Advanced Micro Devices Inc. shares ticked higher in the extended session Tuesday after the chip maker’s data-center sales held up, and corrections in the forecast remained in the area of estimates that had not been updated following the company’s pre-announcement earlier in the month.

AMD AMD, -0.67% shares rose 2% in the extended session, following a 0.4% decline to finish the regular session at $59.66. Nearly a month ago, AMD slashed its quarterly revenue forecast by about $1 billion to account for a 40% drop in PC sales amid reports of the worst PC shipment declines on record, but had not updated its full-year forecast. The company announced in early August it was holding firm to its full-year forecast even though it saw some softness on the horizon.

For the fourth quarter, AMD forecast revenue of $5.2 billion to $5.8 billion, with its embedded and data-center segments “expected to grow,” with revenue of $23.2 billion to $23.8 billion for the year and gross margins of about 51%.

Analysts had estimated revenue of $5.95 billion for the fourth quarter, and $24.16 billion for the year.

That would suggest data-center sales were not being reduced like the $1 billion cut to PC sales — about the same dollar amount that Wall Street lowered their forecasts for the year by, on average, following the warning. With the difference between the Street average and the low end of AMD’s forecast being just shy of $1 billion, on average, that would suggest a forecast that was roughly in line.

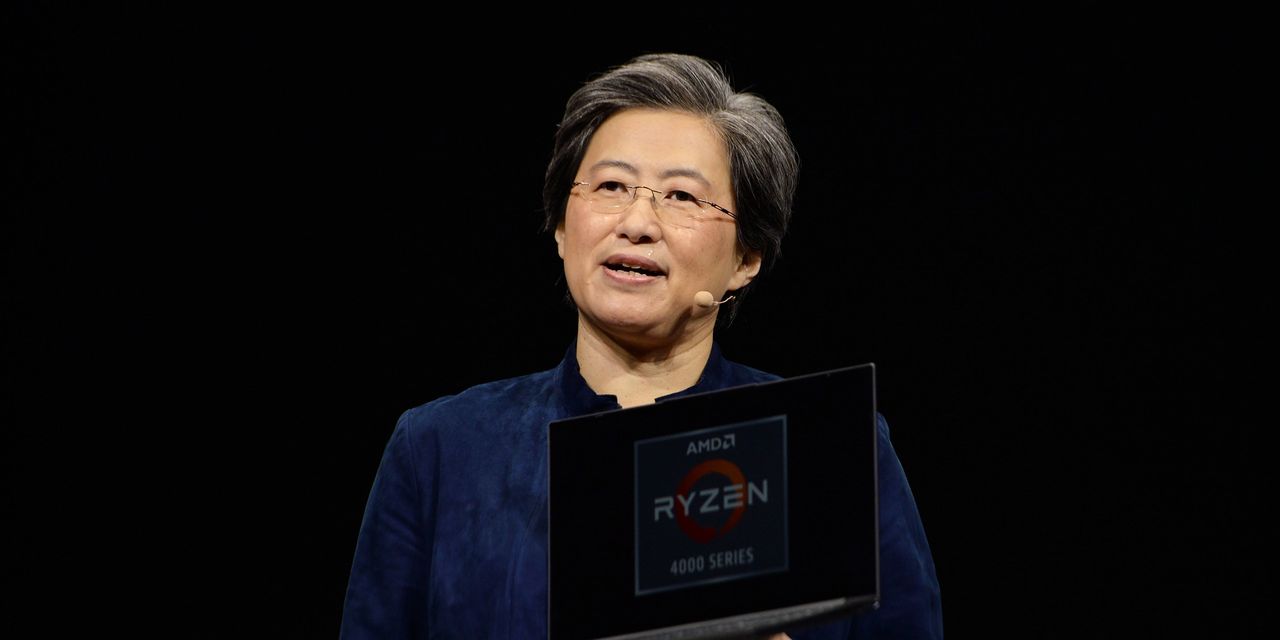

“Third-quarter results came in below our expectations due to the softening PC market and substantial inventory reduction actions across the PC supply chain,” said Lisa Su, AMD’s chief executive, in statement.

“Despite the challenging macro environment, we grew revenue 29% year over year, driven by increased sales of our data-center, embedded and game-console products,” Su said. “We are confident that our leadership product portfolio, strong balance sheet, and ongoing growth opportunities in our data center and embedded businesses position us well to navigate the current market dynamics.”

The company reported third-quarter net income of $66 million, or 4 cents a share, compared with $923 million, or 75 cents a share, in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were 67 cents a share, compared with 73 cents a share in the year-ago period.

Revenue rose to $5.57 billion from $4.31 billion in the year-ago quarter, while gross margins fell to 42% from the company’s acquisition of Xilinx and Pensando earlier in the year, compared with 48% in the year-ago period.

Analysts surveyed by FactSet had forecast 69 cents a share on revenue of $5.65 billion.

Intel earnings reaction: ‘Shock and awe’ cost cuts rocket Intel stock up 10% to best day since March 2020

Data-center sales rose 45% to $1.6 billion, while analysts expected $1.64 billion, the company reported, using its reclassified product groups. Intel’s data-center sales fell 27% to $4.2 billion from a year ago, and the group was not profitable for the quarter.

Client — that is, PC — sales fell 40% to $1 billion from a year ago, as reported in the warning, while the Street had estimated $1.17 billion.

AMD shares have fallen 58% year to date. By comparison, the PHLX Semiconductor Index SOX, +0.77% is down about 39%, while the S&P 500 index SPX, -0.41% is down 19%, and the tech-heavy Nasdaq Composite Index COMP, -0.89% has fallen 30%.

Add Comment