(Bloomberg) — When Oguz Alper Oktem spotted a couple of electric scooters outside his Los Angeles apartment in the summer of 2017, the then-head of Turkey’s answer to Netflix.com wondered how they could help to ease traffic in his home city of Istanbul where congestion is among the worst in the world.

Most Read from Bloomberg

After returning to the Turkish financial hub a year later, Oktem quit his job with BluTV and set about with plans to set up a micro-mobility app. One of the first challenges, Oktem recalls, was tracking down a scooter in Turkey. The chase led him to Athens, and after a lengthy journey back home with the two-wheeler, Marti was created.

Now, just four years later, Marti — the Turkish word for “seagull” — is set to become the first Turkish firm to go public in New York via a merger with a blank-check company. With an enterprise value of $532 million, the firm, formerly known as Marti Ileri Teknoloji AS, has set an ambitious target to grow this valuation by more than 10 times.

Oktem, 31, a passionate environmentalist and former Deutsche Bank AG banker, is pushing ahead with the plans to merge with Galata Acquisition Corp. — a special purpose acquisition company with a focus on Turkey and backed by Callaway Capital Management LLC — even as a SPAC boom that started at the onset of the pandemic wanes.

A series of prominent mergers have fizzled out in recent months due to market volatility and fading investor appetite. As of the beginning of July, the value of SPAC deals had dropped to around $10 billion this year, compared with $149 billion in all of 2021, according to Bloomberg Intelligence.

SPACs from the Middle East have also struggled. Dubai-based ride sharing firm Swvl Holdings Corp. and music-streaming business Anghami Inc. both plunged earlier this year after their post-merger debuts.

Hailing Boom

Dismissing the downturn, Oktem says there’s nothing to worry about if both the SPAC and the target company are strong.

“We don’t lose money, we make money,” he said in an interview at Marti’s Istanbul headquarters where several vehicles are ready to be deployed. “We believe we have only done 10% of the business that we’ll eventually build in Turkey.”

Marti is tapping a boom in ride-hailing apps, which attracted $2.83 billion of investment in 2021, up from $1.31 billion the previous year, according to research by BloombergNEF, CB Insights and PitchBook. The company also offers bicycle and moped services.

The company expects an Ebitda of $835,000 this year and forecasts a jump to $31.7 million in 2023 as the firm expands its fleet. By comparison, Texas-based Bird Global Inc., which operates in 35 countries, and Helbiz Inc., which is active in North America and Italy, both have negative Ebitda figures, according to company presentations and TradingView data.

Turkey Expansion

At home, Marti has already nabbed a 64% market share — three times larger than its closest rival — with total app downloads of 5.6 million, according to an investor presentation. It competes with the likes of Dubai-based Fenix, Superpedestrian Inc.’s Link, Dutch-based Go Sharing and local Binbin in Turkey.

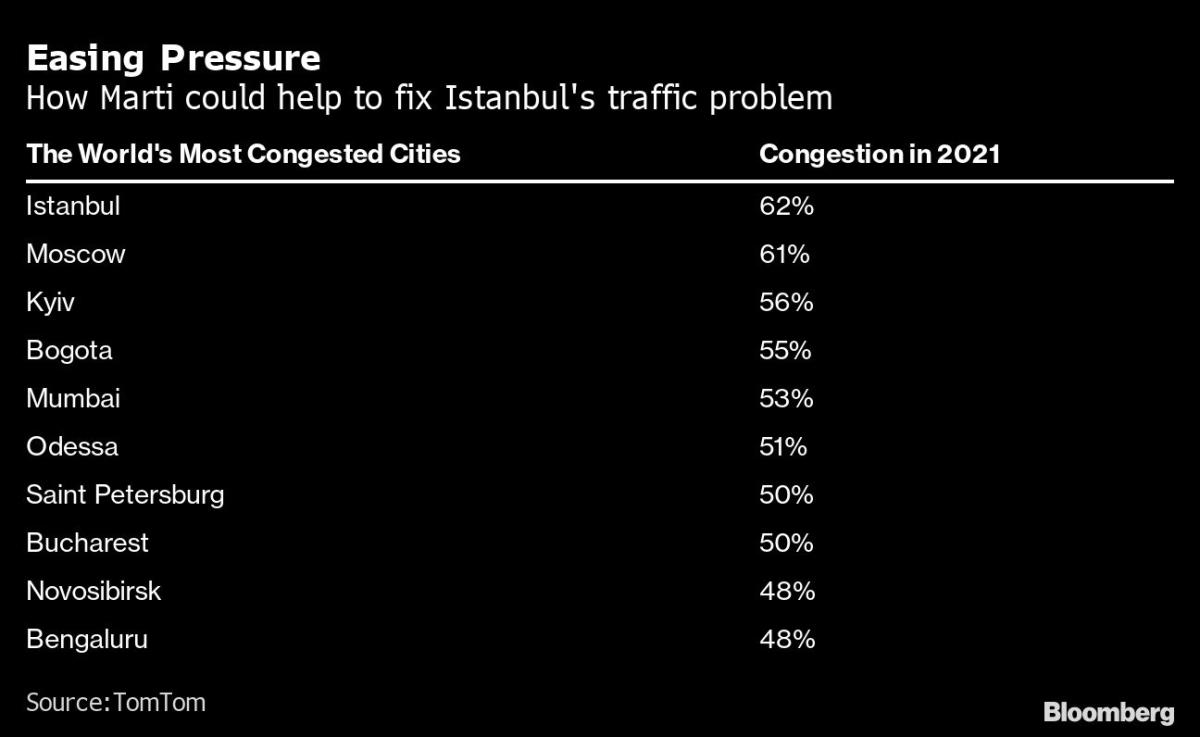

And there should be enough business to go around. Istanbul ranked as the world’s most congested city in 2021, according to navigation system developer TomTom.

Oktem has dismissed an investigation by the Turkish Competition Authority, which will look into allegations that Marti abused its dominant position in the market, and is pressing ahead with expansion. He plans to use the proceeds from the New York listing to more than double Marti’s fleet to around 96,000 scooters.

Marti was valued at about $100 million last year when it attracted $30 million of investment from the likes of the European Bank for Reconstruction and Development and Turkish private equity firm Actera. Other investors include AutoTech Ventures LLC and Beco Capital.

For now, Oktem will focus on the business in Turkey due its low labor costs, and the firm plans to expand its services like its global rivals Uber Technologies Inc., Lyft Inc. and Indonesia’s PT GoTo Gojek Tokopedia Tbk.

“Local mobility super apps in other emerging markets, such as Indonesia, Brazil, and India, are valued in the billions of dollars,” Oktem said. “We hope to get there too.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment