(Bloomberg Opinion) — Usually when a company cuts its dividend, shareholders fret.

That is not the case at Casino Guichard-Perrachon SA, which said on Thursday that would eliminate its dividend in 2020 in an effort to bring down its debt.

The shares haven’t changed much from Wednesday, highlighting that the move was much-needed and long-overdue. It could save 500 million euros ($556.5 million) over 18 months at a time when funds are needed to reduce borrowings of 2.9 billion euros in France alone.

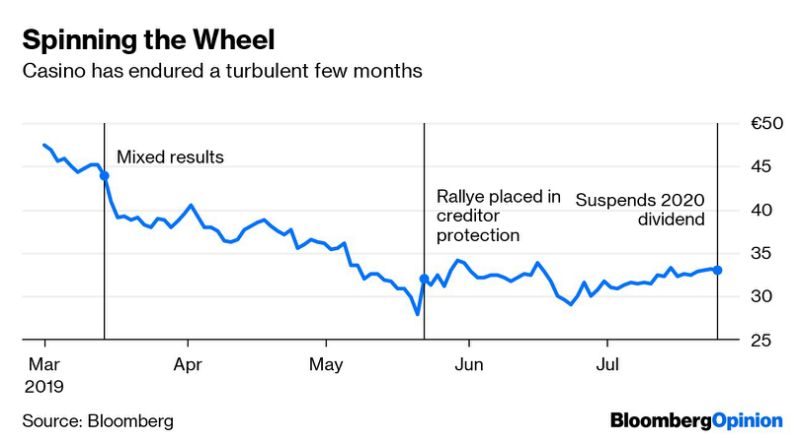

Rallye SA, which owns 52% of Casino, had been reliant on cashflows from the company to service its own borrowings. But Rallye has been in safeguard proceedings since May, giving it time to restructure its debts. This has lifted the constraints from Casino and left it free to pare the dividend. It has already cancelled the interim pay-out.

True, some minority shareholders may be unhappy at the loss of the income. But Casino had been over-distributing. They should have at least been braced for possibility of the payout being radically reduced or ditched.

What’s more, it is the best course of action for the group given its aim to reduce net debt to less than 1.5 billion euros by the end of 2020. Longer term, it may also provide more scope to invest.

Cutting the dividend is also better than some of the alternatives. One option would have been to do even more sale and lease back deals, which simply swap one form of borrowing for another. I have already cautioned on the property disposals it has announced over the past year.

The company hasn’t decided what will happen to the payout in 2021. But the willingness to suspend it – at least for now – indicates that management is running the company for all Casino shareholders, rather than just Rallye.

And that is a good thing because there are still risks for Casino.

While the convoluted corporate structure has long been a worry, the operating performance has held up.

But the French market remains intensely competitive. While same store sales there were better than expected, free cashflow deteriorated, a worrying sign.

Also, Rallye still has a big holding in Casino. As the parent tries to deal with its debt, which stood at 2.9 billion euros at June 30, there remains a risk that some of that stake will have to be offloaded.

Shares in Rallye fell as much as 3.7% on Thursday. The flipside of today’s dividend cut is that its parent will no longer benefit from the income.

As for Casino, its shares have recovered since Rallye was put into safeguarding proceedings, but still remain well below their high for the year, reached in March.

Thursday’s news, which included board approvals for a plan to simplify the web of listed companies in Latin America, have given shareholders a lot of reason to cheer. It helps that takeover interest, potentially from Carrefour SA, or even Amazon.com Inc., can’t be ruled out.

But with the great Casino-Rallye unwinding still at relatively early stage, investors should brace themselves for more upheaval. The subdued share trading on Thursday seems to show they’ve got the message.

To contact the author of this story: Andrea Felsted at [email protected]

To contact the editor responsible for this story: Jennifer Ryan at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”61″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment