Bloomberg News/Landov

Bloomberg News/Landov

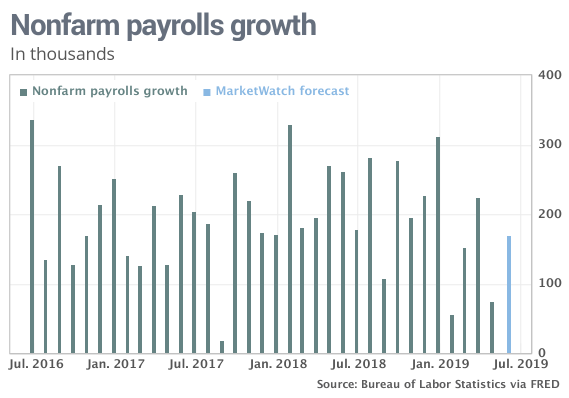

Is a hiring freeze in the U.S. underway? No, but a second poor jobs report in a row would trigger fresh angst about the economy and force the Federal Reserve to lower U.S. interest rates

Here’s what to expect in the June employment report due Friday morning after the July 4 holiday.

Improved job creation

The number of new jobs created in June is widely expected to bounce back from a meager 75,000 increase in May. Economists polled by MarketWatch predict the U.S. created 170,000 jobs in June.

How confident should investors be in the forecast?

The drop-off in May was unusually sharp, but similar weakness has not been evident in other labor-market signposts. Perhaps most telling, layoffs remain near a 50-year low and show little sign of rising. So even if hiring has slowed, companies aren’t resorting to widespread job cuts.

Economists have been saying for months that hiring has to slow. The big question is, is hiring weaker because the economy has gotten weaker? Or is it because the U.S. is running out of skilled workers?

The answer is probably both.

Read: ADP says U.S. adds 102,000 private-sector jobs in June

Low unemployment

The shortage of skilled workers is the result of the tightest labor market in decades. The jobless rate is seen holding steady in June at 3.6%, which is the lowest rate since 1969.

Unemployment rarely moves much in either direction from month to month, making it hard to get a good read on what’s going on in the labor market in the short run. The jobless rate would have to rise several months in a row and top 4% to really worry Wall Street DJIA, +0.67% and Washington.

Even that’s unlikely. The U.S. only has to produce about 75,000 or so new jobs a month, economists estimate, to keep the unemployment rate at its current level in light of slow growth of the labor force.

Read: The U.S. economy just entered a record-shattering 11th year of expansion

Steady wage gains

Hourly wages are forecast to rise 0.3% in June. An increase of that size would nudge the gain in wages over the past 12 months back up to 3.2% from 3.1% in May.

Wage growth have leveled off, however, after a prolonged upward move that began in early 2015 and lasted through the early part of this year. Hourly wage gains peaked at 12-month rate of 3.4% in February.

Worker pay isn’t rising quite as fast as it usually does during the height of an economic expansion, but it’s not contributing much to inflation, either.

Read: Robots are coming for your jobs — Oregon, Louisiana, Texas have most to lose

Pockets of weakness

Retailers have reduced employment in 2019 while manufacturers and construction firms have barely added any new jobs. That helps to explain why job creation has faltered this year. These industries have traditionally hired big during economic expansions.

Home builders are the most likely to add jobs because of a pickup in construction fueled by warmer weather and falling mortgage rates, but none of these industries is likely to hire in a big way anytime soon.

Add Comment