(Bloomberg Opinion) — FedEx Corp. has managed to fall out of a basement window.

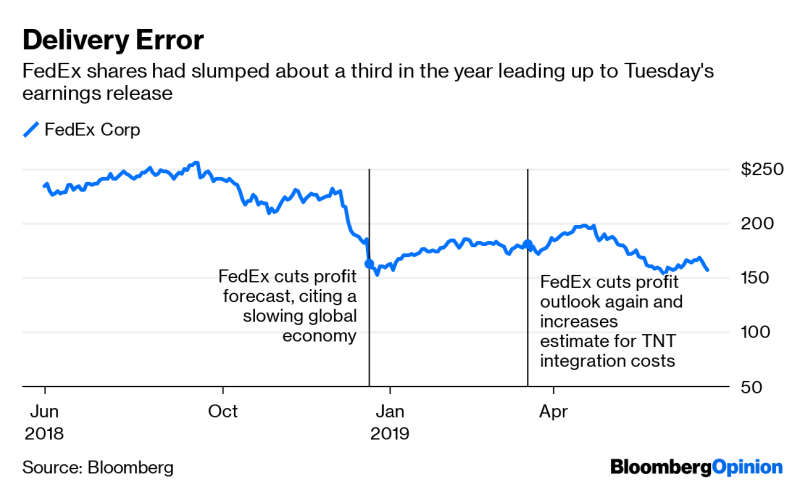

Expectations heading into the parcel-delivery company’s fiscal fourth-quarter earnings report on Tuesday were low. In the past six months, the company cut its 2019 outlook twice amid a weakening global trade backdrop; announced a series of puzzling executive departures; became a candidate for inclusion on China’s list of unreliable entities; and dropped Amazon.com Inc. as a customer for its domestic air-delivery unit. And yet FedEx found a way to pile on further, forecasting its first annual decline in adjusted earnings per share in more than five years.

FedEx said it expects a mid-single-digit percentage-point drop in its fiscal 2020 EPS, after adjusting for certain retirement plans and the ever-escalating budget for integrating the company’s acquisition of TNT Express.(1)And it could be an even sharper slide than FedEx is predicting. The company’s guidance assumes moderate U.S. economic growth, “no further weakening in international economic conditions from the company’s current forecast and no additional adverse developments in international trade policies and relations.” Those are huge variables. The U.S. is reportedly willing to suspend an escalation of tariffs on Chinese goods to enable talks between the two sides, but anything can happen on that front. China, meanwhile, is reportedly contemplating blacklisting FedEx over the misrouting of packages destined for Huawei Technologies or involving the company’s products.

To the extent that its crystal ball is working, FedEx warned that macroeconomic weakness and trade uncertainty as well as the “strategic decision” not to renew the Amazon contract would pressure operating income at its Express air-delivery unit. FedEx has said the e-commerce giant only accounts for 1.3% of its overall revenue and on Tuesday said the negative impact to its operating income from this change will reverse in fiscal 2021. But the e-commerce giant and its logistics aspirations are likely to have reverberating and lasting effects on FedEx’s network.

Exhibit A could be a report from the Wall Street Journal earlier this week that FedEx is offering steep discounts to entice other online merchants to fill its planes with their e-commerce shipments. FedEx on Tuesday pushed back on that report, saying it hadn’t made any pricing changes recently and that it’s seen strong growth in demand since a change last year. Even without extra discounts, e-commerce deliveries typically yield less than good shipped to businesses or urgent legal documents and medical supplies. FedEx warned of an ongoing shift to less-profitable services as another factor weighing on its Express unit.

FedEx expects operating income at its Ground unit to grow in fiscal 2020, but investors are focused on margins, and there was little in the company’s earnings report to give them hope that the multiyear slide on that front had come to an end. FedEx cited higher costs since it started offering delivery six days a week in January as one drag on its fourth-quarter results. Well, FedEx plans to roll out seven-day-a-week delivery by January 2020. The amount of investment required for FedEx needs to equip its network to profitably handle the deluge of e-commerce shipments isn’t shrinking, either. The company expects to spend another $5.9 billion on capital expenditures in 2020, short of the $6.2 billion analysts had been expecting but up from $5.5 billion in fiscal 2019.

Expect that capital-expenditure budget to come under scrutiny. FedEx appears to already be anticipating it: “While we are adjusting our costs to mitigate revenue weakness and market shifts, we will continue to invest in areas that expand our capabilities, improve our long-term efficiencies and reduce our cost to serve,” CFO Alan Graf said in the earnings press release. On a call with analysts, FedEx said there were a number of good projects that didn’t make the cut. But it remains unclear what kind of return FedEx is getting for all of this spending, or if it’s just throwing money at its challenges. Much of its spending over the past few years has been earmarked for new aircraft purchases, but you could make the argument the Express fleet should be rethought, rather than just replaced. Pressed by analysts on the company’s last earnings call, Graf said he wasn’t going to let “one bad quarter decide how we’re going to manage this business for the next five years.” But what about a string of bad quarters? FedEx is now looking at two disappointing years.

(1) FedEx now expects to spend $1.7 billion cumulatively through fiscal 2021 to integrate the $4.4 billion acquisition of TNT. That’s up from a forecast of $1.5 billion only three months ago and compares with an initial prediction of $700 million to $800 million in integration expenses.

To contact the author of this story: Brooke Sutherland at [email protected]

To contact the editor responsible for this story: Beth Williams at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Brooke Sutherland is a Bloomberg Opinion columnist covering deals and industrial companies. She previously wrote an M&A column for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”38″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment