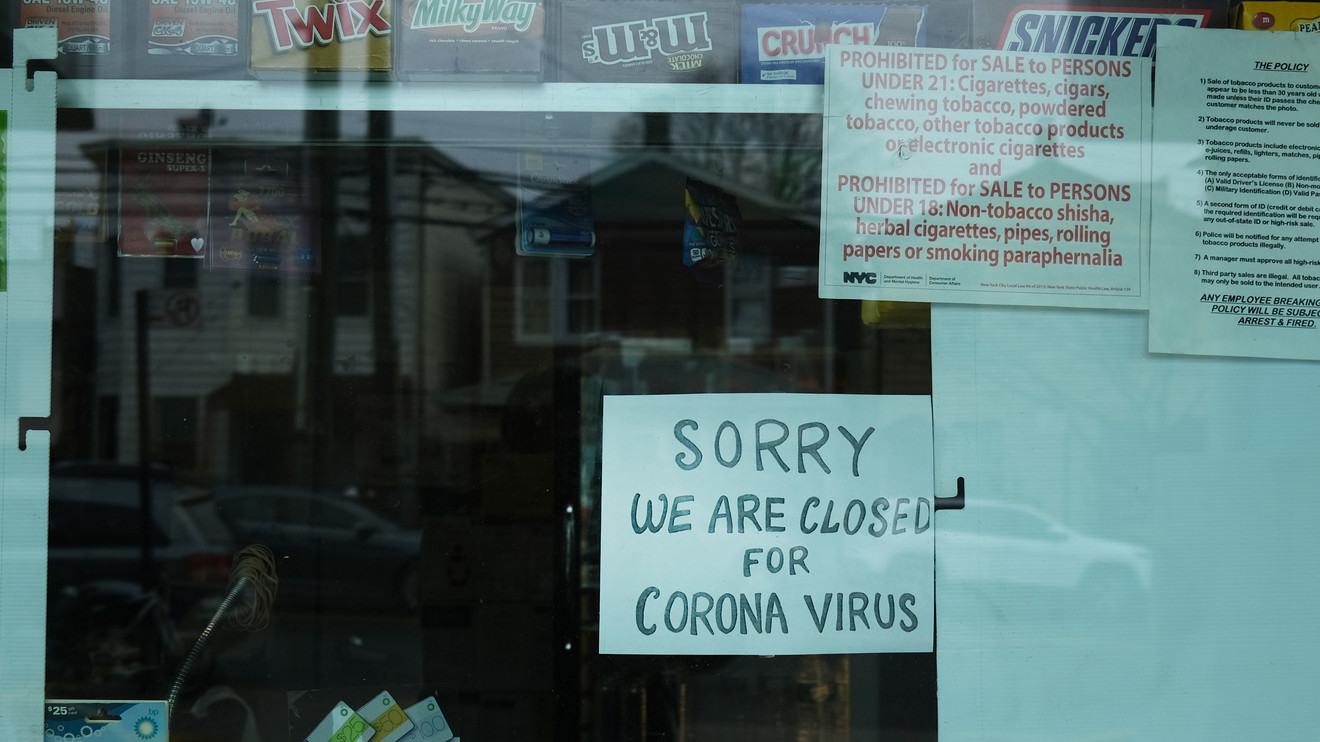

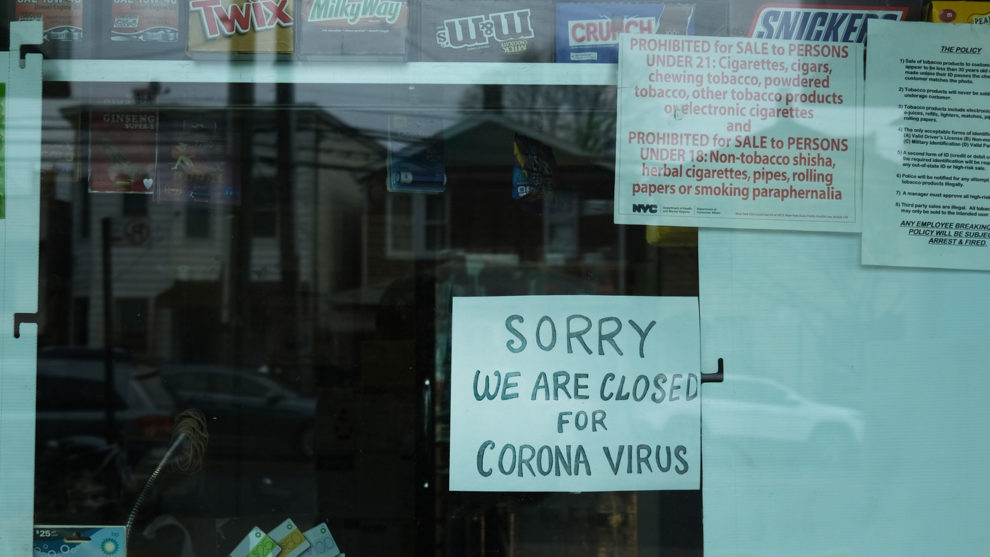

A fight over “business interruption” insurance policies that aren’t covering coronavirus-related claims has drawn a high-profile participant, with President Donald Trump weighing in.

The insurance industry “can’t be comfortable with a populist president talking about the topic on national TV, framing it in terms of what he thinks is fair, and generally opposing the industry’s view. That’s an ‘uh-oh’ moment,” said Capital Alpha Partners analyst Ian Katz in a Monday note.

Trump addressed the issue in Friday’s two-hour coronavirus briefing at the White House, saying he “would like to see the insurance companies pay if they need to pay.” The president said there’s “an exclusion” for pandemics “in some cases,” but “in a lot of cases, I don’t see it.”

“You have people that have never asked for business-interruption insurance, and they’ve been paying a lot of money for a lot of years for the privilege of having it,” Trump said at the briefing. “And then when they finally need it, the insurance company says, ‘We’re not going to give it.’ We can’t let that happen.”

While some of Trump’s comments on Friday were concerning for insurers, other remarks at the briefing could be encouraging for the industry and its lobbyists, according to Capital Alpha’s Katz. “If the president is saying the language in the contracts should rule, the insurance industry is probably comfortable with that. The understanding is that most policies exclude pandemic coverage,” the analyst wrote.

Last month, 18 U.S. lawmakers wrote a letter to trade associations for insurers that urged them to “work with your member companies and brokers to recognize financial loss due to COVID-19 as part of policyholders’ business interruption coverage.”

Insurance trade groups, for their part, said in a letter this month to two members of Congress that “standard business interruption policies do not, and were not designed to, provide coverage against communicable diseases such as COVID-19, and as such, were not actuarially priced to do so.” The letter noted that the groups and other industries’ trade associations have called for a “COVID-19 Business and Employee Continuity and Recovery Fund” from the federal government that would aid impacted businesses and their employees.

Seven Republican senators came to the insurance industry’s defense on Friday, essentially warning Trump in a letter about trying to change business-interruption policies.

“If the insurance industry were now forced retroactively to cover perils that were never accounted for, commercial insurers could experience significant economic strain and/or insolvencies, given the magnitude of the current cumulative estimated claims,” the letter said. The senators also said they’re “very skeptical” about efforts to “create a TRIA-like solution for future pandemics,” referring growing support for a Pandemic Risk Insurance Act (PRIA) that would mirror the Terrorism Risk Insurance Act.

Insurance stocks, as tracked by the SPDR S&P Insurance ETF KIE, -3.21% , fell by 3% on Monday, while the broad S&P 500 index dropped 1%. The insurance ETF has lost 24% in the year to date, while the S&P has shed 15%.

“We think the industry will be able to fight off the effort to retroactively change contracts, if for no other reason than the law is probably on its side. But the PRIA issue is a long-term one,” Katz said in his note.

Add Comment