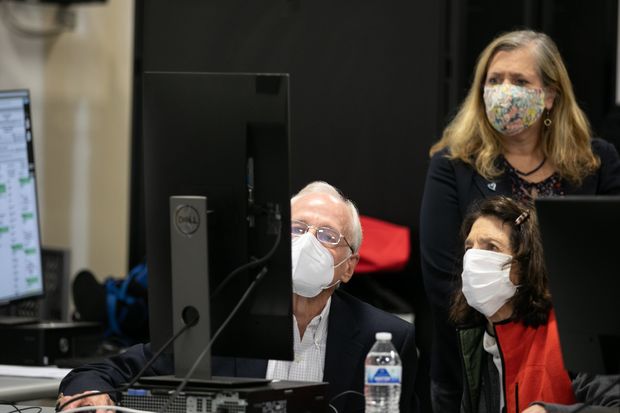

ATLANTA, GA – NOVEMBER 04: Members of an adjudication review panel look over scanned absentee ballots at the Fulton County Election Preparation Center on November 4, 2020 in Atlanta, Georgia.

Jessica McGowan/Getty Images

European stocks advanced Thursday, extending gains as traders reacted to the possibility of a dividend U.S. government.

Up 2% on Wednesday, the Stoxx Europe 600 SXXP, +0.81% rose 1%. The French CAC 40 PX1, +0.91% led the national indexes with a 1.3% advance.

Futures on the Dow Jones Industrial Average YM00, +0.93% rose 325 points, after the 367-point gain for the blue chips DJIA, +1.33% on Wednesday.

Former Vice President Joe Biden is leading in the Associated Press electoral college count, needing only Georgia, North Carolina or Pennsylvania to defeat President Donald Trump. At the same time, the AP tally on the U.S. Senate is deadlocked at 48. The comment from Sen. Majority Leader Mitch McConnell of a possible stimulus deal by the end of the calendar year also helped financial markets.

“Yesterday illustrated the esteem in which politicians are held by financial market participants. Equities soared on the rising probability of gridlock in Washington, which should prevent either party inflicting too much damage on corporate America,” said Ian Williams, a strategist at U.K. brokerage Peel Hunt.

The Bank of England meanwhile extended the size of its quantitative easing program by £150 billion as it forecasts the U.K. economy to contract in the fourth quarter. England’s new one-month lockdown starts Thursday.

Of stocks on the move, Societe Generale GLE, +4.23% rose 5% as the French bank reported a third-quarter profit of €862 million and lifted its capital ratio outlook for the year.

Engineering software maker Aveva AVV, -3.03% dropped after reporting a 38% drop in adjusted EBITDA for its Sept. 30-ending half year.

Add Comment