What just happened?

“A week is a long time in politics” is an old chestnut. But what happens when it’s politics that’s making the clock slow to a crawl?

In the seven days that feel like seven lifetimes since our last edition, much of the action in the ETF market has been a response to the election.

Health-care ETFs surged on the assumption that a Biden presidency would seek to uphold Obamacare, but clean-energy ETFs initially pulled back after it seemed a Democratic sweep of Washington wasn’t in the cards, before bouncing again. Defense-themed funds got a boost on the heels of Pfizer’s vaccine news, as well.

A few weeks ago, we highlighted the back-and-forth, up-and-down nature of bank ETF fund gains and losses: one week they’re hot, the next they’re not. In the most recent week, four of the five top gainers we highlighted were bank ETFs, with an emphasis on community and regional players. And their performance was impressive. Scroll down to the bottom of this newsletter to see for yourself.

Stay tuned, stay in touch, and as always, thanks for reading.

Open 24/7 to serve you

On Wednesday, about $5 million of one of the biggest government bond ETFs exchanged hands, according to FactSet data. The trading activity in the iShares 20+ Year Treasury Bond ETF TLT, +1.13% represented roughly half its average daily volume over the past 30 days, a notable feat considering that the U.S. bond market was closed for the Veteran’s Day holiday.

That market quirk is a good reminder of one of the often-cited benefits of ETFs – tradability – said Todd Rosenbluth, head of ETF and mutual fund research for CFRA.

Because investors trade ETFs on exchanges – hence the name – just like individual stocks, anyone who wants to make a bet on bonds can do that using ETFs even if the market is closed, Rosenbluth said. He thinks “that’s a good thing for folks who want to trade.”

Does that mean the bond market and ETFs can get out of sync with each other? Well, sort of.

It’s important to understand that most ETF trading takes place in a secondary market, and does not impact the underlying securities market at all.

“We don’t need the underlying bonds to trade for a transaction to happen,” Rosenbluth said in an interview. “In contrast, a bond mutual fund might accept your money on a day when the market is closed but they might need to transact in the bond market in order to fulfill the order. ETFs will trade such that one purchase of TLT may be crossed with one sale of TLT, meaning the asset manager doesn’t have to touch the bond market at all.”

Still, there are times, particularly when markets are dislocated, when an ETF’s “net asset value” may differ slightly from the value of all the underlying holdings. In contrast, mutual fund NAVs are defined by the value of the underlying holdings, totted up once a day after the close of trading. In big, liquid funds like TLT, investors can generally expect the two valuations to get back into sync with each other very quickly. In times like the market turmoil of March, that may become more difficult, however.

Is there an ETF for that?

If you’ve been watching the parade of corporate earnings over the past few weeks and wondering how much self-reported information to take with a grain of salt, one ETF may have exactly the approach you’re looking for.

The TrimTabs All Cap US Free-Cash-Flow ETF TTAC, -0.02% picks stocks based on companies’ cash after operations, minus accounting for capital expenditures. (It has a sister fund, the All Cap International Free-Cash-Flow ETF TTAI, +0.34%. )

Did someone say cash flow that’s FREE? Well, not quite.

Getty Images

That approach “gives us a good idea of how profitable the companies are on a cash basis,” said Janet Johnston, TrimTabs’ co-CIO. “We believe free cash flow is the most reliable indicator of quality over the long term. There’s so much manipulation that goes into corporate earnings reports. Companies have discretion in terms of how they report their expenses, the timing of their revenues, and more.”

The fund is ideal for anyone looking for a quality strategy, Johnston told MarketWatch.

TTAC is somewhat anomalous: it’s an actively-managed transparent fund. It’s also sector-neutral, and managers “follows the data,” in Johnston’s words, to see what trends may emerge among particular corners of the market. This year, one surprising development was that car-parts companies screening well, prompting fund managers to add shares of CarMax Inc. KMX, -0.37% and AutoNation Inc AN, -2.29%.

The portfolio is still heavily skewed toward the most familiar names – Amazon.com Inc. AMZN, -0.45%, Microsoft MSFT, +0.26%, JPMorgan Chase & Co. JPM, -1.97%, Facebook Inc. FB, +0.79%, and NVIDIA NVDA, +1.62% make up the top five holdings – but not at market weightings.

In the year to date through Wednesday, it had returned 9.91%, just lagging the S&P 500’s 10.6% gain, for a 59-basis point management fee.

Weekly rap

| Top 5 gainers of the past week | |

| Invesco KBW Regional Banking ETF KBWR, -1.89% | 21.3% |

| SPDR S&P Regional Banking ETF KRE, -2.02% | 19.7% |

| SPDR S&P Oil & Gas Equipment & Services ETF XES, -0.65% | 18.2% |

| First Trust NASDAQ ABA Community Bank Index Fund QABA, -1.53% | 18% |

| First Trust Nasdaq Bank ETF FTXO, -1.98% | 17.7% |

| Source: FactSet, through close of trading Wednesday, November 11, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| PIMCO 25+ Year Zero Coupon US Treasury Index ETF ZROZ, +1.61% | -5.1% |

| SPDR FactSet Innovative Technology ETF XITK, +1.40% | -5.1% |

| iShares 25+ Year Treasury STRIPS Bond ETF GOVZ, +1.03% | -5.1% |

| Innovator IBD 50 ETF FFTY, +0.24% | -4.9% |

| iShares U.S. Home Construction ETF ITB, +0.25% | -4.8% |

| Source: FactSet, through close of trading Wednesday, November 11, excluding ETNs and leveraged products | |

| Top 5 biggest inflows of the past week | |

| SPDR S&P 500 ETF Trust SPY, -0.40% | $12.3 billion |

| iShares iBoxx $ High Yield Corporate Bond ETF HYG, -0.32% | $3 billion |

| Invesco QQQ Trust QQQ, +0.15% | $2.1 billion |

| Vanguard Total Stock Market ETFVTI | $1.3 billion |

| SPDR Bloomberg Barclays High Yield Bond ETF JNK, -0.25% | $1.2 billion |

| Source: FactSet, through close of trading Wednesday, November 11, excluding ETNs and leveraged products | |

Visual of the week

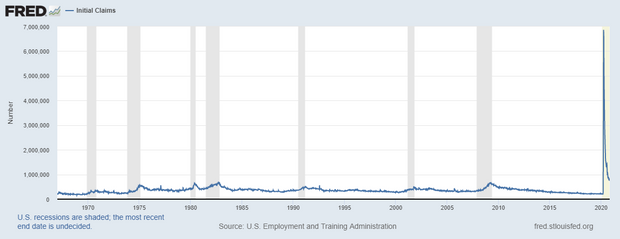

The chart above is a stark visual reminder of the difficulties still facing the U.S. economy as we brace for a long winter with the coronavirus. It shows the number of people filing for first-time jobless benefits. The spike in late March, when 3.3 million people filed, more than 10 times the number in the previous week, forever skewed the decades-old chart.

The numbers have been coming down, steadily if slowly, but the most recent reading, of 751,000, still dwarfs anything ever seen before, even in the depths of the Great Recession. Many economists remain convinced that even with a COVID-19 vaccine on the horizon, some permanent damage to the economy — to say nothing of the human toll — is inevitable.

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.

Add Comment