One wonderful thing about my job — and there are many wonderful things — is that people are willing to spend the time to educate me and my colleagues about products not currently on our radar.

Our most recent visitor was focused on health savings accounts (HSA), which allow people covered by high-deductible health insurance plans to save for uninsured medical expenses on a tax-preferred basis.

And what heavenly tax preferences. Contributions made by the employer are exempt from both federal income and FICA taxes (for the record, employer contributions to 401(k) accounts are not exempt from FICA taxes). Similarly, contributions made by employees — if made through an employer Section 125 salary reduction plan — are also exempt from federal income and FICA taxes. (If the employee contributions are outside of a Section 125 plan, they can be deducted from the employee’s federal income tax but are not exempt from FICA taxes.) In addition, any investment earnings on employee/employer contributions accrue tax-free. Withdrawals are also tax-free as long as they are used for medical expenses, which are defined very broadly to include dental, eyeglasses, hearing aids, etc. And, after age 65, participants can withdraw their funds for any purpose and pay ordinary income tax. This last provision makes them equivalent in tax treatment to 401(k) plans and IRAs at a minimum, and the no-FICA tax and no-tax for medical expenses makes HSAs a much better option.

To qualify for an HSA, an individual’s employer must offer a high-deductible health insurance plan. Individuals can also purchase such a plan in the individual insurance market. Qualifications for “high deductible” in 2020 include a minimum deductible of $1,400 for individual coverage and $2,800 for family coverage.

Those qualifying for an HSA in 2020 may contribute up to $3,550 for an individual and $7,100 for a family. Account holders ages 55 and older can contribute an additional $1,000. The contribution limits are indexed annually for inflation. Any unused balances can be carried over from one year to the next without any limit. This provision makes HSAs much more valuable than flexible spending accounts, which have to be exhausted by the end of each year.

My understanding of the rationale behind HSAs is that giving workers very generous tax breaks to save for medical expenses makes it easier for employers to offer high-deductible plans. These high-deductible plans, in theory, encourage people to be more cost-conscious shoppers for medical care and eventually lower the nation’s overall health costs. It’s not clear things are working out quite as intended, however. While some evidence suggests that those with high-deductible plans are less likely to use health care services, a new study indicates that people with larger HSA balances tend to have more health care activity.

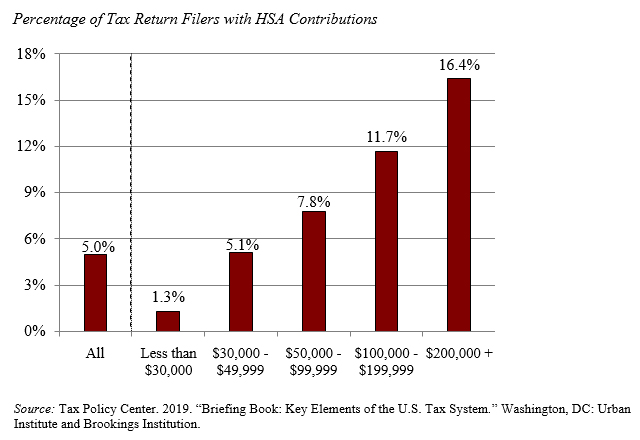

In the meantime, who benefits from these generous tax preferences for HSAs? The higher paid, of course. They face higher tax rates, so the exemptions of contributions and investment earnings and tax-free withdrawals are much more valuable to them than to the lower paid. Also, higher earners are more likely to be constrained by the contribution limits on retirement accounts and look to HSAs as an additional means of tax-preferred saving. Indeed, tax return data show that the percentage of households with HSA contributions increases sharply with income. (See figure below.)

In short, as a policy person, HSAs are not where I would pile on tax preferences. Fortunately, to date, HSA balances are tiny — $62 billion — compared with 401(k)/IRA holdings — $16 trillion. If I were in charge, I would dial back the preferences. But, in the meantime, any eligible high earner out there should certainly take advantage of the opportunity.

Now read: Choosing an HSA can save you money now and make you even more later

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment