The second-quarter earnings season will kick off in earnest next week, and investors should brace for bad news with all signs signaling a second straight decline that will confirm an earnings recession.

The big reveal will come from management commentary about the causes of the slump and whether it will drag on into the coming quarters.

As second-quarter results have trickled in ahead of the unofficial kickoff on Monday, S&P SPX, +0.46% earnings per share are expected to decline 3.0% from a year ago, following a 0.3% drop in the first quarter, according to FactSet data.

Recessions are generally defined as two consecutive quarters of declines. The last time S&P 500 earnings per share declined in back-to-back quarters was the four-quarter stretch of EPS declines that ended after the second quarter of 2016.

Don’t miss: An earnings recession looms for first time in 3 years.

Gail Dudack, chief investment strategist at Dudack Research Group, a division of Wellington Shields & Co., said second-quarter results could prove “pivotal” for the equity markets.

“The only good news is that expectations are low,” Dudack wrote in a note to clients. “Nevertheless, it is clear that to support a sustainable advance in the [S&P 500 index] earnings need to improve and beat the current consensus.”

See now: Banks should shine among S&P 500 stocks this earnings season

Of the S&P 500’s 11 key sectors, five are expected to suffer year-over-year EPS declines, led by materials and information technology, as a slowdown in the global economy and trade disputes have acted as a drag on consumer and business spending.

So far, investors don’t seem too concerned, as the S&P 500 index SPX, +0.46% rose to record highs on Thursday. But what is perhaps more important for investors than what companies say about what happened over the past three months is what they expect for the rest of the year.

See now: Rush to beat China tariffs drives PC shipments higher, but that may bode ill for rest of 2019

“While the bar for Q2 results has been lowered heading into the reporting period…the larger concern is if second-half guidance will support consensus expectations,” wrote Lindsey Bell, investment strategist at CFRA, in a research note to clients. “Corporations have every incentive to be conservative at this point given the unknown regarding trade outcomes, the economic weakness being exhibited from China and a slowdown in Europe.”

The following are the five things that MarketWatch expects to be the most important factors to watch for during earnings season:

Trading races

The continuing trade tensions between the U.S. and major trading partners, China, Europe and more recently India, are expected to feature again this earnings season with even Federal Reserve Chairman Jerome Powell now acknowledging the impact they are having on the broader economy.

Read more: Fed’s Powell says trade worries restraining the economy, hints at interest-rate cuts soon

Investors can expect to hear more news of job cuts and other cost reductions, and projects put on hold as companies wait for clarity on the state of trading rules and agreements.

There’s a lot at stake.

“The importance of getting some sort of trade deal — that lowers trade barriers and gives large, U.S. companies some certainty over future trade policies — swamps that of Federal Reserve policy …because the difference between an escalation of the trade dispute and its resolution is large enough to have an even greater impact than the historic corporate tax cut instituted in late 2017,” J.P. Morgan’s chief equity strategist Dubravko Lakos-Bujas told MarketWatch in an interview this week.

A resolution of the dispute could mean a difference of as many as 800 points to the S&P 500 index, said the strategist. If a deal is struck, and it happens to coincide with one or two interest rate cuts, it would boost the index to 3,200 to 3.300, he said.

“If for whatever reason we go down the wrong path, and we get escalation of the trade dispute, then we have a downside of 2,500,” or about 20% below the record high set early Friday, he said.

TS Lombard highlighted a whole other set of risks in the different approaches taken by U.S. and China negotiators that the U.S. may not be fully taking on board. The U.S. approaches talks with the view that it is defending a negotiating position, “but for China much of what the U.S. is trying to achieve appears to be a threat to the system that is fundamental to the power and control of the Communist Party,” TS Lombard analysts wrote in a recent note.

The talks have moved past the issue of the bilateral trade deficit to what TS Lombard views as a U.S. “assault on the basic workings of China’s economy, in particular its intended state-sponsored ‘great leap forward’ in technology,” said the note. Democrats have started to support that view, turning the talks into more of a battle for global supremacy, and means its resolution will become a key 2020 election issue.

Analysts noted that the treatment of Huawei has taken on a different complexion to the ZTE issue from a year ago. The U.S. view of the Chinese telecoms giant is effectively that it should not exist, they wrote.

“If this broad assault on China’s economic modus operandi continues for several months, Beijing may conclude that nothing will satisfy the US … so that when Mr Trump judges the moment ripe to ‘turn on a dime’ and reach agreement with China, he may find the negotiating room empty,” they cautioned.

Meanwhile, the aggressive rhetoric from the White House, the tit-for-tat retaliatory tariffs that trading partners are placing on each other and frequent changes of mind are showing up in data, in company releases and on calls.

Just last week, the Institute for Supply Management said its manufacturing index fell to 51.7% in June from 52.1% in May, the slowest pace in more than two years, weighed down by tensions with China and Mexico and weak exports. The index stood at 60.8% last August, before the trade war with China really began to heat up, spurring a round of tariffs by both countries. The index has now fallen for three straight months.

Don’t miss: Why the U.S.-China trade deficit is so huge: Here’s all the stuff America imports

Tensions with Mexico hit highs last month after Trump threatened to apply tariffs to all Mexican imports in an effort to pressure authorities to crack down on migrants attempting to enter the U.S. via the southern border.

Although Trump later dropped its threat, the move caught businesses by surprise. Many executives complained about the White House trade strategy.

“China tariffs and pending Mexico tariffs are wreaking havoc with supply chains and costs. The situation is crazy, driving a huge amount of work [and] costs, as well as potential supply disruptions,” said an executive at a computer maker.

Read now: Bond legend Dan Fuss says tariff hikes will put leveraged debt markets through the ‘wringer’

See: UnitedHealth stock has bounced back after a rough first quarter. Will its positive streak continue?

Cloudy outlook

As with all earnings seasons, investors will be looking to third-quarter outlooks for signs of encouragement, but companies might not be able to make strong predictions. The executives of companies that have already reported results have indicated that their forecasts are still cloudy.

“The pricing environment remains uncertain due to the overhang of tariffs and trade,” MSC Industrial Direct Co. MSM, +2.07% Chief Executive Erik Gershwind said after his company delivered a disappointing forecast earlier this week.

Read: J&J earnings preview: Wall Street is still optimistic despite company’s legal issues

Broadcom Inc. AVGO, +3.38% which posted its second-quarter report in mid-June, said that lingering questions about the Huawei Technologies Co. ban as well as general trade tensions are “reducing visibility” for customers.

Last week, a warning from South Korea-based electronics behemoth Samsung Electronics Co. 005930, +0.22% that second-quarter profit could be less than half what it was last year rattled the entire chip sector. Samsung said it expects second-quarter operating profit to decline 56% from a year ago to 6.5 trillion won ($5.6 billion), citing sluggish demand for memory chips, made worse by the continuing U.S.-China trade war.

See related: Tech earnings are a test amid tumultuous times, and all the chips are on the table.

Lindsey Bell from CFRA said CEO confidence readings have been reflecting the uncertain outlook for some time and capital spending has slowed as a result. “Capex reductions could be part of the revised outlooks for 2019,” she wrote. “…At most risk would be the technology, industrials and financials sectors given their exposure to trade and a lack of reductions in earnings expectations since April.”

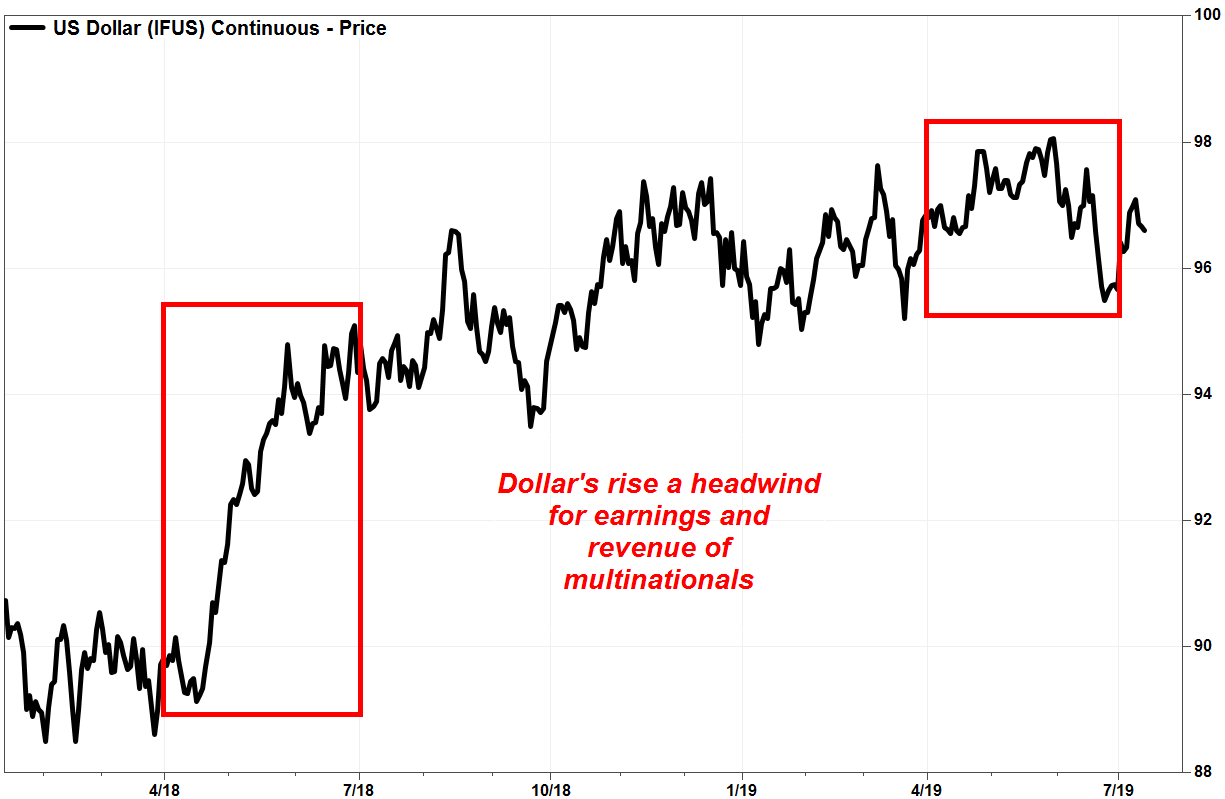

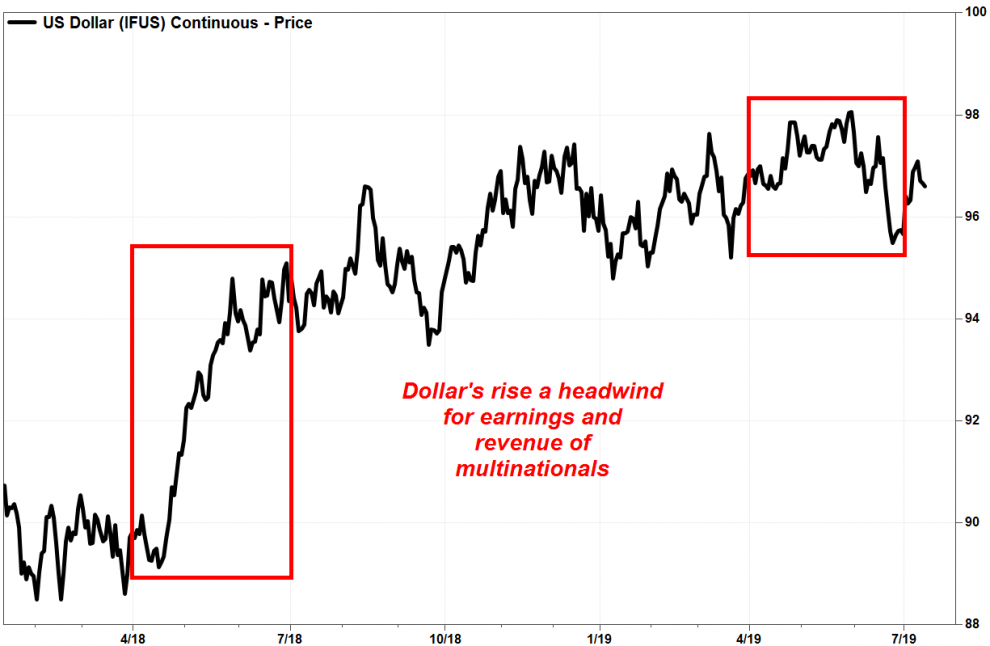

Dollar daze

Changes in the dollar’s value against the currencies of the U.S.’s major trading partners can materially impact a multinational company’s results, as it can cause fluctuations in the value of earnings and revenue derived from overseas operations and the costs of materials sourced from international markets.

The ICE U.S. Dollar Index DXY, -0.34% a measure of the greenback against a basket of six major rivals, climbed to a daily average of 97.05 during the three months ended June 28, according to FactSet data, a 4.9% increase from the daily average of 92.48 over the same time last year.

FactSet, MarketWatch

FactSet, MarketWatch

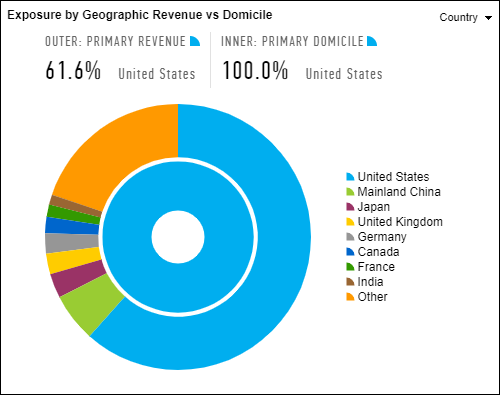

It’s no wonder President Trump has called for a lower dollar; the dollar’s strength over the past year has been a significant headwind to S&P 500 earnings and revenue in the second quarter, and could put a damper on second-half outlooks. And since nearly 40% of the S&P 500 companies’ revenue in aggregate is derived from overseas markets, according to FactSet, the negative impact of dollar strength will reach all sectors.

Also read: Goldman sees ‘low but rising risk’ Trump will intervene to weaken U.S. dollar.

FactSet

FactSet

Already, Delta Air Lines Inc. DAL, +2.48% President Glen Hauenstein said on a post-earnings conference call with investors this week, according to a transcript provided by FactSet, that “currency headwind,” which is corporate-speak for a stronger dollar, reduced international revenue by 1.5 percentage points, and was the primary reason for the slight decline in the international yield trend. Read more about Delta’s earnings.

PepsiCo Inc. PEP, -0.80% another early reporter, said dollar strength reduced second-quarter net revenue by 3 percentage points and lowered earnings per share by 2 percentage points. For 2019, the company said current consensus dollar expectations implies a “foreign exchange translation headwind”—another way of saying the negative effects of dollar strength—of 2 percentage points for both revenue and EPS. Read more about PepsiCo’s results.

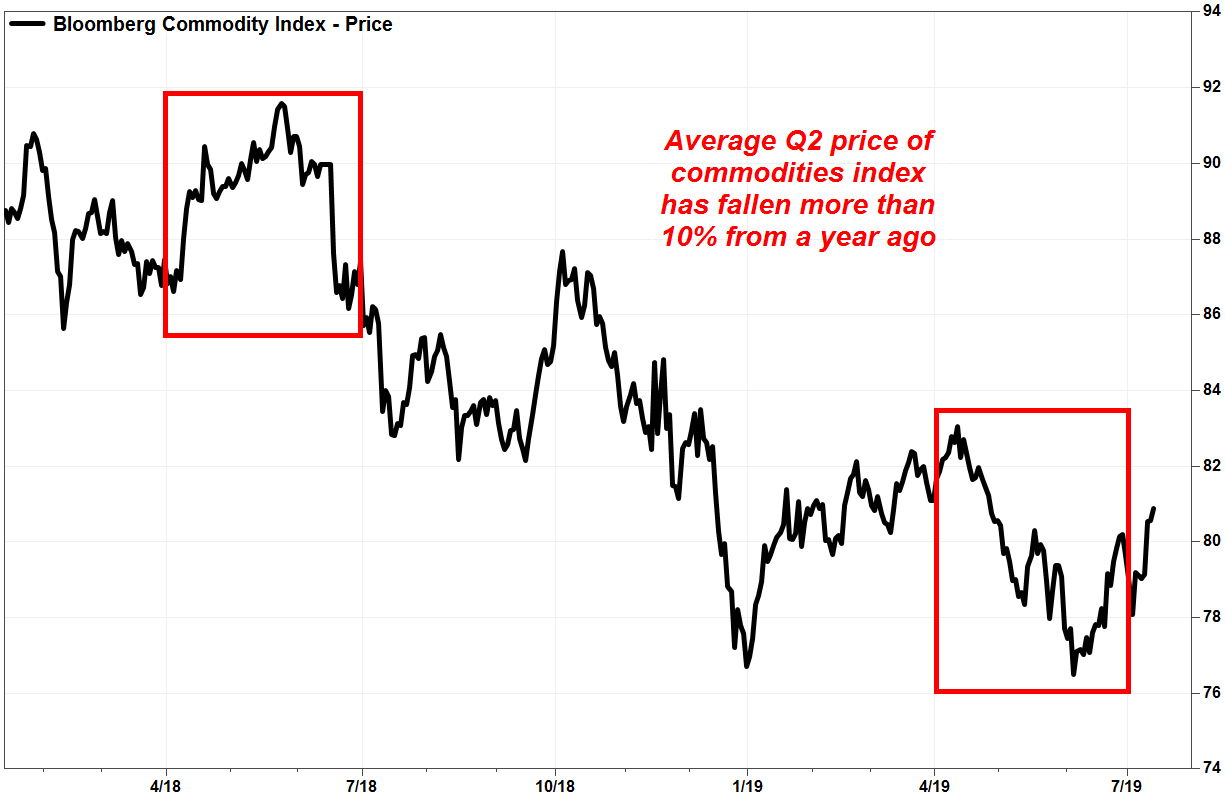

Price points

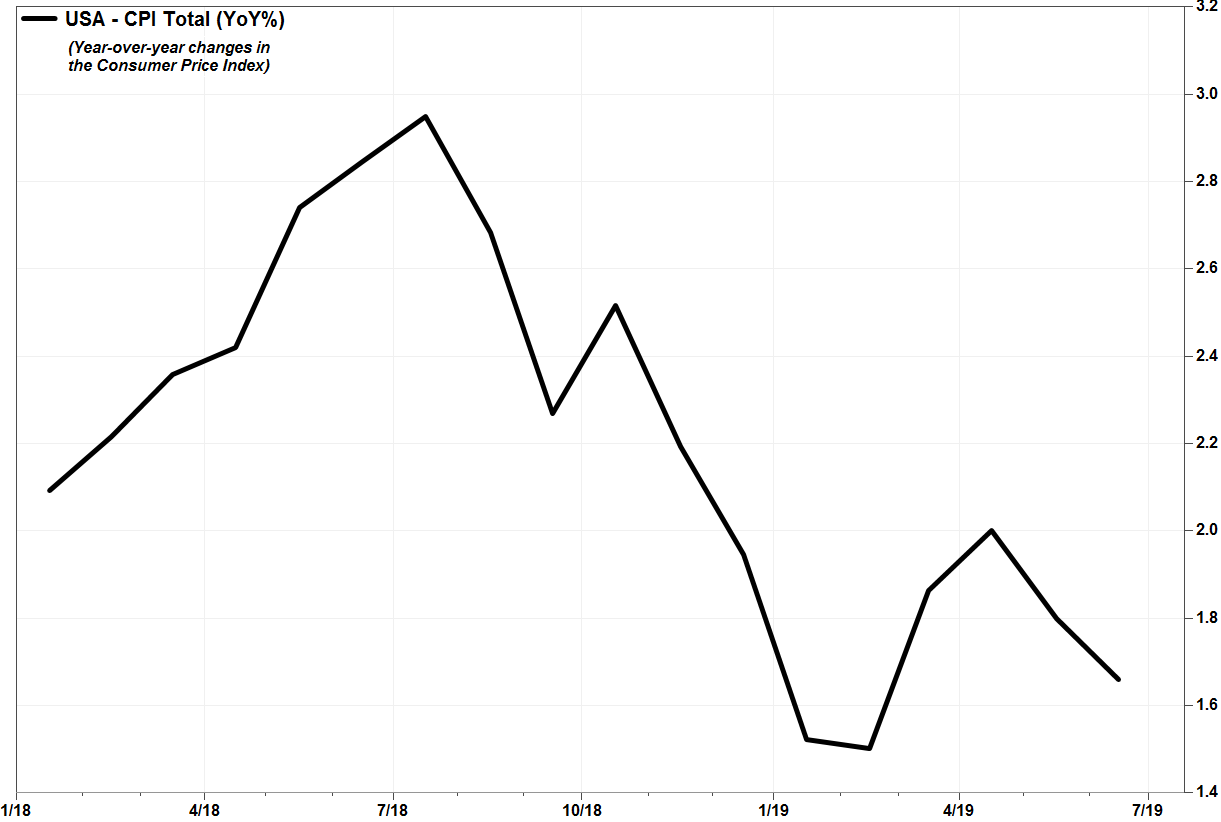

In the midst of the worries about tariffs and dollar strength, as well as commodity prices, is the effect they have on pricing power, and therefore a company’s profit margins.

