A GE offshore wind turbine.

AFP via Getty Images

Shares of General Electric Co. charged higher Wednesday, as the industrial conglomerate pleasantly surprised investors by reporting a third-quarter adjusted profit and positive free cash flow.

The stock GE, +4.36% rallied 4.5% to $7.42 on very heavy volume of 251.5 million shares. That was more than double the full-day average of 116.6 million shares, and enough to make GE the most actively traded stock on the New York Stock Exchange.

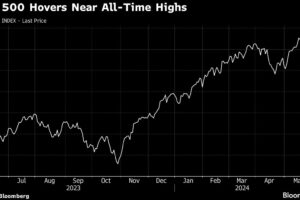

The gains stood out as they bucked the sharp selloff in the broader stock market. The stock was the second-biggest gainer in the S&P 500 index SPX, -3.52%, which tumbled 3.5% with just 15 components gaining ground. See Market Snapshot.

“Our transformation of GE is accelerating,” Chief Executive Larry Culp said in the post-earnings conference call with analysts, according to a FactSet transcript. “We rise to the challenge of building a world that works. This is more true than ever as we continue to deliver for our customers and tackle the world’s biggest challenges, from precision health to the safe return to flight to the energy transition.”

The company reported a net loss that narrowed to $1.19 billion, or 14 cents a share, from a loss of $9.47 billion, or $1.08 a share, in the same period a year ago, which included a $8.7 billion charge from ceding majority ownership of Baker Hughes and other insurance-related and goodwill charges.

Excluding nonrecurring items, adjusted earnings per share fell to 6 cents from 15 cents, but beat the FactSet consensus for a per-share loss of 4 cents.

GE shares have now run up 19.1% in October, enough to make it the best month-to-date performer in the SPDR Industrial Select Sector exchange-traded fund XLI, -3.28%, which is down 2.7% this month.

Don’t miss: GE stock has been on a tear ahead of earnings, as analysts tout it as a COVID-19 vaccine play.

Another shocker was that industrial free cash flow (FCF) for the quarter was a positive $514 million, while the FactSet average of estimates from two analysts was negative $1.03 billion.

And Culp said he expected fourth-quarter FCF of positive $2.5 billion and expects positive FCF in 2021.

Last month, Culp had only said that he expected FCF in the second half of the year to be positive.

That prompted a long-time critic, analyst Stephen Tusa at J.P. Morgan, to ask “what happened?” in terms of timing in September, that “flipped the switch” on FCF.

Culp’s response was:

“We never talked about a specific number with respect to the third quarter, and again, given the progress on the $2 billion of cost actions, the $3 billion of cash actions, I think what was a very strong quarter on the part of our health care business and the lack of any further deterioration of note in Aviation, allowed us to put the quarter that you see here, the $500 million of free cash flow, together.”

For overall revenue, GE reported a decline of 17% to $19.42 billion, but that was above the FactSet consensus of $18.73 billion.

Among GE’s business segments, Power revenue grew 3% to $4.03 billion, topping the FactSet consensus of $3.89 billion, helped by 7% growth in Gas Power revenue.

Renewable Energy revenue increased 2% to $4.53 billion, just ahead of expectations of $4.48 billion, driven primarily by strength in the Onshore Wind business.

“We expect strong Onshore Wind order growth in North America for the fourth quarter and Offshore Wind should recognize its first order of the wind farm.

Healthcare revenue fell 7% to $4.57 billion, as Culp said “pandemic-related demand moderated,” but that beat expectations of $4.14 billion. “Strong delivery” of COVID-19-related product backlog and the delivering of the remaining ventilators ordered by the U.S. government were offset by weakness in Pharmaceutical Diagnostics, the company said.

Aviation remained GE’s weakest business segment, and is expected to remain as such the rest of this year and into next year. Revenue tumbled 39% to $4.92 billion, just shy of expectations of $4.95 billion, given 385 fewer engines sold than last year, lower commercial spare parts shipments and decreased shop visits as the COVID-19 pandemic impacted commercial travel.

Based on trends seen through October in Aviation, Culp said that commercial shipments and shop visits are still down 50% from last year.

“We continue to plan for a steep market decline through the fourth quarter, and a likely multiyear recovery,” Culp said.

Add Comment