Many investors have given up energy stocks for dead, as the supply glut during the pandemic crushed oil prices. But with the hope that coronavirus vaccines will help quell the pandemic in 2021, this is the time to bid for a recovery play as energy demand strengthens.

Recovery play

In an interview, Lewis Altfest, CEO of Altfest Personal Wealth Management, said investors can get “a total return over the next few years, of 50%” with energy stocks. Then again, judging from last week’s action and how much energy stocks have lagged behind the broad stock-market recovery, a return of that magnitude for energy may take place much more quickly.

“If I got my 50%, I would give serious consideration to moving on to something else,” Altfest said.

The investor said he was “not looking at energy as a long-term play.” He acknowledged that electric vehicles will disrupt parts of the energy distribution chain, but added that “obviously there will be increased competition coming as well from wind and solar, and they are getting to be more efficient all the time.”

Altfest’s firm manages about $1.4 billion for private clients. He has worked through all sorts of stock market crises, and participated in a discussion about the October 1987 crash and its aftermath, in 2017.

Investors already jumped aboard the oil-recovery bandwagon last week, when the S&P 500 energy sector rose 27.5%, while the broader S&P 500 Index SPX, -0.46% was up 2.3%.

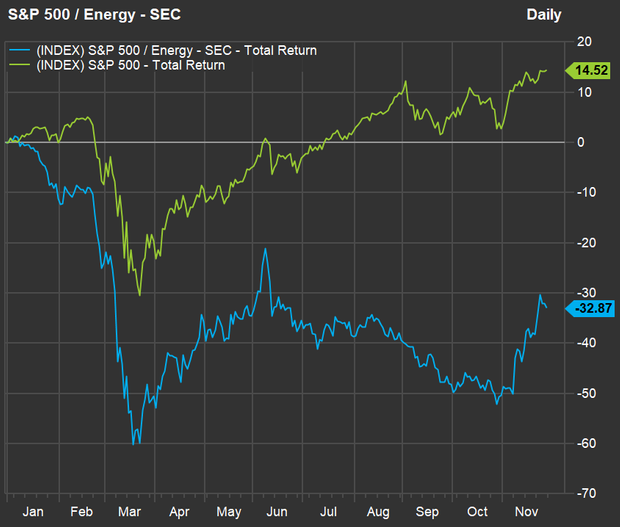

Check out this year-to-date total-return chart for both:

Even after last week’s 27.5% gain, energy is, by far, the worst-performing S&P 500 sector of 2020. (FactSet)

Even after last week’s bounce, the energy sector is this year’s worst performer, by a wide margin:

| S&P 500 sector | Total return – 2020 through Nov. 27 |

| Information Technology | 33.7% |

| Consumer Discretionary | 29.8% |

| Communication Services | 19.5% |

| Materials | 16.5% |

| Industrials | 8.9% |

| Health Care | 7.1% |

| Consumer Staples | 6.2% |

| Utilities | -1.8% |

| Real Estate | -5.4% |

| Financials | -7.8% |

| Energy | -36.5% |

| Source: FactSet | |

Three stocks

Altfest pointed to three integrated oil companies whose shares feature attractive dividend yields. A very high yield always means investors are concerned about dividend cuts. Then again, if the upward drive continues for the sector, the cutting trend may be pretty much over for now.

The first stock Altfest named was BP PLC BP, -7.29%. The company’s American depositary receipts rose 8% last week but ended down 44% for 2020 (excluding dividends). BP cut its dividend by 50% in August. The dividend yield is now about 6%.

Altfest called BP “one of the lower-cost oil producers with a strong balance sheet” and said the company’s cost-cutting and asset sales mean “you should be able to enjoy that 6% dividend without as much concern about [another] dividend cut.”

“You should get a capital gain as the economy strengthens,” he added.

The other two companies Altfest discussed haven’t cut their dividends this year. In fact, both are included in the S&P 500 Dividend Aristocrats Index SP50DIV, -2.64%, which is made up of the 64 companies among the S&P 500 that have raised their regular dividends on common shares for at least 25 consecutive years. (That’s the only criterion for inclusion in the Aristocrats group — it makes no difference how high or low a stock’s current yield is. You can invest in the Aristocrats through the ProShares S&P 500 Dividend Aristocrats ETF NOBL, -0.95%, which holds all 64 stocks.)

Shares of Exxon Mobil Corp. XOM, -5.12% rose 9% last week and ended with a year-to-date decline of 42%. The company hasn’t cut its dividend during the pandemic, and its shares now have a yield of 8.66%. As a giant integrated operator (meaning it produces oil, refines it, transports fuel and distributes it on a retail level), the company is benefiting from “lower input costs,” Altfest said.

He expects tremendous gains for the shares, even with the risk of a dividend cut. He doesn’t expect the company to cut the payout, but if it were to do so, “psychologically it would be best for them to wait for the stock to rally before cutting the dividend,” he said.

The third energy stock Altfest discussed was Chevron Corp. CVX, -4.52%, which rose 6.4% last week and ended with a year-to-date decline of 24%. The shares have a dividend yield of 6.4%. Altfest called Chevron “a high-quality integrated producer with a strong asset base and low debt leverage.”

An energy ETF

For investors who want to take a broader approach to an energy recovery rather than selecting a few individual names, Altfest suggested the Energy Select SPDR ETF XLE, -5.52%, which holds 26 stocks of oil and natural gas producers, as well as drillers and energy services companies.

The ETF was up 9% last week and ended with a 35% decline for 2020. Its dividend yield is 5.66%.

Add Comment