The good news for many companies outside of the materials and energy sectors is that prices companies pay for raw materials have generally declined, as a slowing of the global economy and a rising dollar have weighed on commodities prices.

The average daily price of the Bloomberg Commodity Index, which tracks the futures’ price movements of a basket of more than 20 physical commodities, during the second quarter was 79.78, according to FactSet data, down 10.5% from the same period a year ago.

FactSet, MarketWatch

FactSet, MarketWatch

That’s one of the reasons earnings are expected to fall for the materials sector by 18% from a year ago and by 9% for the energy sector, through Friday. It has also contributed to the decline in consumer inflation over the past year.

FactSet

FactSet

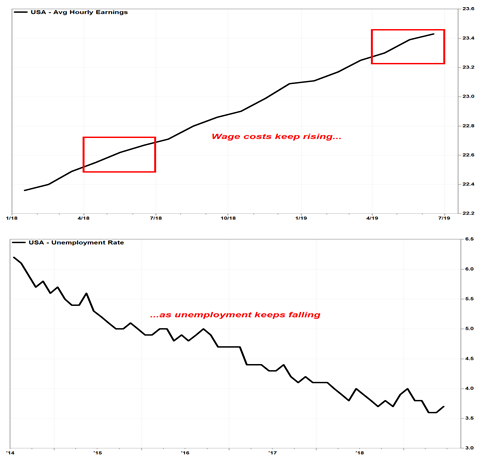

But when consumers are getting used to lower prices, at a time when unemployment at historically low levels has led to rising wage costs, it makes it harder for companies to raise prices to offset the higher costs resulting from tariffs.

FactSet, MarketWatch

FactSet, MarketWatch

And that can affect gross profit margins, or how much a company can earn from what they sell.

For example, fasteners, tools and manufacturing supplies company Fastenal Co. FAST, +1.94% reported this week second-quarter earnings that fell more than expected even as revenue increased, as gross profit as a percentage of sales fell 1.8 percentage points to 46.9% in the second quarter. Employee-related expenses increased 6.8%.

“We successfully raised prices as one element of our strategy to offset tariffs placed to date on products sourced from China, those increases were not sufficient to also counter general inflation in the marketplace,” the company said in a statement.

“We’re seeing it in a bunch of fronts; obviously, the direct impact of tariffs, but the indirect through companies we buy from,” said Chief Executive Daniel Florness, in a post-earnings conference call with analysts, according to a FactSet transcript. “Some pass it on in different ways, some spread it across all products, some apply it strictly to tariff-related products. Nonetheless, it’s created a lot of supply chain inflation.”

Investors can expect this problem to continue to affect the outlook for the current quarter, if not the full year.

“We have taken price adjustments going into the third quarter,” Florness said. “We will, as a supply chain partner, share some with our customer. We will absorb some of it.”

Recession will run on

Florness’s comments suggest worries that weighed on second-quarter results will continue as companies provide guidance for the current quarter.

The third-quarter earnings outlook suggests the earnings recession will continue into the third quarter. Through Friday, S&P 500 EPS is expected to decline 1.1% from a year ago, according to FactSet, compared with an estimated decline of 0.8% earlier this week, and an increase of 1.2% as the end of the first quarter.

While a nice rebound is expected in the fourth quarter, as full-year 2019 EPS is expected to increase by 2.4% over 2018, that estimate is down from 2.6% earlier this week at from 3.2% at the end of March.

Investors may not care so much about this earnings weakness, as the S&P 500 index keeps marching higher to fresh records, fueled by hopes that trade tensions will eventually ease and the Fed will lower interest rates to juice the economy. But investors should be careful what they wish for, as the outlooks for the economy and corporate earnings go hand in hand.

“Many [Fed members saw in June] that the case for a somewhat more accommodative monetary policy had strengthened,” said Fed Chairman Jerome Powell, in his semiannual testimony to Congress. “Since then, based on incoming data and other developments, it appears that uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.” Read more about Powell’s testimony.

Additional reporting by Chris Matthews in New York and Jeffry Bartash in Washington, D.C.

Add Comment