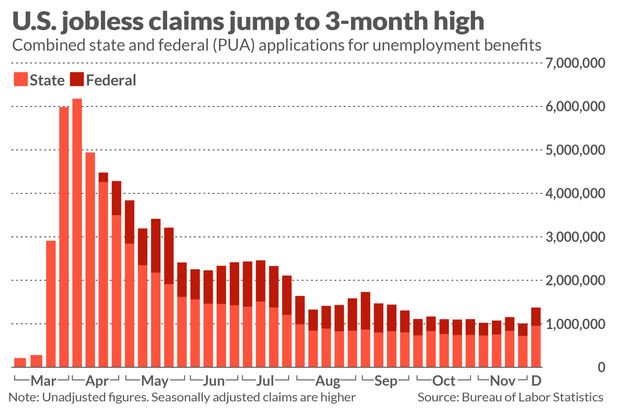

The numbers: New applications for U.S. unemployment benefits jumped to a nearly three-month, owing to an increase in layoffs after a record surge in coronavirus cases as well as to filing delays tied to the Thanksgiving holiday.

Initial jobless claims surged by 137,000 to 853,000 in the seven days ended Dec. 5, the Bureau of Labor Statistics said Thursday. Economists polled by MarketWatch had forecast new claims to total a seasonally adjusted 720,000.

Another 427,609 applications for benefits were filed through a temporary federal-relief program that expires at the end of the year.

While jobless claims have correctly reflected the rise and decline in unemployment during the pandemic, a government watchdog agency also found the number of distinct individuals applying for or collecting benefits has been inflated by fraud, double counting and other problems.

Read: Jobless claims inflated, GAO finds

The Bureau of Labor Statistics plans to take steps to improve the data, but for now the claims report is not considered entirely accurate. Economists say to pay attention to the direction of claims instead of the totals.

Read: Why the inaccurate jobless claims report is still useful to investors

What happened: New jobless claims rose the most in the states of California, Texas, Illinois and New York, where coronavirus cases have risen again. They fell in Louisiana.

The number of people receiving benefits through programs administered by the states also rose for the first time in almost three months. These so-called continuing jobless claims climbed by 230,000 to a seasonally adjusted 5.76 million in the week ended Nov. 28.

Continuing claims funded by a temporary federal program fell by an unadjusted 36,140 to 4.53 million in the week ended Nov. 17, the latest data available.

These federal claims have more than tripled since August, however, as people who’ve exhausted state benefits shift to the federal program. It’s a sign that a growing number of Americans are threatened with long-term unemployment.

The pandemic is not the only thing distorting the claims data. The weekly totals are also prone to large swings due to filing delays around holidays from Thanksgiving through New Year’s Day.

Some people who lost their jobs before the recent holiday likely waited until the following week to file their applications. That would partly explain why claims fell two weeks ago and then surged last week.

The number of people receiving benefits from eight separate state and federal programs, meanwhile, was reported at an unadjusted 19.04 million as of Nov. 21, which would be the lowest total since April.

Those numbers are also under dispute, though. The government’s more comprehensive monthly jobs report indicated that a far smaller 10.7 million people were unemployed in October.

Economists say the true number of unemployed is probably in the middle.

Read: The 245,000 new jobs added last month is smallest since U.S. recovery began in May

See: MarketWatch Coronavirus Recovery Tracker

Big picture: The record increase in coronavirus cases has put more strain on the U.S. economic recovery, with many cities and states reimposing restrictions and some businesses being forced to sideline workers again.

Layoffs could remain elevated for months as businesses cut back and become more cautious about hiring again, at least until vaccines are broadly disseminated or the surge in coronavirus cases loses steam.

Read: Absenteeism, shutdowns’ tied to coronavirus spike hurt U.S. businesses again

What they are saying? “The jump in weekly unemployment claims was partially due to a rebound from lower claims during Thanksgiving week, but the trend of more Americans losing jobs is clearly rising over the last month,” said Robert Frick, corporate economist at Navy Federal Credit Union.

“Given Covid-19 cases and deaths are now regularly setting new highs, these reports put into question job growth in December, especially given the rapid slowdown in growth in November,” he added.

Market reaction: The Dow Jones Industrial Average DJIA, -0.15% and S&P 500 SPX, +0.01% were set to open lower in Thursday trades.

Add Comment