(Bloomberg) — Dell Technologies Inc. reported quarterly profit that topped Wall Street estimates, in a sign that corporate demand for computers and storage hardware remains strong.

Earnings, excluding some items, were $1.75 a share in the fiscal third quarter, the Round Rock, Texas-based company said Tuesday in a statement. Analysts, on average, projected $1.59, according to data compiled by Bloomberg. Adjusted revenue rose 1.2% to $22.9 billion in the period ended Nov. 1, just missing analysts’ estimates of $23 billion.

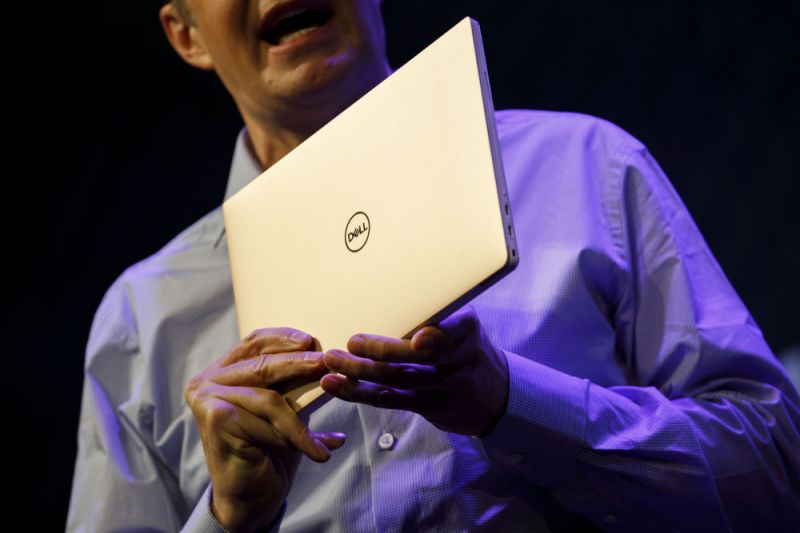

Chief Executive Officer Michael Dell has sought to outperform peers by diversifying his company’s product portfolio. Macroeconomic forces, including trade and geopolitical tensions, have caused Dell’s clients to slow down their data-center hardware purchases. Hewlett Packard Enterprise Co. and Cisco Systems Inc. said earlier this month that businesses have been more cautious due to global uncertainty.

Dell’s revenue growth is helped by its majority interest in software maker VMware Inc., while the company’s personal computers and storage hardware products continue to boost profit.

“Our highly differentiated set of offerings enables us to continue to win in a consolidating industry, while also driving long-term value for all stakeholders,” Jeff Clarke, Dell’s vice chairman, said in a statement.

Shares gained about 2% in extended trading, after closing at $53.19 in New York. The stock has gained 8.8% this year.

The personal computer division grew 4.6% to $11.4 billion in the quarter. Commercial sales rose 9.4% due to corporate clients upgrading their computers to adopt Microsoft Corp.’s Windows 10 operating system. Revenue from consumers, on the other hand, fell 6.4% in the period.

Revenue from Dell’s data-center hardware declined 6.1% to $8.39 billion. Storage hardware sales increased 6.9%, but servers and networking gear dropped 16%, highlighting a slower spending environment among large corporate clients.

VMware, majority owned by Dell, said sales exceeded analysts’ estimates, rising 12% to $2.46 billion. Analysts, on average, projected $2.41 billion, according to data compiled by Bloomberg. Profit, excluding some items, was $1.49 a share, compared with analysts’ average estimate of $1.42. VMware makes software that allows customers to combine multiple tasks on a single server, and is trying to shift to selling more programs that help companies run applications in the cloud and in their own data centers.

Dell repaid about $1.1 billion of gross debt in the most recent period and has paid down about $3.5 billion so far this year. The company said it repaid more than $18 billion in gross debt since its EMC Corp. acquisition, announced at $67 billion, closed three years ago and is on target to repay about $5 billion of gross debt in fiscal 2020.

–With assistance from Dina Bass.

To contact the reporter on this story: Nico Grant in San Francisco at [email protected]

To contact the editors responsible for this story: Jillian Ward at [email protected], Andrew Pollack, Alistair Barr

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”31″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment