The week of April 17 we will see earnings season start in earnest. As always, earnings results and guidance will be critical in determining the state of the broader economy, and how investors decide to position their portfolios.

So far, 2023 has been unexpectedly good for most stocks. Many market participants came into the year expecting a recession, and another challenging year for the equity market, but that hasn’t materialized.

Because the performance of the technology sector has been so strong this year, earnings reports from the tech giants are going to be front and center. Will they be able to show strong earnings and rally further? Or are earnings going to be a sell the news event.

Image Source: Zacks Investment Research

Next week we will see earnings reports from Netflix NFLX, Tesla TSLA, Lam Research LRCX, and Taiwan Semiconductor TSM.

Also getting a lot of attention this earnings season will be bank stocks. After the Silicon Valley Bank debacle, investors are going to want to know how the other regional and national banks are faring in this new higher interest rate environment.

Earnings for Charles Schwab SCHW, State Street STT, Bank of America BAC, and Morgan Stanley MS will be closely scrutinized. There is also a litany of smaller financial institutions reporting next week.

Friday morning, we got the first preview of bank earnings. JP Morgan JPM and Citibank C both beat earnings expectations. JPM surprised to the upside by 20%, while C beat by 12%.

Tesla

Tesla has been a huge winner in 2023 up 49% YTD. Yet analysts don’t have high expectations for earnings growth. Current quarter sales are expected to grow 25% YoY to $24 billion, but earnings are projected to contract -21% to $0.85 per share.

During its last reporting period Tesla beat earnings expectations by 9%, so it will be interesting to see if these lowered estimates help it edge out another beat. Zacks Earnings ESP projects a -1.7% miss for the electric car manufacturer. TSLA reports Wednesday after the market close.

Image Source: Zacks Investment Research

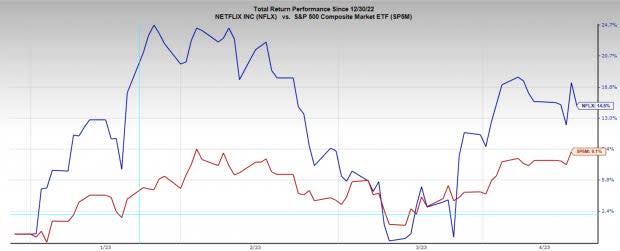

Netflix

Netflix stock has had a decent year to date performance, although quite volatile. After being up 25% in January, the stock tanked to a negative performance. It has rallied considerably since the banking crisis though and is now up 15% YTD.

With a Zacks Rank #3 (Hold), analysts have mixed expectations for earnings. Sales are expected to grow 4% YoY to $8.2 billion, but earnings are expected to shrink 20% YoY to $2.81 per share. Last quarterly report NFLX did awfully, and missed earnings estimates by -75%.

Image Source: Zacks Investment Research

It’s worth noting that Netflix valuation is as appealing as it has been in a long time. Trading at 31x earnings it is well below its five-year median of 64x. In 2022 NFLX experienced a -75% drawdown, which is what brought its valuation to the level it is today. NFLX reports Tuesday after the market close.

Image Source: Zacks Investment Research

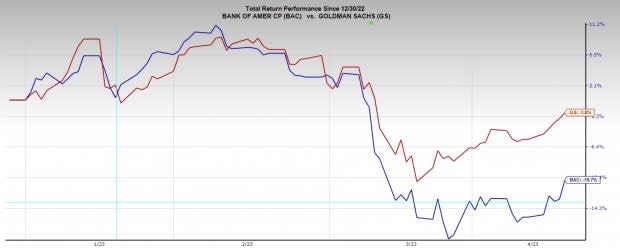

Bank of America and Goldman Sachs

Tuesday morning, we will see earnings reports from Bank of America and Goldman Sachs GS. Both have put up lackluster returns YTD, and neither have strong earnings expectations.

Image Source: Zacks Investment Research

Analysts have unanimously downgraded BAC earnings expectations across timeframes. Current quarter earnings expectations have been lowered by nearly -4% over the last 60 days. Last quarter, Bank of America beat estimates by 12%, but the Zacks ESP is projecting a -1.7% miss.

Image Source: Zacks Investment Research

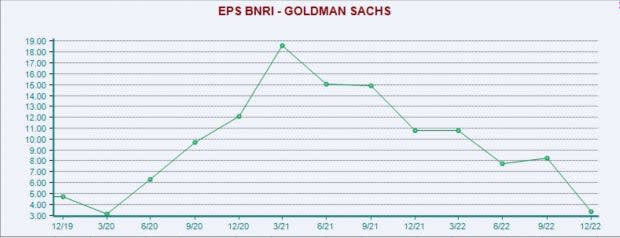

Goldman Sachs estimates aren’t any better. Sales are expected to stagnate YoY, while earnings are projected to be down -24% YoY to $8.14 per share. EPS have been collapsing over the past two years.

Image Source: Zacks Investment Research

Conclusion

It should be a busy and interesting start to the earnings season next week. Will tech stocks be able to continue their phenomenal and unexpected start to the year? Have banks made it through the worst of the crisis? Next week, we will begin to answer some of these questions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Bank of America Corporation (BAC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Morgan Stanley (MS) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment