Bloomberg News/Landov

Bloomberg News/Landov

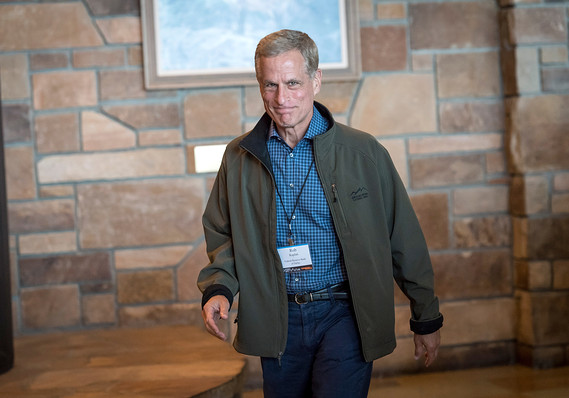

Dallas Fed President Robert Kaplan said Thursday he was open-minded about the possibility of more interest-rate cuts in coming months, as a way to manage downside risks.

“The Fed may have a role to play” in avoiding severe weakening in the economy, Kaplan said in an interview on CNBC.

“I’m going to have an open mind of taking further action over next couple of months,” he added.

The Dallas Fed president is not a voting Federal Open Market Committee member this year, but he is influential as a member of the central bank’s internal communications subcommittee. He was decidedly more dovish than two other top Fed officials, Kansas City Fed President Esther George and Philadelphia Fed President Patrick Harker, who earlier today said they would like to hold interest rates steady.

Asked about the different views, Kaplan said he put a lot of emphasis on risk management.

He said he was worried that the entire Treasury yield curve TMUBMUSD10Y, +1.60% is below the lower bound of the Fed’s benchmark short-term rates.

This signal, combined with weak manufacturing and a fear that global weakness was “seeping” into the U.S. economy, might justify further action, he said.

Kaplan traced the downturn in business confidence to President Donald Trump’s tweets in late May that he was considering tariffs on Mexico over immigration policy. This came even after the U.S. and Mexico and Canada re-wrote the NAFTA pact.

Business leaders suddenly realized that trade tensions would never go away, even if deals were reached, he said.

Opinion: Brace for a stock market drop if the Fed’s Powell doesn’t yield to Trump

Add Comment