Shares of General Electric Co. surged for a second day on Thursday, as Chief Executive Larry Culp’s call for cash flow to be positive in the second half of the year emboldened investors, but left a J.P. Morgan analyst questioning the rally.

The industrial conglomerate’s stock GE, +4.06% jumped 4.7% in very active midday trading, putting them on track to close at a two-month high. Trading volume swelled to 168.7 million shares, more than double the full-day average of 82.6 million share, and enough to make the stock the most actively traded on the New York Stock Exchange.

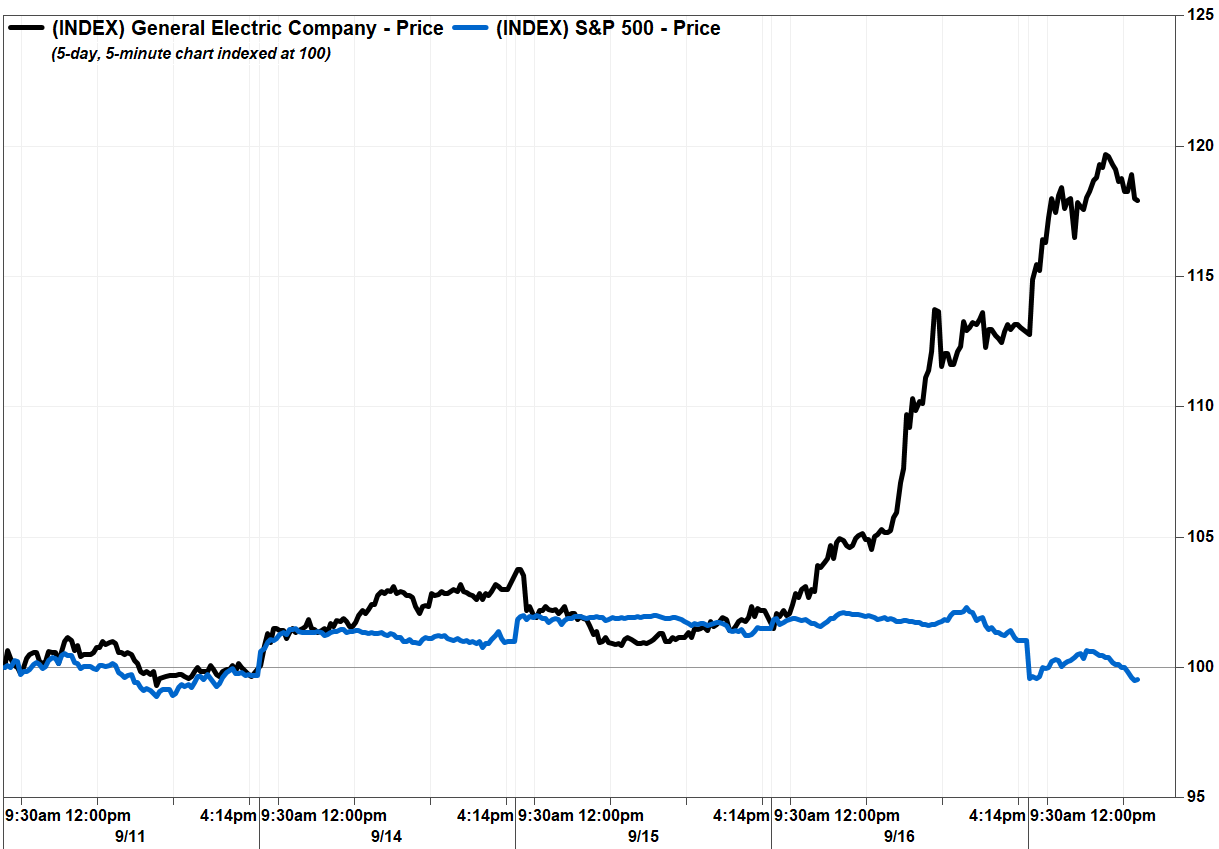

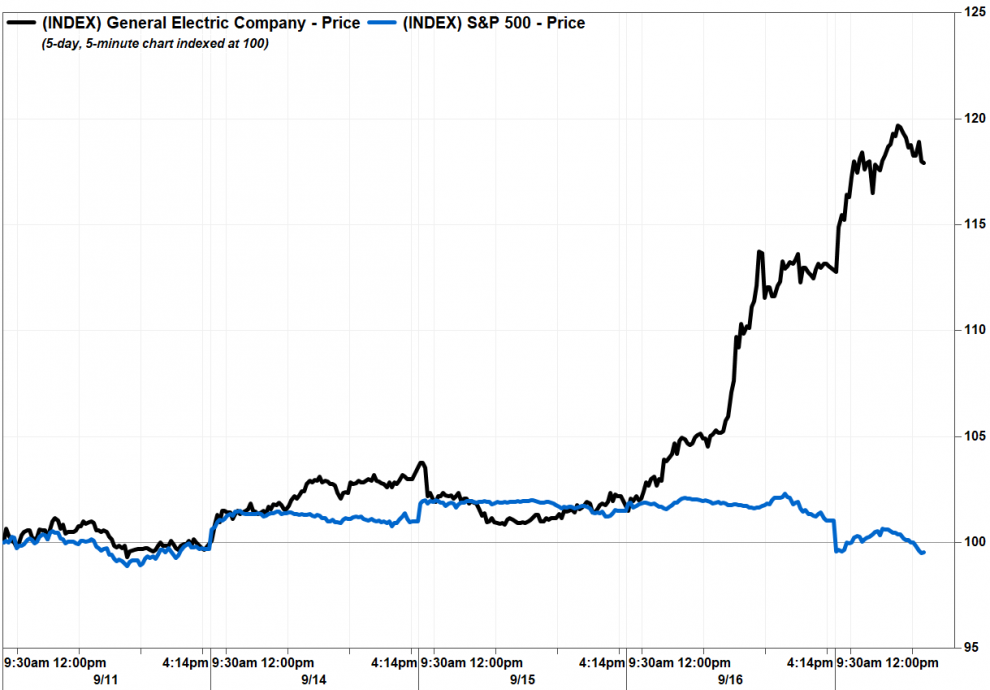

Adding to Wednesday’s 10.7% run up, the stock’s two-day gain of 15.9% is the biggest since it hiked up 23.7% in the two days ended March 25.

The rally stood out, as it came in the face of a 1.9% drop in the S&P 500 index SPX, -1.53% over the past two days.

Speaking at the Morgan Stanley Laguna Industrials Conference on Wednesday, CEO Culp said: “Today, we’re of the view that we’ll deliver positive free cash flow here in the back half [of the year].”

That compares with what he said on July 29, in the conference call with analysts following second-quarter results: “[B]ased on what we see today and the actions we’ve taken, sequential improvement in earnings and cash in the second half of 2020 is achievable, and we expect to return to positive industrial free cash flow in 2021.”

The stock fell 4.4% that day, and 11.9% over three days, as after a negative free cash flow (FCF) print of $2.1 billion in the second quarter, his comments were viewed as a reluctance to confirm Wall Street expectations that FCF would be positive in the second half of the year.

Also read: GE’s stock sinks, as CEO Culp can’t call a bottom in the Aviation business.

J.P. Morgan analyst Stephen Tusa said his comments on Wednesday were “better than prior vague communication” that cash flow would just “improve” in the second half, and appeared as “blessing the consensus” currently of more than $2 billion in positive FCF for the period.

Culp also provided some indication that the worst may have passed, but held back from suggesting a recovery had started.

“Clearly, our markets are by and large stabilizing, but not in any way rapidly recovering,” Culp said. “But we’re not going to wait on the markets.”

Tusa reiterated his neutral rating on GE’s stock, as he took Culp’s apparently upbeat comments with a grain of salt. He doesn’t have a price target, as he withdrew his $5 target on Aug. 31.

“Stepping back high level, this sounded to us like more of the same, with a ‘bad today, but better tomorrow’ message, but with little tangible evidence of recovery across the businesses,” Tusa wrote in a note to clients.

Regarding the stock’s rally after the comments, Tusa said, “we struggle to understand the reaction,” as the net of Culp’s “qualitative commentary” is no change to his view.

Culp’s comments didn’t seem to impress Tusa’s peers either, as none of the 19 analysts surveyed by FactSet changed their ratings or price targets since he spoke.

Add Comment