What just happened?

It’s the best of times — vaccines are here! — and the worst: the coronavirus death toll is rising, more Americans are losing their jobs and the holiday season is upon us, although without many of the comforts that normally go along with it.

Stocks have zigzagged over the past week as Congress tries to come to an agreement on more relief funds, but the recovery seems to be spreading more broadly throughout the market, including in the price of oil. Biotech ETFs caught a bid as the first vaccines were administered, and clean-energy ETFs took another leg higher as Joe Biden’s presidential win was confirmed by the Electoral College.

That broadening — and lack of one consistent theme — can also be seen in the best and worst performers of the week, as well as the biggest inflows, at the bottom of this newsletter.

Thanks for reading, and stay warm!

Middle child, or middle ground?

Back in October, when Invesco launched the NASDAQ Next Gen 100 Fund QQQJ, -0.07%, some ETF-watchers thought its premise was intriguing. “At some point, the FAANG stocks will stop leading the market and the next wave of companies will potentially step up and replace them,” Todd Rosenbluth, head of mutual fund and ETF research, told MarketWatch at the time.

That’s because QQQJ offers exposure to the 100 second-largest companies in the Nasdaq, letting its “big brother,” Invesco QQQ Trust QQQ, -0.14%, take the 100 largest.

Now, two months later, the “some point” Rosenbluth referenced is here. Early in December, Nasdaq announced changes to the index, and shortly after, Invesco followed by confirming corresponding updates to its funds.

Some 41 new stocks will be added to QQQJ, ranging from cloud companies like NetApp Inc. NTAP, -1.08% to casino operator Caesar’s Entertainment CZR, -0.96%.

The shuffle is a reminder that companies have very different lifespans: some that cycle into the “second-biggest” tier are growing up, but some are being “demoted,” in Rosenbluth’s words. It suggests that “middle child” might be a better analogy than “baby brother.”

To be sure, “demoted” isn’t necessarily a bad thing. The newly-constructed QQQJ is worth a look, in part because it includes so many poster children of the stay-at-home economy, like DataDog Inc. DDOG, -1.76%, DraftKings Inc. DKNG, -0.21% and Etsy ETSY, -0.34%. It just means that with this ETF perhaps more than others, investors need to be sure they understand what’s inside the funds they buy, Rosenbluth said.

Exchange-traded sundries

As Linda Richman might say, it’s neither Bitcoin nor an ETF. Discuss.

The Bitwise 10 Crypto Index Fund KEYS, +1.32% is, instead, an index fund traded over-the-counter, and made up of 10 different cryptocurrencies, that charges a sizable management fee and trades at a big premium to its net asset value (for a reminder of what that means, here’s some earlier MarketWatch reporting.)

Initial ETF-Twitter response has not been encouraging.

Still, the fund has gathered $176 million in its first four weeks of existence, proof that investors are eager for exposure to crypto.

Is there an ETF for that?

Sure, there are plenty of clean-energy and renewables ETFs. But this firm thinks it has a new approach: a fund that tracks the entire lifecycle of the “new energy economy.”

The fund, the Blue Horizon BNE ETF BNE, , launched December 9.

Blue Horizon Capital’s president, Govind Arora, told MarketWatch that most clean-energy funds focus on the “bookends” of the sector: the initial production, and then the final products, like electric vehicles. Arora and his partner John Mitchell, both energy-industry veterans, wanted to offer investors exposure to the whole process, including things that many investors might not ordinarily think of, like energy storage and the infrastructure that powers energy distribution.

Their professional experience, Mitchell argues, allows Blue Horizon to take a more “holistic” view of the sector.

Beyond the concentration across some specific segments of the clean-energy economy, BNE stands out for its broad exposure. It holds 100 stocks, Mitchell pointed out, more than many other competitors. For example, the SPDR S&P Kensho Clean Energy ETF CNRG, +1.60% has about 40, and the ALPS Clean Energy ETF ACES, +1.16% has 34.

It’s also fairly global, with about 48% of its holdings coming from the Americas, John said. In comparison, about 76% of the Kensho fund’s portfolio comes from the U.S. But the iShares Global Clean Energy ETF ICLN, +1.56% has only about 42% of its portfolio allocated to North American companies.

As previously noted, clean-energy ETFs have been on a hot streak this year in anticipation of a Democratic presidential administration. Many have more than doubled in value throughout 2020.

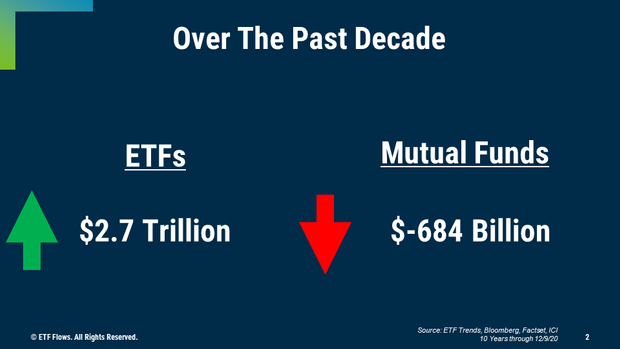

Visual of the week

“Every time we have a downturn it’s MASSIVE for ETF flows,” said ETF Trends’ Dave Nadig on Twitter. “People wait to harvest losses (or just give up on the market). But when the money comes back, it overwhelmingly comes into ETFs.”

Weekly rap

| Top 5 gainers of the past week | |

| SPDR S&P Kensho Clean Power ETF CNRG, +1.60% | 8.9% |

| Innovator IBD Breakout Opportunities ETF BOUT, +0.55% | 8.0% |

| Virtus LifeSci Biotech Clinical Trials ETF BBC, +0.98% | 7.2% |

| Invesco Dynamic Biotechnology & Genome ETF PBE, +1.07% | 6.9% |

| SPDR S&P Biotech ETF XBI, +1.68% | 6.6% |

| Source: FactSet, through close of trading Wednesday, December 16, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

| Inspire Tactical Balanced ESG ETF RISN, -1.23% | -3.7% |

| Defiance Next Gen SPAC Derived ETF SPAK, +1.22% | -2.8% |

| iShares Transportation Average ETF IYT, -0.29% | -2.6% |

| iShares Core High Dividend ETF | -2.1% |

| Schwab US Dividend Equity ETF SCHD, -0.53% | -1.9% |

| Source: FactSet, through close of trading Wednesday, December 16, excluding ETNs and leveraged products | |

| Top 5 biggest inflows of the past week | |

| iShares Core S&P 500 ETF IVV, -0.23% | $3.14 billion |

| Vanguard Small-Cap ETF VB, +0.05% | $2.9 billion |

| Vanguard Total Stock Market ETF VTI, -0.20% | $2.75 billion |

| Vanguard Mid-Cap ETF VO, -0.48% | $2.62 billion |

| Vanguard Small-Cap Growth VBK, +0.26% | $831 million |

| Source: FactSet, through close of trading Wednesday, December 16, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.

Add Comment