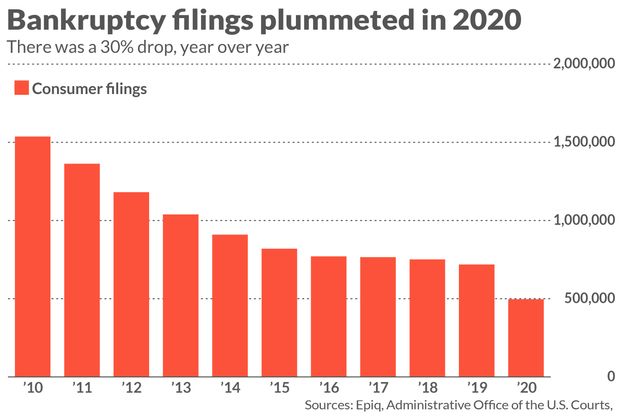

By many measures, the pandemic induced all sorts of financial stress last year. But consumer bankruptcy cases — a way to address financial pain and deepening debts — plummeted in 2020.

There was a 30% drop in all bankruptcies year over year, falling to 529,071 from 757,634 one year earlier, according to data provided by the American Bankruptcy Institute, a professional association. There were 496,565 consumer bankruptcy petitions filed last year, the lowest since 1987 and a 31% decline from 2019.

Commercial bankruptcies dipped in 2020, except for Chapter 11 filings to restructure debt obligations, the ABI said. Those filings — which included prominent retailers rocked by the coronavirus, like Neiman Marcus, J.Crew and JCPenney — jumped 29%.

That data comes amid plenty of grim statistics about Americans’ financial health: From August to December, more Americans said they hadn’t eaten enough and it was difficult to pay for typical household expenses, according to the U.S. Census Bureau.

Unemployment rates have been improving from their double-digit numbers in the early spring, but last month marked the first drop in jobs since that rebound started. The jobless rate in December was 6.7%. Meanwhile, household savings rates keep dropping nationally, and over one-third of people say they’re operating in financial “survival mode.”

Stimulus money, state reopenings and eviction moratoriums may have helped

Bankruptcy cases had already been slipping before the pandemic, coinciding with a years-long bull market and decades-low unemployment rates. Still, 2020’s pronounced drop “surprised a lot of people,” said Amy Quackenboss, the executive director of the American Bankruptcy Institute — herself included.

In early spring, Quackenboss said a rise in consumer bankruptcy cases would start in May and June. Now she says there are several reasons why her prediction didn’t pan out, starting with the success of the $2.2 trillion CARES Act.

“ Eviction and foreclosure moratoriums put off the moment when people need to take action just to keep a roof over their head, according to attorney William Kransdorf. ”

“I think the depth and breadth of the stimulus packages are doing their job,” she said. State reopenings in the late spring and summer might have staved off or delayed bankruptcy for some, she added, and people may have kept holding off on filing because they were waiting to see what was in another stimulus package. President Trump signed a $900 billion second relief package late last month.

Other observers have their own theories. Eviction and foreclosure moratoriums put off the moment when people need to take action just to keep a roof over their head, according to attorney William Kransdorf.

The Centers for Disease Control and Prevention announced the national eviction moratorium in September, and its Dec. 31 deadline was pushed to Jan. 31 in the second relief package. One pause on foreclosures for mortgages backed by the Federal Home Administration runs through Feb. 28.

Without these types of “triggers,” people are “deferring the things they can defer,” said Kransdorf, the director of the NYC Bankruptcy Assistance Project at Legal Services NYC, which provides civil legal services to low-income people.

Kransdorf and his staff filed 100 cases last year, half the number of 2019 filings. He saw a small spurt in cases in the fall, beginning roughly a month after CARES Act money for supplemental $600 unemployment insurance ran out.

Immediate financial pressures can force a decision to file, but their absence may prolong the process.

“Filing for bankruptcy is really good when debt collectors are at your front door and ready to take to your stuff,” said Pamela Foohey, a visiting professor at Yeshiva University’s Benjamin N. Cardozo School of Law.

“ Another potential reason for 2020’s decline in filings: Someone might be so strapped for cash that they can’t even afford the bankruptcy process right now. ”

But Foohey, who wasn’t surprised by the 2020 filing dip, said many people typically take several years trying get out of the red before resorting to bankruptcy. It took two years after Lehman Brothers’ 2008 bust for bankruptcies to reach a recent high of 1.59 million in 2010, case counts show. “People want to pay their debts, and they are eternally optimistic their financial situation will get sunnier,” Foohey said.

Another potential reason for 2020’s decline in filings: Someone might be so strapped for cash that they can’t even afford the bankruptcy process right now, Foohey said. For many, she said, “the time to file is when you’ve made it through the catastrophe” and have income sources for attorneys and creditors.

But the going rate for legal representation could be around $1,300 up front for a Chapter 7 case and $3,800 stretched out in a Chapter 13 case, Foohey said. (In a Chapter 7 case, a consumer sells off assets to pay creditors and discharge debts. In a Chapter 13 case, a debtor pays in an installment plan, typically between three and five years.)

Those sums may be especially cost prohibitive now. “That would counsel to, ‘Let’s just wait,’” Foohey said.

Quackenboss, Foohey and Kransdorf agree that at some point, bankruptcy cases are bound to bounce back — but the timing and extent are unclear because there are many variables at play. Those include questions about how much proposed $2,000 stimulus checks, extra unemployment benefits or the 2021 job market can pull people from insolvency.

Another question is how much medical debt incurred during the pandemic will translate into future cases, Quackenboss added. Before an estimated 15 million people lost employer-sponsored health coverage in 2020, a 2019 study found people were twice as likely to file for bankruptcy if they went without coverage for up to two years.

‘The stigma of bankruptcy is real’

Another hurdle might be an emotional one. “The stigma of bankruptcy is real, and it’s unfortunate,” Quackenboss said. “The whole purpose of bankruptcy is to give people a fresh start.”

There are lasting consequences to filing for bankruptcy. For example, a bankruptcy sticks on a credit report for seven or 10 years from the filing date, depending on the type of petition. It wipes out the credit history before that point, said Kransdorf, and that might not be such a setback for someone who already had derogatory information in their file.

Anyone considering the idea needs to think like a company, Kransdorf said.

“Corporations make decisions to file for bankruptcy that are devoid of shame or a sense of a moral failing,” he said. “People need to make the same kind of decision. They don’t need to be concerned about bankruptcy as a badge of failure or a moral failure. It’s none of those things.”

In fact, it may even be a boon for the economy. Bankruptcy is “going to be a very important tool to recover from the mess COVID-19 made,” Kransdorf said.

“It benefits the banks that people get rid of debts they’ll never be able to pay, so they can go back to economy and generate revenue,” he said.

Add Comment