(Bloomberg) — The buzz around possible U.S. currency intervention is growing louder as Goldman Sachs Group Inc. has now weighed in on an idea that’s been making the rounds on Wall Street.

President Donald Trump’s repeated complaints about other countries’ foreign-exchange practices have “brought U.S. currency policy back into the forefront for investors,” strategist Michael Cahill wrote in a note Thursday. Against a fraught trade backdrop that’s created the perception that “anything is possible,” the risk of the U.S. acting to cheapen the dollar is climbing, he said.

The U.S. last intervened in FX markets in 2011 when it stepped in along with international peers after the yen soared in the wake of that year’s devastating earthquake in Japan. That effort buoyed the dollar. However, more analysts in recent weeks have been contemplating the wild-card notion that the U.S. could forcibly weaken the dollar. The U.S. hasn’t taken that step since 2000.

“Direct FX intervention by the U.S. is a low but rising risk,” Cahill wrote. “While this would cut against the norms of recent decades, developed-market central banks have recently used their balance sheets more actively, and FX intervention is akin to unconventional monetary policy.”

Growing Ranks

Goldman joins analysts from banks such as ING and Citigroup Inc. in writing on the prospect. Intervention has become a hot topic since Trump tweeted last week that Europe and China are playing a “big currency manipulation game.” He called on the U.S. to “MATCH, or continue being the dummies.”

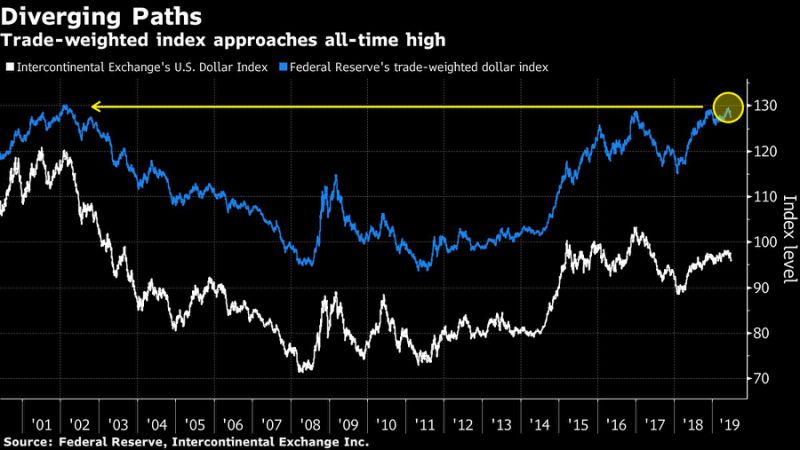

Buoyed in part by a round of Federal Reserve rate increases, the dollar has strengthened against many of its peers. A Fed trade-weighted measure of the greenback isn’t far below the strongest since 2002, underscoring the competitive headwinds American exports face overseas. Trump has grown concerned that the currency’s strength will undermine his economic agenda, which has also fed into his criticism of the U.S. central bank.

Still, in a tweet on Thursday, where Trump criticized Facebook Inc.’s plan for a digital currency, the president came out in support of the greenback, calling it “by far the most dominant currency anywhere in the world.”

There may be some wrinkles to consider with intervention, Cahill wrote. While the Treasury and Fed have typically contributed equal amounts in past episodes, if the Fed chooses not to participate it would “substantially limit” the potential scale, he said. Treasury’s Exchange Stabilization Fund holds roughly $22 billion in greenbacks and around $50 billion in special drawing rights that it could convert, in addition to euros and yen.

To be sure, even if the Treasury acted on its own, “we would expect that the symbolic importance of this step would still have a significant market-moving effect,” he wrote.

Read: Currency Wars Are Easy to Start and Tough to Win: Daniel Moss

Trade Backdrop

That’s not to say it’ll be easy to leave a lasting impact on a market that trades about $5 trillion daily. In past interventions, various nations’ central banks typically acted together, strengthening the signal to investors. But this time, the U.S. may find itself flying solo, especially if its efforts would work to the detriment of American allies as trade tensions simmer.

“The international community would be unlikely at this stage to coordinate with the U.S. to weaken the dollar,” Cahill said.

There’s also the question of whether it would make sense for the U.S. to boost holdings of the low-yielding currencies it’d wind up buying should it sell dollars.

Intervention by the U.S. would increase portfolios of euro, yen and especially Chinese yuan, wrote Sebastien Galy, a senior macro strategist at Nordea Investment Funds. The U.S.’s reserves in euro and yen “in a base case scenario earn nothing.”

The market has yet to display much concern about the prospect of U.S. intervention: Global currency volatility is at a five-year low. However, the risk of Trump moving beyond words to achieve a weaker greenback would increase if the European Central Bank pursues further monetary stimulus, according to analysts at ING and Societe Generale.

“In in the intensifying currency war against the Eurozone (Germany), he will instruct the US Treasury (via the NY Fed) to intervene directly and unilaterally to drive the dollar lower,” SocGen global strategist Albert Edwards wrote in a note Thursday. “I am surprised he has not done so already, but any additional ECB easing will surely be the straw that will break the camel’s back.”

(Adds Trump tweet in seventh paragraph.)

–With assistance from Ruth Carson.

To contact the reporter on this story: Katherine Greifeld in New York at [email protected]

To contact the editors responsible for this story: Benjamin Purvis at [email protected], Mark Tannenbaum, Greg Chang

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”44″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment