(Bloomberg) — Grab Holdings Inc. is partnering with Singapore Telecommunications Ltd. to apply for a full digital banking license, jumping aboard a Singapore government initiative to attract technology firms into its financial sector.

Grab will own a 60% stake in the consortium that will apply for the bank license in Singapore, while the telco known as Singtel will hold the rest, according to a joint statement. The consortium plans to set up a digital bank targeting so-called digital-first consumers, as well as small and medium enterprises that lack access to credit.

The move teams one of Southeast Asia’s largest operators of online businesses from finance and car-hailing with Singapore’s largest telecommunications firm. The Monetary Authority of Singapore unveiled plans this year to grant as many as five virtual bank licenses to boost competition and innovation. Of these, two will be full bank licenses and three wholesale licenses limited to serving corporate clients only — the first category requires capital of S$1.5 billion ($1.1 billion), the second S$100 million.

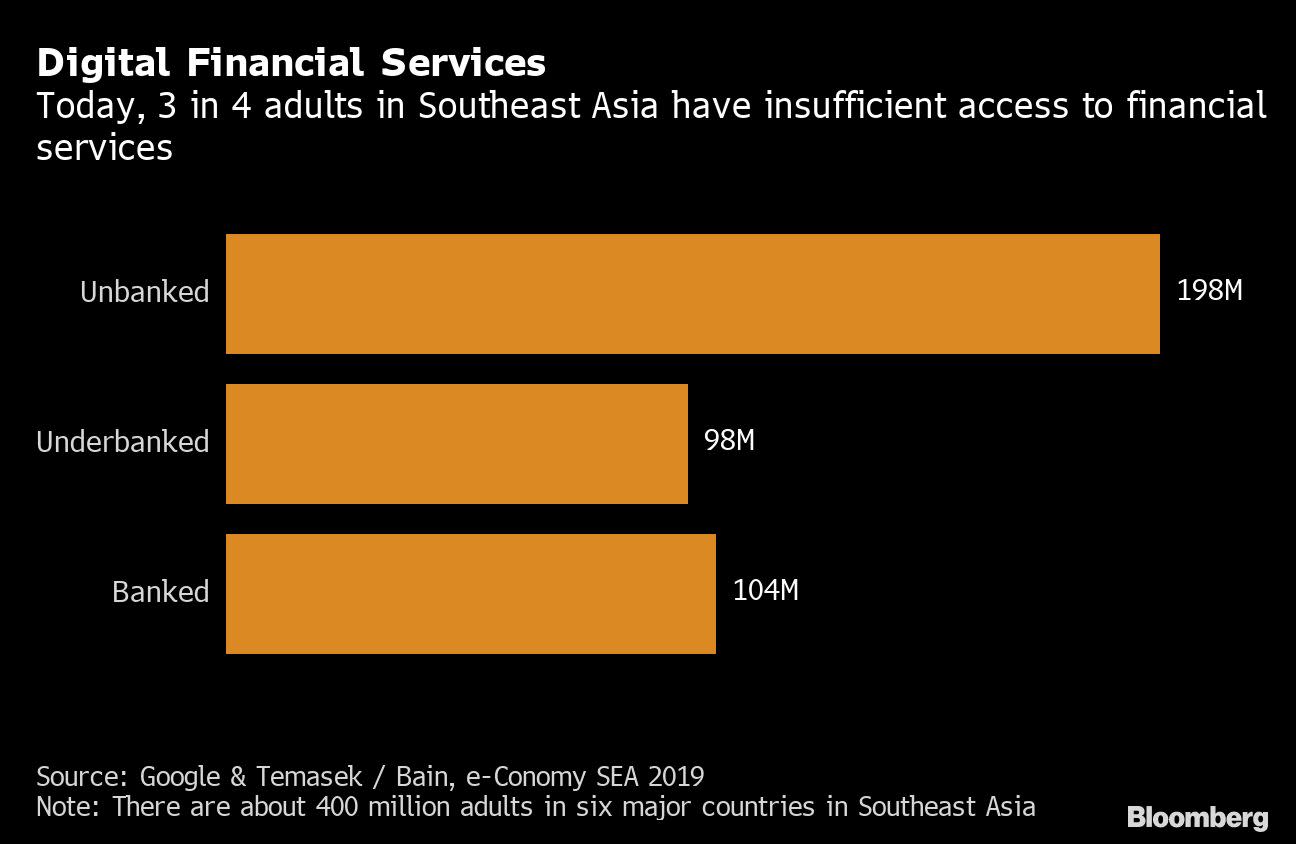

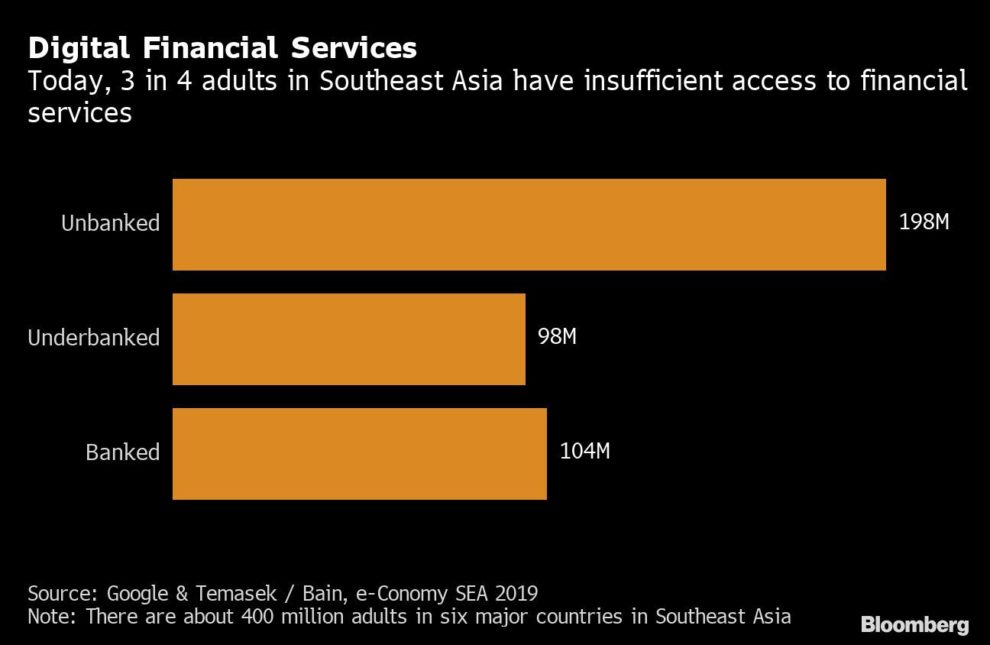

Southeast Asia’s digital lending market is expected to more than quadruple to $110 billion by 2025, according to a report by Bain & Co., Google and Temasek Holdings Pte. Bids for the new virtual licenses are due by the end of the year. Several other groups have expressed interest in joining Singtel and Grab in applying, including billionaire Alibaba founder Jack Ma’s Ant Financial, gaming gear-maker Razer Inc. and Oversea-Chinese Banking Corp.

Singapore Digital Bank Wannabes Must Prove They Can Profit

Efforts to open up the Singapore banking industry to technology companies come on the heels of a similar move in Hong Kong, where Ant and Chinese competitors including Tencent Holdings Ltd. obtained licenses earlier this year.

For Grab, a digital banking business complements its growing suite of services built atop a ride-hailing platform that’s expanding regionally. Its advantage over other non-bank companies is an existing share of online payments built up under the GrabPay brand from ride-sharing users and local merchants. The startup, one of Southeast Asia’s most valuable, is expected to fold its financial operations into any eventual digital bank.

Grab doesn’t disclose the number of users — which include many for food delivery — but said its app has been downloaded onto more than 166 million mobile devices in Southeast Asia.

The company, which started out as a taxi booking app in Kuala Lumpur in 2012, has sought to forge closer ties to Singapore. It’s moved its base to the city and taken other steps to polish its local credentials. In March, it announced a new headquarters building in the city, and Chief Executive Officer Anthony Tan revealed plans to double local staff to 3,000.

Grab has expanded into financial services across Southeast Asia in partnership with 60 financial institutions including United Overseas Bank Ltd. in Singapore and Malayan Banking Bhd. in Malaysia. It set up the Grab Financial Group in 2018, which, among other things, provides digital payments services and personal loans. It also launched a numberless card with Mastercard and plans to start wealth management services next year.

Singtel has delved deeper into financial services as growth in its core telecoms business plateaus in an uncertain economy. The company swung to a net loss of S$668 million in the quarter ended September, due to an exceptional item related to Bharti Airtel Ltd.

The carrier’s been offering its own mobile payments service in cooperation with regional associates, including in Thailand. Users can pay via its Dash app when traveling wherever Dash’s partners are located. The app can also be accessed through Apple Pay. Digital banking is a natural extension of the company’s existing mobile financial services, said Arthur Lang, CEO of Singtel’s International Group. Its shares were largely unchanged on Monday.

“We want to fundamentally change the way consumers and enterprises bank,” he said.

Read more: SingTel Earnings Expected to Recover Next Year, Led by India

(Updates with Singtel’s shares from the 10th paragraph)

–With assistance from Kyunghee Park and Ishika Mookerjee.

To contact the reporters on this story: Chanyaporn Chanjaroen in Singapore at [email protected];Yoolim Lee in Singapore at [email protected];Saket Sundria in Singapore at [email protected]

To contact the editors responsible for this story: Edwin Chan at [email protected], Marcus Wright, Derek Wallbank

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”62″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment