Getty Images

Getty Images

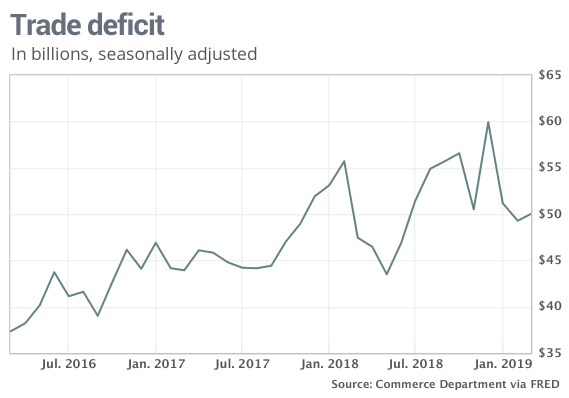

The numbers: The nation’s trade deficit rose slightly in March, but it continued to run below year-ago levels in a sign the gap might not weigh on the economy as heavily this year as it did in 2018. A chief reason: A smaller trade gap with China.

The trade deficit with China fell in March to the lowest level in three years, reflecting a decline in imports amid a festering trade dispute with the Trump White House.

In March, the trade deficit edged up 1.5% to $50 billion from a revised $49.3 billion in February, the government said Thursday. Economists polled by MarketWatch had forecast a $50.1 billion gap.

What happened: Imports rose 1.1% to $262 billion, reflecting an increase in oil, food and industrial supplies. Imports from Germany hit a record high.

The U.S. imported fewer cell phones, consumer electronics and other household goods — products that largely come from China. These imports can swing sharply from month to month, however.

Exports rose a slightly smaller 1% to $212 billion. Shipments of fuel and soybeans — much of it headed to China — increased.

Exports of commercial aircraft declined — a dropoff that took place the same month of a fatal crash that caused a worldwide suspension of Boeing’s MAX 737 jet.

Trade ties with China continued to be disrupted by the ongoing dispute with the Trump White House. The U.S. gap in goods with China fell to a three-year low after seasonal adjustments and a five-year low in raw terms.

Through the first three months of this year, the U.S. trade deficit in goods totaled $150.4 billion, down from $156.3 billion in the first quarter of 2018.

The deficit with China alone is $13 billion less compared to the same period a year earlier.

Read: Trade fight with China hasn’t affected most Americans so far. Here’s what could change that

Big picture: The U.S. economy has grown for years and remains the biggest in the world despite decades of trade deficits, but a persistently large gap has weighed on gross domestic product. Bigger deficits subtract from GDP.

That wasn’t the case in the first quarter. The U.S. trade deficit narrowed in the first three months of the year, helping to boost GDP by an unexpectedly strong 3.2%.

Don’t expect a repeat in the second quarter, however. Economists predict the deficit will creep higher and act as a drag on GDP. Even a favorable trade deal with China won’t do much to help since many of the goods the U.S. imports are no longer made in America. The U.S. has to get them from somewhere.

Read: Stars are aligned for economy as it closes in on record for longest expansion

Market reaction: The Dow Jones Industrial Average DJIA, -1.42% and S&P 500 SPX, -1.21% were set to open lower in Thursday trades amid doubts over whether the U.S. and China can resolve a tense standoff over trades rules for imports and exports.

Read: Trade fight with China hasn’t affected most Americans so far. Here’s what could change that

Also Read: Market calm shattered: Trump tariff threat ‘raises odds of further tariff escalation’

The 10-year Treasury yield TMUBMUSD10Y, -2.08% fell slightly to 2.46%. Many loans such as mortgages and auto loans are tied to changes in the 10-year note, whose yield has fallen from a seven-year high of 3.23% in October.

Want news about Asia delivered to your inbox? Subscribe to MarketWatch’s free Asia Daily newsletter. Sign up here.

Add Comment