Gilead Sciences Inc.’s prominent COVID-19 drug unexpectedly brought in $100 more million in sales than analysts had expected in the third quarter, but that doesn’t mean Wall Street’s questions about Veklury have faded away.

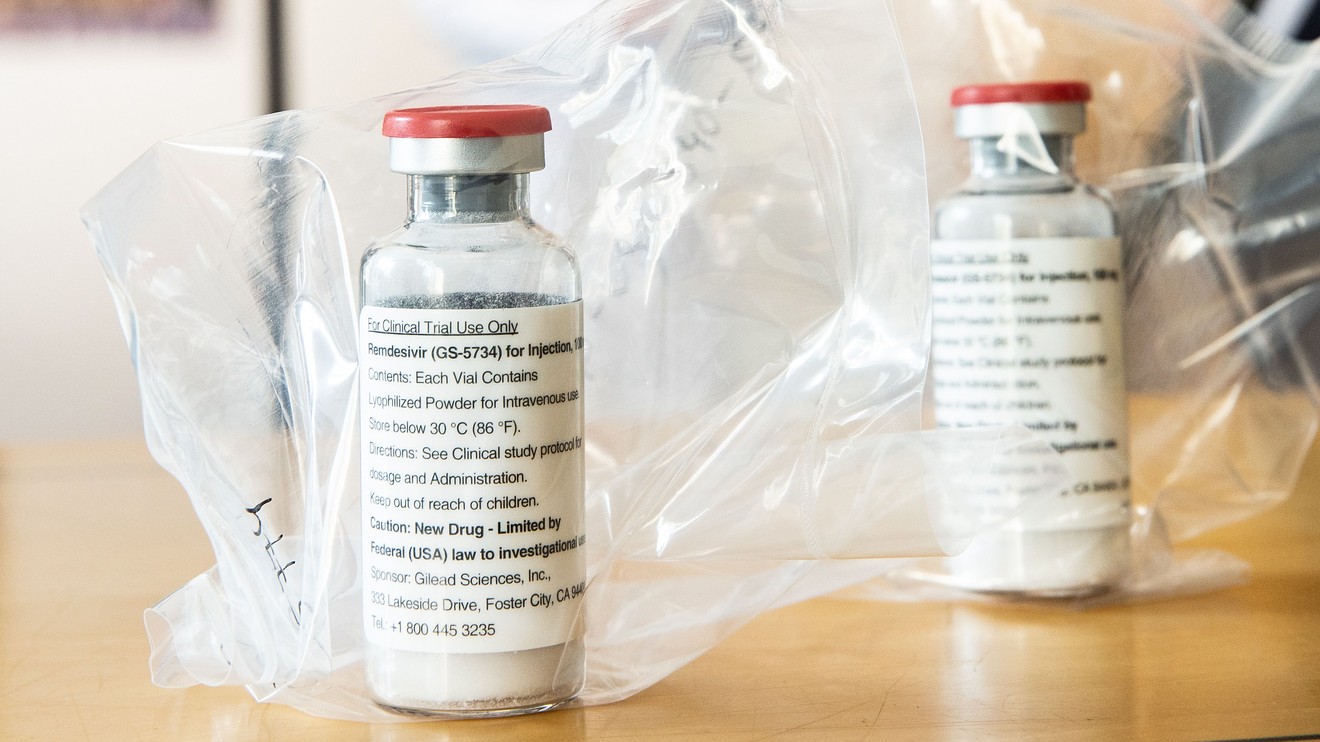

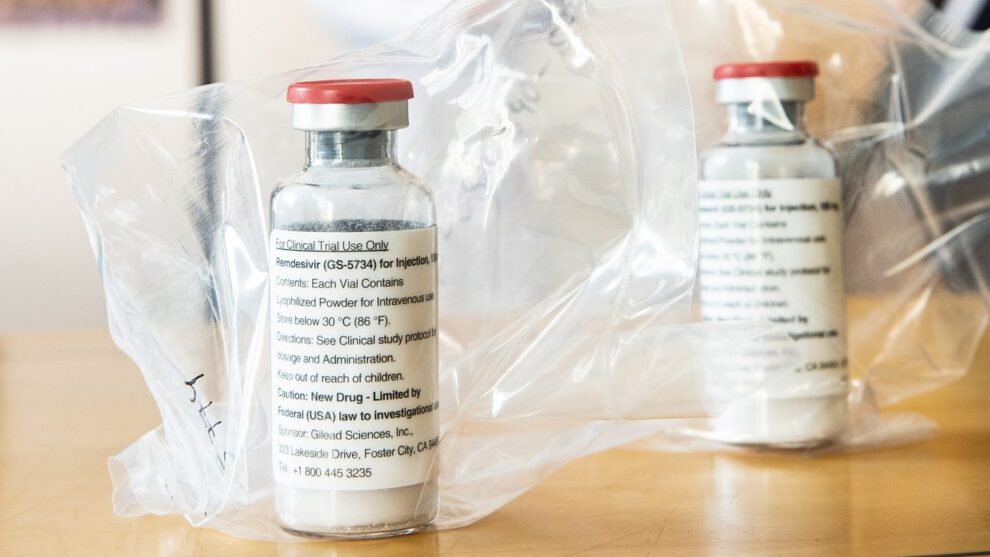

Shares of Gilead GILD, -0.64% were down 2.0% in trading on Thursday, the day after the company shared that Veklury, the antiviral drug also referred to as remdesivir, brought in $873 million in sales for the third quarter of 2020 — a figure that is significantly higher than what analysts had expected. The FactSet consensus was $771.7 million.

“It was essentially a ‘so-so’ quarter for Gilead as the future for remdesivir as a long-term growth driver is not clear,” Maxim Group’s Jason McCarthy told investors on Thursday.

Read:Fast start for coronavirus drug boosts Gilead earnings, but stock sinks on forecast

Analysts and physicians have been largely ambivalent about Veklury’s potential, with some taking aim at the fact the recent Food and Drug Administration approval failed to take into account three negative clinical trials and concerns about the longer-term financial potential of the therapy.

“We’ve been vocal in our view that Veklury might not work at all in most hospitalized COVID-19 patients,” Raymond James analyst Steven Seedhouse told investors.

However, Seedhouse also points out that recent events may actually help boost Veklury’s sales and utilization in the fourth quarter, at least. The U.S. is seeing record-breaking numbers of coronavirus cases and hospitalizations, which would likely increase utilization of the drug.

Two trials testing Eli Lilly & Co.’s LLY, -1.57% investigational antibody treatment in hospitalized patients were paused this month, including a study pairing the Lilly’s bamlanivimab with Veklury and one sponsored by the National Institutes of Health. (Lilly is focusing development of bamlanivimab on patients with mild to moderate forms of COVID-19 and has already filed an application with the FDA for an emergency use authorization treating these patients.)

Gilead executives told investors during this week’s earnings call that Veklury is prescribed to between 40% and 50% of hospitalized COVID-19 patients in the U.S. Given that this is the only FDA-approved therapy option and considered the standard of care, this percentage range “is lower than our prior expectations,” according to SVB Leerink’s Geoffrey Porges.

See also:Doctors question FDA approval of Gilead’s COVID-19 treatment and say it has limited benefits

The drug maker also outlined a traditional approach to sales and marketing for Veklury during the call that Seedhouse noted. This includes direct promotion to physicians and hospitals. “We have a field team,” Johanna Mercier, Gilead’s chief commercial officer, told investors, according to a FactSet transcript of this week’s earnings call, “that are now going out to make sure that physicians are aware and educated on where best to use Veklury.”

The FDA last week formally approved the antiviral drug, making it the first treatment to receive a full regulatory approval during the pandemic. (The drug initially received an emergency use authorization in May.)

Gilead’s stock is down 11.% so far this year, while the S&P 500 SPX, -1.21% is up 1.2%.

Add Comment