Financial freedom costs money.

One 25-year-old man living with his parents asked users of the social-media site Reddit to chime in on his mother’s advice that he save up between $10,000 and $15,000 before he moves out.

He’s debt-free, earning at least $1,800 per month and planning to rent an apartment in an area where the cheapest studio goes for $850 a month. That’s $550 more than the rent his parents make him pay now. “Is my mom right on the money,” he wondered, “or is she trying to make her baby stay with her forever?”

He’s debt-free, earning at least $1,800 per month and planning to rent an apartment in an area where the cheapest studio goes for $850 a month.

Redditors overwhelmingly came to the same conclusion: Mother knows best. “In the long game of life, you’ll quite possibly never be given a chance to save $10,000 to $15,000 so quickly,” one commenter said. “Being on your own is cool and everything, but take advantage while you can. Set yourself up for success,” another wrote.

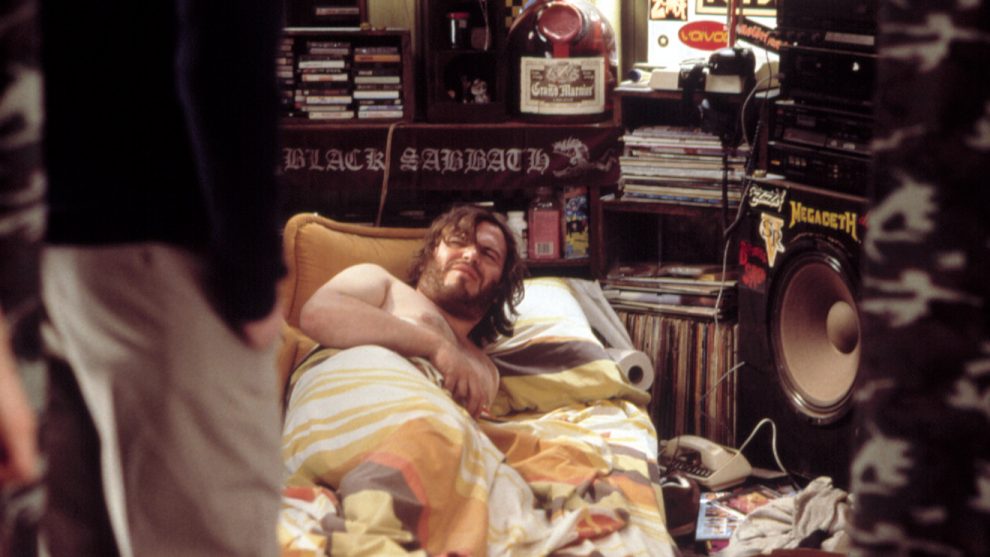

Some financial advisers told MarketWatch they also agree with his mother. Eric Walters, the founder of SilverCrest Wealth Planning in Greenwod Village, Colo., said $10,000 was a good starting point. A comfy cushion was crucial for absorbing all life’s unexpected bumps and avoiding the move back “to mom and dad’s basement,” he said, “and that’s not what anyone wants.”

James Gambaccini, managing partner of Acorn Financial Services in Reston, Va., said $10,000 to $15,000 is a good start. Whatever the final sum, he recommended young adults save up for six months of fixed and discretionary living costs before moving on.

Rather than having anxiety about her son leaving home, others said this 25-year-old’s mother may want to ensure that once he goes, he doesn’t come back.

Rather than having anxiety about her son leaving home, Gambaccini said the 25-year-old’s mother may want to ensure that once he goes, he doesn’t come back. That might mean her son asking for a large lump sum if something went wrong in his life.

Don’t miss: Millennials are now haggling in job interviews, hotels and airports

Other said a five-figure savings was probably more than most millennials would need before flying the coop. James DiVirgilio of Chacon Diaz & DiVirgilio in Gainesville, Fla., said if the young man was willing to cut back on expenses and share costs with a roommate, he could move out sooner and build his emergency reserve at the same time.

That independence helps young adults foster responsibility and built assets over time, DiVirgilio said. “Part of what millennials need to do is get out and make decisions.” He is speaking from his experience. DiVirgilio himself is a millennial.

An increasing number of recent college graduates are living with their parents. In 2016, 28% of were living with mom and dad, up from 19% in 2005.

This Redditor is one of many young and restless millennials living at home due in part to rising rents and living expenses and stagnant wages, particularly for those on the first rung of the corporate ladder. An increasing number of recent college graduates are living with their parents. In 2016, 28% of recent graduates were living with their parents, up from 19% in 2005.

But this restless Reddit user is unusual in other ways: He said he doesn’t have any student-loan debt. Americans have $1.5 trillion in student-loan debt and that burden is tying down many borrowers who have to put money towards debt payments instead of rent or a mortgage.

Millennials can expect to face these expenses when they leave home

The biggest part of moving out is finding to place to move to. The national median monthly rent was $1,530 as of March, according to HotPads, a rental search platform owned by Zillow Z, +1.59% In many places, landlords will require the first and last month’s, plus a security deposit. That could add up to as much as $4,600 before you pay for groceries or moving costs.

Landlords often require the first and last month’s, plus a security deposit. That could add up to as much as $4,600 before you pay for groceries or moving costs.

Charges like deposits, application fees, parking and pet deposits can add another $3,420 in yearly housing costs, HotPads said.

But it all depends on how much you earn. Housing costs should equal at most one-third of someone’s expenses, DiVirgilio said. The good news: Nearly 47% of working millennials had at least $15,000 in savings, according to a report released last year by Bank of America BAC, -0.39% that polled 2,000 people between the age of 23 and 37.

Millennials are supposedly splurging on trendy and expensive avocado toast. However, millennials spent an average of $6,300 of their annual pretax income on food, according to NerdWallet. That’s $887 less than the average yearly spending for all generations, it said. They also spend approximately $8,426 per year on transportation costs, $623 less than the national average.

Other research reaches different conclusions, saying millennials spend about $2,300 a year more compared to older generations on groceries, gas, restaurants, coffee and cell phone bills.

Add Comment