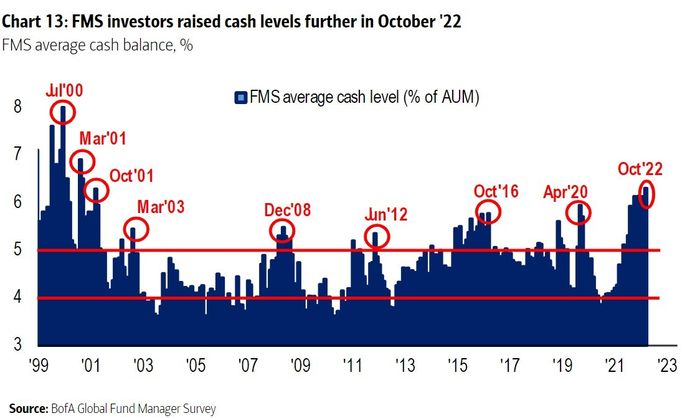

Fund managers have taken their cash positions to the highest level in 21 years, according to the long-running monthly survey of portfolio managers.

The survey found the average cash level was 6.3% in October, up from 6.1% in September and well above the long-term average of 4.8%.

Relative to the history of the survey, investors are 2.6 standard deviations overweight cash and 3 standard deviations underweight equities.

A net 72% expect a weaker economy in the next 12 months, and 91% say earnings are unlikely to rise 10% of more in the next year.

A growing percentage are expecting a policy pivot: 28% expect lower short-term rates in the next 12 months, up from 14% in September.

The survey “screams macro capitulation, investor capitulation, and crucially start of policy capitulation,” said Bank of America strategists led by Michael Hartnett.

The S&P 500 SPX, +2.65% has dropped 23% this year, and S&P’s U.S. government bond index has declined by 12%.

Add Comment