(Bloomberg) — ESG has become a punching bag for the far right, for disgruntled corporate executives and even industry insiders. But there’s one group whose growing disapproval might be the ultimate game changer.

Most Read from Bloomberg

Retail investors are slowly starting to look under the hood of the $40 trillion environmental, social and governance industry that’s increasingly steering their savings, and many aren’t liking what they see. What’s more, some of the biggest names in finance have been tainted by greenwashing allegations, with Goldman Sachs Asset Management and the investment arm of Deutsche Bank AG among the most prominent.

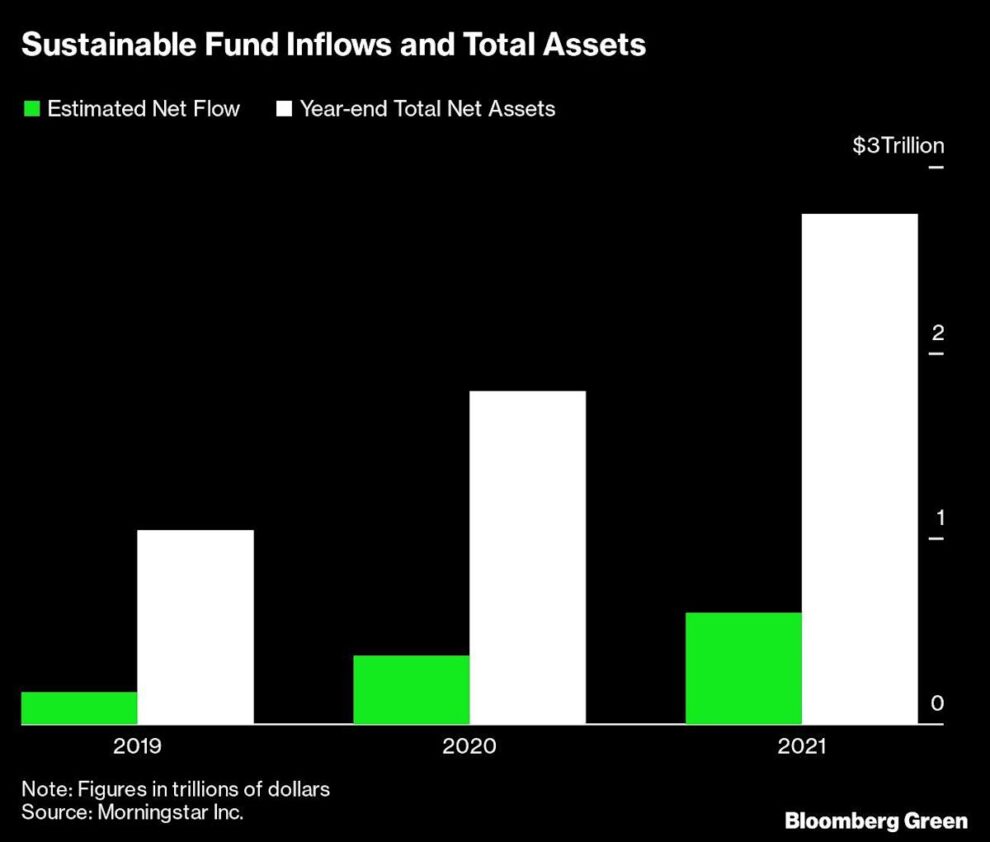

The cracks in the ESG firmament appear to be widening elsewhere, too. After attracting huge amounts of money for three straight years, demand for ESG is cooling. Flows into ESG funds globally slumped 36% in the first quarter, according to data provided by Morningstar Inc. It’s the worst showing since before the pandemic began and was followed by another decline in April, Bank of America analysts reported. In May, investors made the biggest-ever monthly redemptions from US exchange-traded ESG funds, Bloomberg Intelligence estimates.

And ESG returns, which rode out the worst lockdown-induced selloffs, also are starting to sag. By the second week of June, European ESG equity funds had, on average, lost 14%, compared with an 11% decline in the Stoxx Europe 600 index. In the US, they lost 16%, which was only marginally better than the S&P 500.

But perhaps more importantly, doubts about how much good ESG actually does risk becoming a more lasting turn-off for regular people.

When Neil Baker, a 37-year-old who works in the UK construction industry, started looking for ESG investments less than two years ago, he said he was dismayed at what he found. One stock he really didn’t want to own was Facebook parent Meta Platforms Inc. But finding an ESG fund without big tech was almost impossible, he said.

“I don’t want to over-ham it too much, but I felt like I’d almost been had because I thought I was buying into the more ethical side of this,” he said. “And then you start looking, you’re thinking, why is Facebook in there?”

While ESG fund managers may have good reasons for building their portfolios the way they do, the gap between the complex strategies they’re applying and the expectations regular people have of what ESG should do is starting to be a problem that’s playing out in real life. For example, the investment arm of Danske Bank A/S this year adjusted an ESG portfolio amid complaints from consumer advocates about the presence of fossil-fuel stocks. Danske initially pointed out it was playing by the rules, but eventually removed the assets in question.

Financial professionals that deal directly with retail clients are starting to speak out about the disillusionment they’re seeing. For non-institutional investors trying to navigate ESG, “there’s confusion across the board,” said Dan Lane, a senior analyst at UK-based online retail broker Freetrade Ltd.

Industry insiders readily admit that ESG remains hard to define. “What is an ESG fund? I literally have no idea myself,” said Gemma Woodward, head of responsible investment at Quilter Cheviot, which designs bespoke ESG products for professional and retail clients.

Baker ended up ditching ESG altogether and going with a broad index fund. He might be among the few who even bothered to look into ESG in the first place, according to a recent survey by Charles Schwab. It found that 66% of UK retail savers don’t care whether their allocations are sustainable, and instead only want to maximize returns.

If those survey results play out in real life, the ESG industry could be facing an abrupt halt to a party that Bloomberg Intelligence estimates has inflated to roughly a third of the global total for assets under management.

For now, the giants of ESG are becoming this year’s laggards. The world’s biggest ESG exchange-traded fund — BlackRock Inc.’s $20.9 billion iShares ESG Aware MSCI USA (ticker ESGU) — has lost almost a quarter of its value this year. The ETF, which holds shares of Meta, Exxon Mobil Corp. and Chevron Corp., performed even worse than the MSCI World Index amid a global selloff.

Perhaps ironically, the BlackRock ESG ETF’s exposure to the kind of big tech stocks that Baker was trying to avoid is why it’s done so badly this year. In fact, ESG’s early flirt with tech — due to its perceived low carbon footprint — has been the undoing of many an ESG fund manager in 2022.

ESG’s recent performance dip has coincided with a rise in notoriety. Mike Pence has called it a “left-wing” conspiracy that Republicans must “rein in.” Elon Musk has dubbed it “the Devil Incarnate,” while Republican donor and hedge fund boss Peter Thiel has described it as a “hate factory.” Meanwhile, researchers at the European Central Bank have said it remains “unclear” whether the ESG investment industry is actually helping the fight against climate change.Against that backdrop of confusion, disillusionment and outright anger, regulators are sharpening their teeth. In Germany, the authorities stunned the ESG asset management world on May 31 by launching a raid on the headquarters of Deutsche Bank and its fund unit, DWS Group, amid allegations of greenwashing. Over the weekend, it emerged that the US Securities and Exchange Commission is investigating potentially dubious ESG claims at the investment management unit of Goldman Sachs Group Inc.

Read More: Political Right Zeroes In on ESG Investors as New US Enemy No. 1 Read more: ESG Fund Bosses Hit by ‘Reckoning’ as Goldman, DWS in Crosshairs

As normal people wonder whether ESG is worth it, a new regulatory framework is about to make their opinions a lot more important to the fund management industry.

In Europe, whose ESG rules are fast becoming a global benchmark, asset managers are desperately trying to prepare for a looming deadline that will force them to care a lot more about retail client perceptions. Starting in August, the European Union will require financial advisers to make sure individual investors get exactly what they want out of their ESG holdings, even if that means sending them to a competitor. The change applies to all fund managers targeting European investors — whether they’re in the US or Asia — and is likely to influence regulatory frameworks across other jurisdictions, if history is any guide.

In practice, that means that if a client thinks it would be weird to include Meta in an ESG fund, an investment adviser needs to make sure they know that. Lawyers advising the fund industry are trying to prepare their clients for the risks ahead.

Read more: Fund Managers Brace for Correction as Greenwash Rules Go Global

“There’s a real concern that retail investors don’t understand the different faces of sustainability,” said Lucian Firth, a partner at law firm Simmons & Simmons in London who advises ESG fund managers. “What is sustainability? It means lots of different things to different people. Does the retail investor know? They might have in their mind that this stuff should do good and you see these adverts that my money can do good and make me returns, but what do they actually mean?”

The upshot is “there will be more litigation risk,” he said.

Europe’s main banking association, EBF, has already warned of the “great legal uncertainty” the new regulatory framework represents for the finance industry, as well as the “huge confusion” for clients. It’s lobbying to have the new rules, which fall under Europe’s revised Markets in Financial Instruments Directive, delayed by almost a year.

European authorities have so far shown no inclination to grant the requested delay. And consumer protection groups are warning that any hold-up would be bad for retail investors.

Guillaume Prache, managing director at retail investor association Better Finance, said the group is concerned the industry will “water down” what’s essentially a “once in a generation” opportunity to bolster retail investors’ rights.

Retail clients make up about a quarter of direct investment flows in Europe, according to the European Fund and Asset Management Association. On top of that, insurers and pension funds manage roughly 40% of total flows, much of which represents money saved by regular people. So the finance industry can’t afford to mess up this moment.

Money managers who aren’t “running around like scared chickens right now” probably “haven’t understood the magnitude” of the new regulatory mix due to take effect in August, said Eric Pedersen, head of responsible investments at Nordea Asset Management.

Unless firms advising retail investors do their job properly, it “puts every step of the chain really in jeopardy,” Pedersen said.

Quilter Cheviot’s Woodward said it probably won’t be enough for advisers just to hand retail clients a questionnaire and hope they’ll understand their ESG demands. The goal is “to actually have a conversation,” she said. There are so many different ways to do ESG, and clients will need to talk through categories spanning everything from impact to thematic, stewardship, focus and integration, among others; that creates lots of room for interpretation, and potentially even greenwashing, Woodward said.

Individual investors shouldn’t assume they’ll have a good feel for what might be lurking in an ESG fund, said Shila Wattamwar, global head of ESG retail and wealth at Morningstar Sustainalytics. They’ll need to look under the hood, and “they might be quite surprised by the holdings they might have,” she said.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, sums up the challenges facing ESG in the same way as Winston Churchill once tried to sum up Russia: “a riddle, wrapped in a mystery, inside an enigma.”

The investing form has morphed into something that’s “overblown with hype,” Balchunas said. Ultimately, “people are finding it’s too inconsistent.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment