(Bloomberg) — Sunbathers flocking to Geneva’s new lakeside beach could soon face competition for the best spots on the pebbles after Facebook Inc. and Goldman Sachs Group Inc. committed to investments in the city.

On June 18, Facebook said the organization overseeing its new cryptocurrency would be based in Geneva, initially in a shared office that once housed private bank Coutts & Co. Two days later, Goldman announced plans to hire as many as 25 staff for its revamped wealth management business in the Swiss canton. That coincided with the cruise division of billionaire Gianluigi Aponte’s MSC Mediterranean Shipping Co. saying it would add 300 positions at its Geneva headquarters.

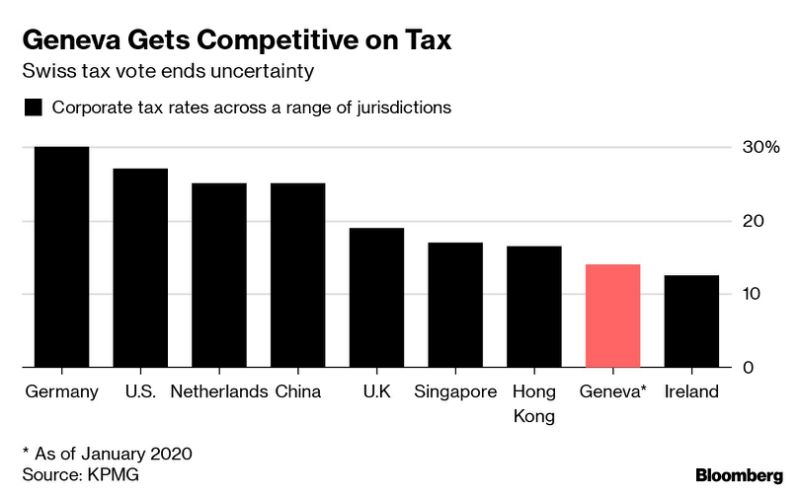

MSC’s expansion came after Swiss corporate tax reforms were approved last month, with Geneva set to be one of the main beneficiaries. The city, one of the world’s top commodity-trading hubs, will have one of the most competitive tax rates in Europe, 4 percentage points lower than Switzerland’s No. 1 financial center of Zurich.

“I’m quite positive about the outlook,” said Thierry Boitelle, a Geneva-based partner at law firm Bonnard Lawson, who bought a case of champagne for his team after Swiss voters approved the tax reform on May 19. “I expect it to make the local economy a bit more dynamic.”

After losing jobs following the erosion of Swiss banking secrecy and a retreat by some multinationals, the canton of half a million people is leveraging its traditional advantages as a hub for finance and diplomacy, said Sebastien Mena, senior lecturer in management at Cass Business School in London.

“Geneva’s international and banking identity is still there, it’s the legacy of centuries,” Mena said. “They have adjusted in the past and will do so again.”

Geneva’s appeal as a place to connect to civil society and international organizations — the city hosts more than 50 such institutions, including the World Trade Organization, and hundreds of NGOs — clinched it for Facebook, said Dante Disparte, a spokesman for its digital currency, Libra.

For Goldman Sachs, Geneva will strengthen its foothold “in one of the most important centers for international wealth management,” said Swiss country head Stefan Bollinger.

While the number of banks in Geneva has shrunk by a quarter over the past decade, workers in the canton’s finance sector are just 11% below a 2012 peak and Switzerland remains the world’s premier hub for cross-border wealth. Taxes on company profits surged in Geneva last year.

“It’s been a tough time for private bankers, but the restaurants are full and the tax take of the canton is looking good,” said Boitelle.

Commodities Hub

Swiss approval in May for the overhaul of the corporate tax code will also reassure the Geneva’s commodity traders, which contribute about 20% of the canton’s taxes. While trading houses have moved some middle and back office functions to lower-cost locations such as Mumbai and Barcelona, the city continues to attract many of the industry’s best-paid people.

Total SA is moving about 200 power, gas and LNG traders to Geneva from London and Paris, the company said earlier this year. Vitol Group, the world’s biggest independent oil trader, last month unveiled plush new offices for about 200 employees on the banks of the River Rhone, a few doors down from the newly renovated building of HSBC Holdings Plc’s Swiss private bank.

“Geneva has weathered the storm,” said Peter Vyvyan-Robinson, head of VR-People, a recruitment firm in the city focused on commodities. “Traders in general like Geneva and do not want to move. They are, after all, the money makers.”

To contact the reporters on this story: Dylan Griffiths in Geneva at [email protected];Hugo Miller in Geneva at [email protected];Andy Hoffman in Geneva at [email protected]

To contact the editors responsible for this story: Anthony Aarons at [email protected], ;Jan Dahinten at [email protected], Dylan Griffiths

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”57″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment