It seemed to start with the name change.

When Mark Zuckerberg’s company was named Facebook, it was nipping at the heels of Big Tech juggernauts like Alphabet Inc. GOOGL, +4.41% GOOG, +4.30% and Microsoft Corp. MSFT, +4.02% and flirting with a place in the exclusive trillion-dollar club occupied by those tech behemoths . After becoming Meta Platforms Inc. META, +1.29%, the company is now worth less than Home Depot Inc. HD, +2.61%

Zuckerberg changed the name of his company to reflect his aggressive goals for establishing a new computing platform that incorporates virtual, augmented and mixed reality, dubbing it the “metaverse.” His goal was to use the massive profit and revenue tossed off by social networks Facebook and Instagram to get to the next generation of computing before rival Apple Inc. AAPL, +7.56%

What he didn’t expect was a massive macroeconomic and competitive upheaval that has threatened Meta’s core social-media businesses from multiple directions. And even while acknowledging that Meta faces tough times ahead, Zuckerberg has refused to veer off-course from his metaverse mission, which is costing the company billions of dollars.

Shares of Meta suffered their second-largest daily decline on record Thursday, plummeting nearly 25% as Zuckerberg detailed the latest effects of his metaverse push. Here are five charts that show those effects, and why Meta has fallen out of favor on Wall Street.

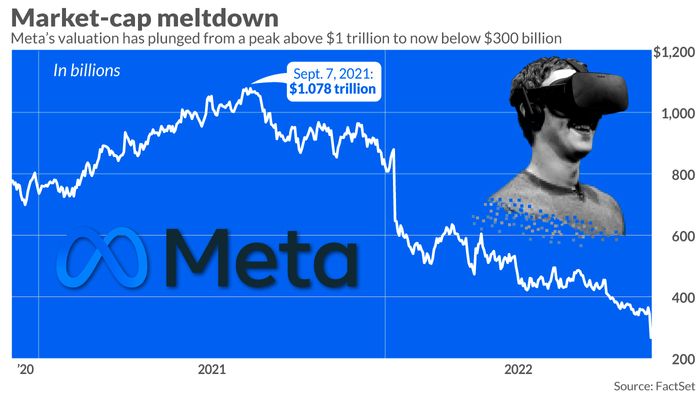

Meta’s stunning fall can be seen in the dramatic decline in the company’s market value.

The company was worth as much as $1.078 trillion last September, after becoming one of just six in the U.S. to ever top the trillion-dollar mark. But Meta’s time in that vaunted group was short-lived, as the company’s market cap has seen a precipitous fall over the past year: Meta finished Thursday with a $263 billion valuation.

The last time Meta was valued at under $300 billion was Feb. 19, 2016, per Dow Jones Market Data.

Meta’s big fall reflects more than just a broader market selloff. The company was the fifth largest U.S. company by market cap as recently as December, according to Dow Jones Market Data, but Thursday’s action brings it down to No. 21, below Mastercard Inc. MA, +3.16%, Home Depot, Bank of America Corp. BAC, +0.86%, and AbbVie Inc. ABBV, -3.84%

Meta isn’t backing down on its plans to spend up on the metaverse, even as the company faces numerous pressures on its main business. Chief Executive Mark Zuckerberg disclosed that he expects Meta’s spending on Reality Labs efforts to “increase meaningfully again” next year. Executives also anticipate that overall capital expenditures could grow to $34 billion to $39 billion in 2023 from an estimated $32 billion to $33 billion in 2023.

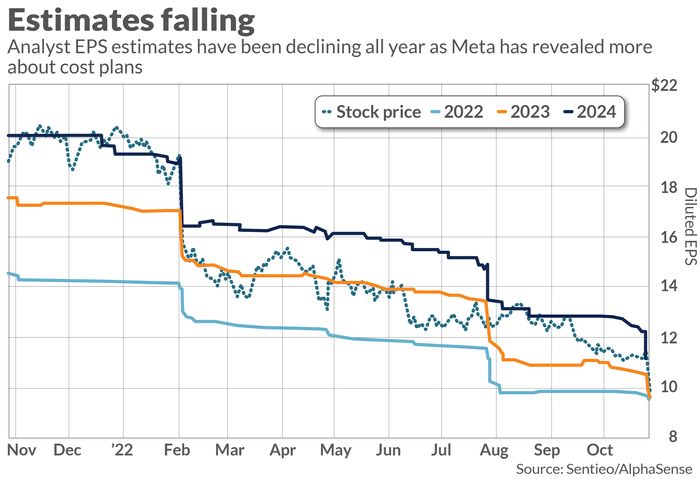

Earnings estimates on Wall Street tend to come down when stocks fall, but Meta’s management seems to be giving analysts ample reason to make sharp cuts as executives continue to talk up spending plans.

Data from Sentieo/AlphaSense show how estimates for Meta’s 2023 earnings per share have fallen from over $17 at the start of the year to around $10 currently. Estimates for 2024 have been slashed as well.

“Material revenue and engagement incrementality from these investments is likely to take time (well into ’23?) and is uncertain,” Morgan Stanley’s Brian Nowak wrote Thursday. “And in the meantime, we see earnings power staying depressed.”

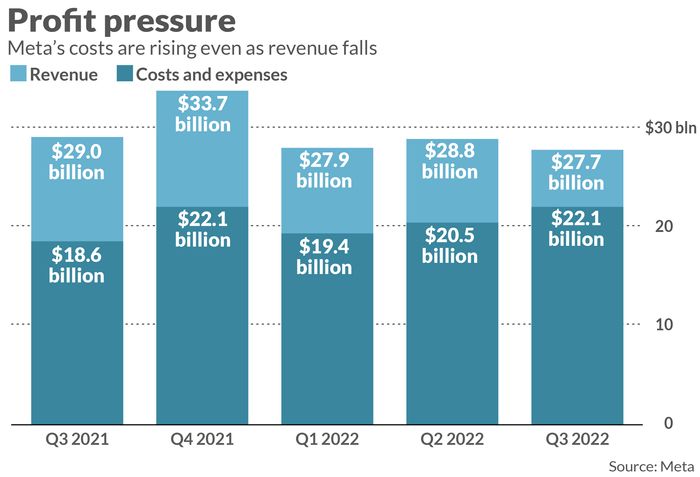

The first data points shown on Meta’s third-quarter earnings report pretty much sum up the company’s issues. As revenue fell 4% from a year earlier, costs and expenses climbed 19%.

The company is dealing with a bevy of issues—from TikTok competition to Apple Inc. AAPL, +7.56% privacy changes to ad-industry pressures—that all weigh on revenue. At the same time, Meta executives are pouring ever-more money into far-out initiatives. With that backdrop, it’s easy to see how earnings fell in half during the latest quarter, and why analysts are becoming more pessimistic about the future.

“Clearly the Street didn’t think the company would take investments this far while revenues were under pressure,” Bank of America’s Justin Post wrote in a note to clients.

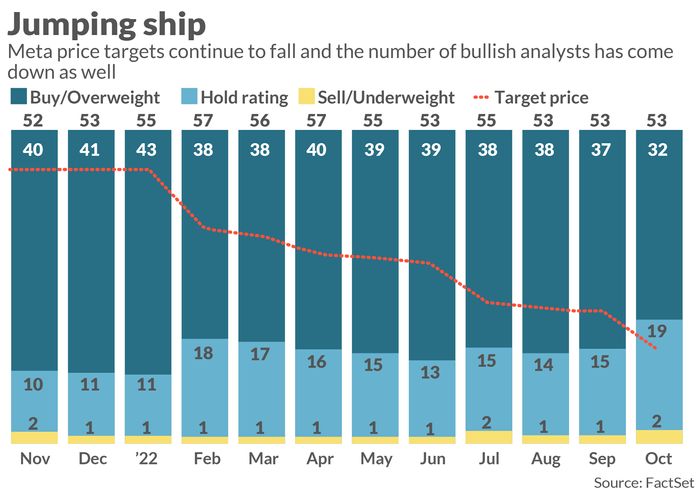

It’s not particularly helpful when analysts downgrade a stock after the bad news has already been announced. Morgan Stanley’s Nowak seemed to acknowledge this in his own downgrade Thursday, writing that while he doesn’t like “’night-of’ ratings changes as they can be reactionary,” the company’s results and outlook are “thesis changing.”

But amid Meta’s roughly 70% stock plunge over the past year, there have been plenty of reactionary downgrades as Meta’s bull camp shrinks. Last November, 40 of the 52 analysts tracked by FactSet had buy ratings. Now, that ratio stands at 32 out of 50. The average Meta price target is currently $162.50, whereas it was almost $400 back in November.

Meta shares were recently trading south of $100.

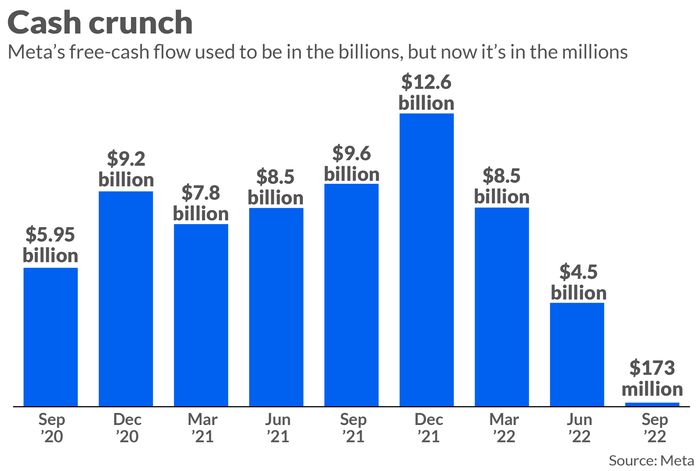

Meta’s earnings fell by half in the latest quarter, but its free-cash flow plunged even more. The company only generated $173 million in free-cash flow last quarter, a mere blip compared to the $9.6 billion it generated a year before. Going back to the third quarter of 2020, Meta hadn’t reported less than $4.5 billion on the metric.

“Higher costs/slower sales has us modeling lower [earnings before interest, taxes, depreciation, and amortization] and FCF in 2023, such that share repurchase has to be reduced,” Rosenblatt Securities analyst Barton Crockett wrote.

Add Comment