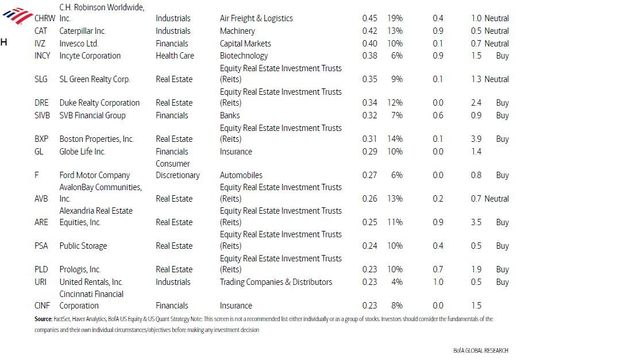

One of Biden’s executive orders starts the process of getting a $15-per-hour minimum wage for federal workers, and Democratic lawmakers have been pushing to increase the federal minimum wage to that rate.

“We expect a higher minimum wage would be positive for discount stores (particularly big chains that already have a $15/hr minimum wage),” Subramanian said.

She offered the chart below showing that discount retailers typically performed better than luxury retailers in periods when the minimum wage climbed.

3. Environmental and social stocks

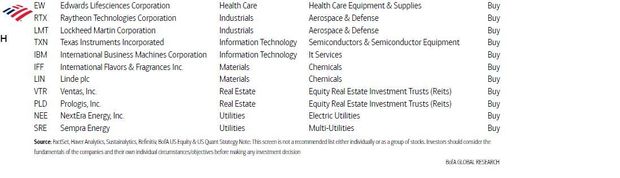

“A number of Biden’s executive orders so far have been around Environmental and Social issues,” Subramanian said. “We believe ESG investing will continue to gain momentum with an ‘ally’ in the White House.”

Her note features the table below showing the “top two Buy-rated companies in each sector based on Environmental & Social scores by Sustainalytics and Refinitiv.” The stocks listed include AT&T T, GM GM, PepsiCo PEP, Goldman Sachs GS, Johnson & Johnson JNJ, Lockheed Martin LMT, Texas Instruments TXN and IBM IBM.

Now read: All of President Biden’s key executive orders — in one chart

And see: Biden calls for $1,400 checks in $1.9 trillion relief plan

This report was first published on Jan. 27, 2021.

Add Comment