The numbers: Factories proved to be a significant drag on April economic activity, a setback reflected in the sharp pullback for the Chicago Federal Reserve’s monthly index tracking the national economy.

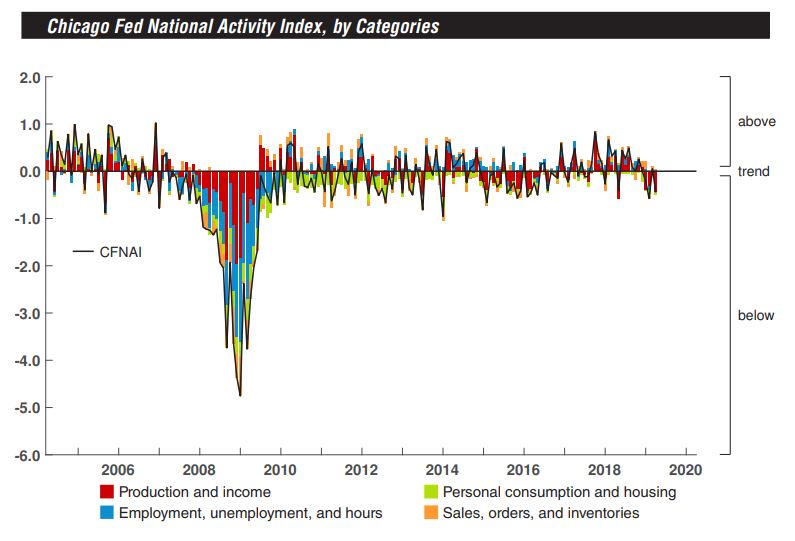

The Chicago Fed’s index registered at a negative 0.45 in April, down from an upwardly revised positive 0.05 in March and a negative 0.31 in February.

The volatile nature of the monthly data puts added emphasis on following the index’s less-volatile, three-month moving average. It decreased to negative 0.32 in April from negative 0.24 in March.

The Chicago Fed index is a weighted average of 85 economic indicators, designed so that zero represents trend growth and a three-month above 0.70 suggests an increasing likelihood of a period of sustained increasing inflation. Thirty-three of the 85 individual indicators made positive contributions in April, while 52 made negative contributions. Thirty-seven indicators improved from March to April (although 14 still made negative contributions), while 48 indicators deteriorated.

The details: The contribution from production-related indicators, meaning factories, declined to negative 0.44 in April from negative 0.04 in March. As the Fed reported earlier, industrial production decreased 0.5% in April. There were declines last month in automotive, chemical products and consumer energy products in particular.

Employment-related indicators contributed positive 0.04 to the Chicago Fed index in April, up slightly from positive 0.03 in March. The U.S. created 263,000 new jobs in April to help drive the unemployment rate down to a 49-year low.

The contribution of the personal consumption and housing category moved down to negative 0.05 in April from neutral in March.

Market reaction: The negative reading could add to the downbeat mood for stock trading Monday. Futures were broadly lower as Sino-American trade tensions continued to face apparent escalation, as U.S. technology companies have begun to comply with the White House’s ban on China’s Huawei Technologies Inc. On Friday, the Dow DJIA, -0.38% shed 0.7% for the week, bringing its weekly losing streak to four, the longest since May 2016.

Add Comment