Getty Images

Getty Images Two hours after the Group of Seven finance ministers and central bank governors issued a joint statement declaring their readiness to take action to support the economy in the face of risks from the coronavirus, the Federal Reserve pulled the trigger, lowering its benchmark rate by 50 basis points.

It was the Fed’s first inter-meeting move since 2008.

“The fundamentals of the U.S. economy remain strong,” the Fed said in a 10 a.m. statement Tuesday announcing its decision that had unanimous support. “However, the coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target rate for the federal funds rate by ½ percentage point, to 1-1 ¼ percent.”

All of a sudden, the reality of revisiting the zero lower bound, which the Fed now refers to as the effective lower bound, is no longer off in the distance. It could be right around the corner.

And this at a time when Fed officials are still saying that the economy and monetary policy are “in a good place” and the fundamentals are sound.

So what do policy makers do when the good place deteriorates into something mediocre and the fundamentals turn sour?

Forward guidance, which I like to call talk therapy? Large-scale asset purchases? Unfortunately, the Fed goes to war with the tools it has, not the tools it might want or wish to have.

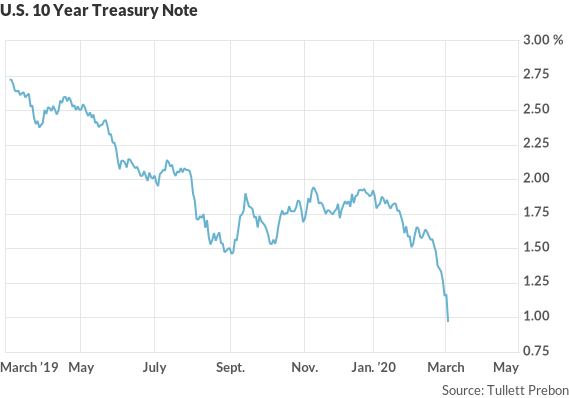

The market has already determined that interest rates will be lower for longer, which is why the yield on the 10-year Treasury note TMUBMUSD10Y, -16.71% dipped below 1%. It doesn’t need the Fed’s guidance.

And stock markets SPX, -3.20% were nonplussed by the Fed rate cut. After suffering their worst week last week since the financial crisis, stocks staged a powerful rally Monday before slumping again on Tuesday.

Fiscal-policy measures, which entail tax cuts and government spending, will be difficult to enact in this highly charged political environment. There is little evidence that the Republicans and Democrats can put partisan differences aside to work together.

Yes, there is bipartisan support for an emergency funding package to address the virus, but the federal government has to make up for lost time and a failure to provide even adequate testing kits.

Global financial institutions are pledging to work together to address the public health emergency and its economic consequences. But so far, monetary policy remains the only viable game in town, with central banks in Australia and Malaysia lowering interest rates as well on Tuesday. Other countries are certain to follow suit as the virus spreads and crisis deepens.

It has already been widely noted that monetary policy is not suited to address supply shocks. While emanating from the supply side — the virus has disrupted production worldwide — the dampening effect on business and consumer spending is within the Fed’s demand-side toolkit to address.

The Fed should get credit for acting pre-emptively on Tuesday. While the actual effect of the virus on economic growth can’t be assessed until it is reported in the aggregate statistics, international organizations and private forecasters had been slashing their growth forecasts for this year.

This week, the Organisation for Economic Co-operation and Development said that in a “downside risk scenario,” global gross domestic product could plunge to 1.5%, half its prior forecast from November.

Futures markets were once again way ahead of the Fed. In recent days, fed funds futures had priced in a series of rate cuts by year end — and two by the time of the March 17-18 meeting in two weeks.

Just last week, several Fed officials suggested they were in no hurry to adjust interest rates.

In a Feb. 25 speech to the National Association for Business Economics, Fed Vice Chair Richard Clarida, after saying that monetary policy was in a good place, mentioned the risks arising from the coronavirus and possible spillover effects from China to the rest of the global economy. But he said it was “still too soon to even speculate about either the size or the persistence of these effects, or whether they will lead to a material change in the outlook.”

It may have been too soon to speculate, but one week was clearly enough time to act!

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment