Hi! This week’s ETF Wrap looks at an interest rate hedge ETF that is producing massive gains amid the carnage of 2022, along with other funds that investors might consider amid concerns over elevated inflation and “roller coaster” markets.

Please send feedback and tips to [email protected]. You can also follow me on Twitter at @cidzelis and find me on LinkedIn.

Inflation has stoked fear in the battered U.S. stock market this week, with investors worrying that the stubbornly high cost of living in the U.S. will lead to more aggressive interest rate hikes by the Federal Reserve. But in the carnage, a small exchange-traded fund that seeks to hedge against rising long-term rates has held up as a big winner with massive gains of around 60%.

The Simplify Interest Rate Hedge ETF PFIX, +1.76%, with around $325 million of assets, has soared 60.4% this year through Wednesday, according to FactSet data. The S&P 500 SPX, -1.13% dropped 17.2% over the same period.

“PFIX is an insurance policy” that may be used to hedge against exposure to long duration bonds in a portfolio, said Harley Bassman, managing partner at Simplify Asset Management, in a phone interview. “It’s not like I’m hoping that bonds crash, but I’m buying them to protect myself.”

As rates climbed this year, bonds have suffered steep losses. The iShares Core U.S. Aggregate Bond ETF AGG, -0.30% has lost 16.4% in 2022 through Wednesday on a total return basis, while the iShares 20+ Year Treasury Bond ETF TLT, -0.06% had a 26.1% loss over the same period, according to FactSet data.

“If you want to use it as speculation on rates, that’s fine,” Bassman said of PFIX. “But really it’s designed as an insurance product.”

Bassman suggested that PFIX, which benefits in a rising-rate environment, might represent 5% of a portfolio’s long-term interest rate exposure such as 20-year Treasury bonds. If rates fall a lot because the U.S. enters into a recession, PFIX will go down while the 95% exposure to bonds should go up, he said.

The Simplify Interest Rate Hedge ETF “is an option product where you have limited loss, unlimited gain,” Bassman said. “It acts like a 7-year put on a 30-year Treasury bond.”

‘Bloodbath’

The Fed has been aggressively hiking interest rates this year in an effort to tame surging inflation.

After losing credibility with his initial expectations that the surge in cost of living was transitory, Fed Chair Jerome Powell probably is now driven to slay inflation through tighter monetary policy to the point of triggering an economic contraction, Bassman said.

“I don’t see Powell stopping this rate rise until inflation really brakes hard because he does not want to be blamed for inflation,” he said. Bassman expects the Fed will keep hiking rates and “push us into a recession” to reduce demand in the economy and bring inflation under control.

Earlier this week, the consumer price index showed that U.S. inflation in August was hotter than expected even as energy prices fell, sparking a selloff in stocks.

Read: Cathie Wood: Fed is ‘probably overdoing it’ in battle with inflation, warns of deflation signs

Based on CPI data, the cost of living rose 0.1% in August for an annual rate of 8.3%.

“I don’t see inflation coming down to 3% or 4% anytime soon,” said Bassman. He said that he expects the Fed will hike its benchmark rate to at least 4%, from its current targeted range of 2.25% to 2.5%.

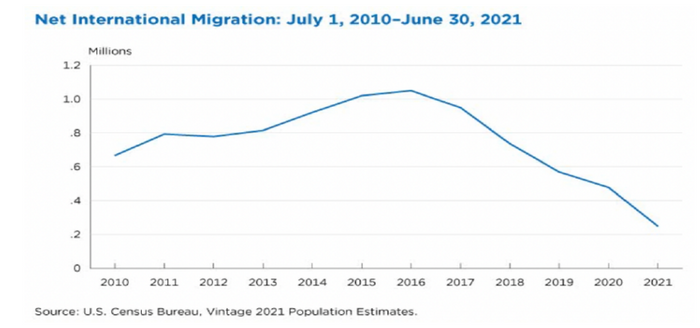

Inflation probably won’t come down quickly in the near term, as owners’ equivalent rent, or the shelter component of the consumer price index, tends to lag behind home prices by six months, according to Bassman. He also noted that labor shortages are providing a “tailwind” for wages as a result of baby boomers leaving the workforce and a decline in immigrants coming to the U.S. over the past several years.

The CPI report, released Sept. 13, led to a “bloodbath” in the market, said Greg Bassuk, chief executive officer of AXS Investments, in a phone interview.

“The scary part, I think, for a lot of folks was the extent to which there were rising prices beyond the core inputs,” said Bassuk. Many investors had been expecting lower gasoline prices to bring down inflation in August, he said.

Amid concerns that the cost of living will remain elevated, Bassuk suggested that investors might consider the AXS Astoria Inflation Sensitive ETF PPI, -1.14%, which provides exposure to areas such as commodities, Treasury inflation-protected securities known as TIPS and cyclical stocks including financials, energy, industrials and materials. Those areas tend to do well in inflationary environments, he said, plus “an investor can very significantly diversify their portfolio” with a single ETF.

In his view, the “2022 roller coaster” will continue this year with questions surrounding Fed policy, geopolitical risks and upcoming midterm elections in the U.S. For that reason, investors might also want to consider “liquid alternative” investment strategies that “cushion on the downside,” he said.

For example, the AXS Chesapeake Strategy Fund Class I EQCHX, +0.89% is up 21.4% this year through Wednesday, FactSet data show. The managed futures ETF is based on a “trend following” strategy and is exposed to areas that don’t correlate to the S&P 500, according to Bassuk.

“The strategy is not designed necessarily to keep pace with strong equity markets,” he said, “but it allows investors to diversify their portfolios so they can weather the storm in markets like we’re seeing this year.”

As usual, here’s your look at the top- and bottom-performing ETFs in the past week through Wednesday, according to FactSet data.

The good…

| Top Performers | %Performance |

| United States Natural Gas Fund LP UNG, -8.87% | 14.2 |

| United States Oil Fund LP USO, -4.08% | 6.8 |

| First Trust Natural Gas ETF FCG, -3.19% | 6.7 |

| iShares U.S. Oil & Gas Exploration & Production ETF IEO, -2.93% | 6.3 |

| iShares Silver Trust SLV, -2.06% | 5.7 |

| Source: FactSet data through Wednesday, Sept. 14, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

| Bottom Performers | %Performance |

| AdvisorShares Pure US Cannabis ETF MSOS, -1.59% | -7.2 |

| First Trust Materials AlphaDEX Fund FXZ, -0.99% | -5.2 |

| iShares U.S. Home Construction ETF ITB, -0.17% | -4.9 |

| SPDR S&P Homebuilders ETF XHB, -0.38% | -4.4 |

| Real Estate Select Sector SPDR Fund XLRE, -2.18% | -3.3 |

| Source: FactSet data |

New ETFs

- AllianceBernstein announced Sept. 14 that it launched its first set of active exchange-traded funds, the AB Ultra Short Income ETF YEAR, +0.00% and the AB Tax-Aware Short Duration Municipal ETF TAFI, -0.14%.

- Krane Funds Advisors said Thursday that it launched the KraneShares S&P Pan Asia Dividend Aristocrats ETF KDIV, to provide “exposure to companies in China, Japan, Australia, and other Asian countries that have paid and increased their dividends over a sustained period.”

Add Comment