The attacks on Saudi Arabia that have sent crude-oil prices surging are certainly the story for financial markets on Monday. Whether they are more than just a fleeting headline depends on just how long production is knocked out or whether the facilities get attacked again.

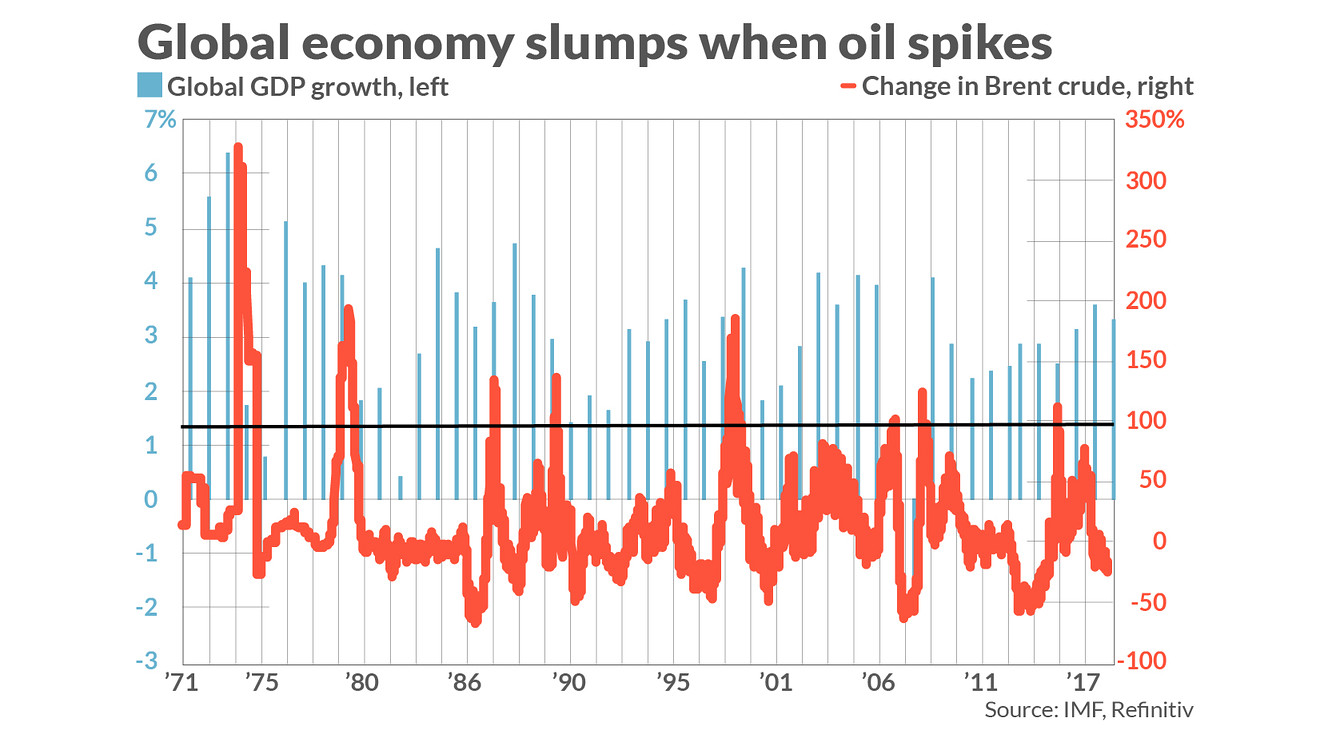

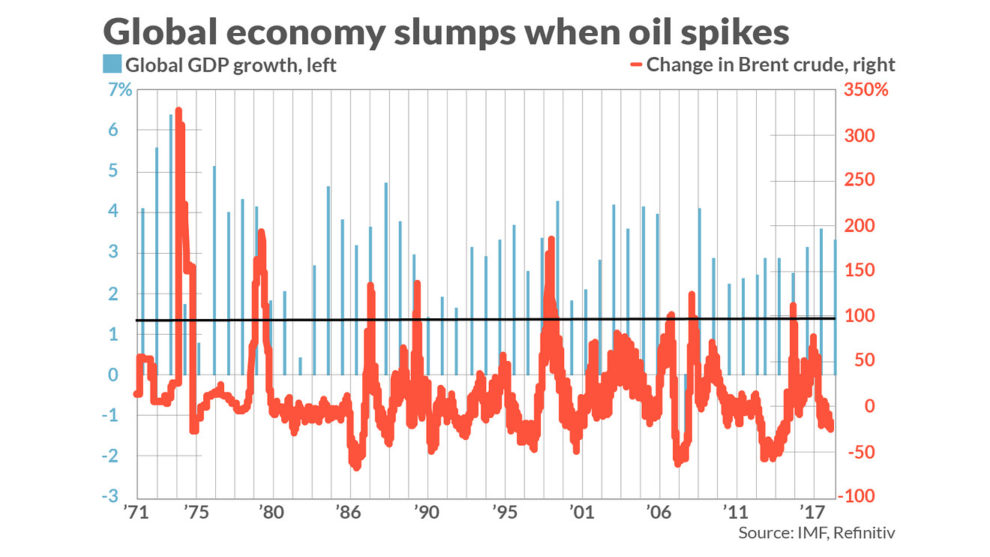

Analysts at U.K. investment adviser AJ Bell calculated that the last eight times that the year-over-year price growth for oil was over 100%, there was either a global recession or economic slowdown six times.

It’s worth pointing out that even with the big 10% rally in crude-oil prices, Brent crude prices BRN00, -1.49% , trading around $65 a barrel, are still below year-earlier levels. On Sept. 17, 2018, Brent traded at $78.40.

The nadir for oil prices last year was just over $50 a barrel, with last year’s average closer to $70.

So, deep breath. If oil prices stay below triple digits — $100 a barrel translate to roughly $3.57 a gallon at the pump — the economic consequences are not likely to be great.

A Federal Reserve paper in 2014 tried to get at the role of oil price shocks in causing U.S. recessions.

The Fed wasn’t sure whether oil prices caused recessions or simply was a proxy for other determinants of the business cycle.

For example, oil price increases and credit contractions tend to occur at approximately the same time, making it difficult to determine their respective contributions to the U.S. business cycle, the Fed paper noted. And while oil price spikes tend to precede recessions, recessions don’t always follow oil price spikes.

Add Comment