Getty Images

Getty Images

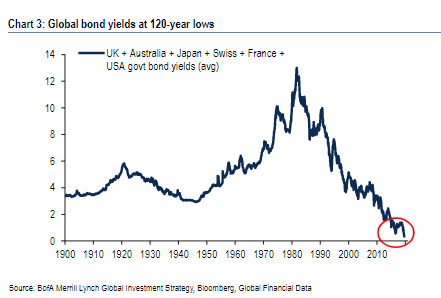

It’s been 120 years since bond yields around the world were this low.

That’s according to a calculation by Bank of America Merrill Lynch, which uses average yields from a host of countries — the U.K, Australia, Japan, Switzerland, France and the U.S. — to arrive at the data.

These low yields are the talk of the market as strategists wonder whether the bond rally will ever run out of stream. Prices and yields move inversely.

“With a substantial amount of central bank easing already priced, in our view, a marked deterioration in economic data would be required for the rally to continue. We believe the risk of a reversal has risen, and [we] turn neutral on duration,” strategists at Goldman Sachs said this week.

J.P. Morgan strategist Marko Kolanovic pointed out that the S&P SPX, -0.66% earnings yield is 5.9% while the global 10-year bond yield is at 0.59% — with that wide spread being in the 95th percentile in data going back to 1985.

Early on Friday, the yield was 1.61% on the U.S. 2-year Treasury TMUBMUSD02Y, +0.00% , 1.7% on the 10-year Treasury TMUBMUSD10Y, +0.00% and 2.22% on the 30-year Treasury TMUBMUSD30Y, +0.00% .

Bond yields for leading G-7 rivals were even lower, with Germany’s TMBMKDE-10Y, +0.00% and Japan’s TMBMKJP-10Y, +0.00% 10-year in negative territory.

Add Comment