Call it revenge of the bonds — or the tech bros.

A nearly 5 basis point decline in the yield of the 10-year Treasury TMUBMUSD10Y, 1.563% sparked huge gains for the recently out-of-favor technology sector, with the Nasdaq Composite COMP, +3.69% registering its largest one-day advance since the U.S. election, and the ARK Innovation ETF ARKK, +10.42% surging over 10%.

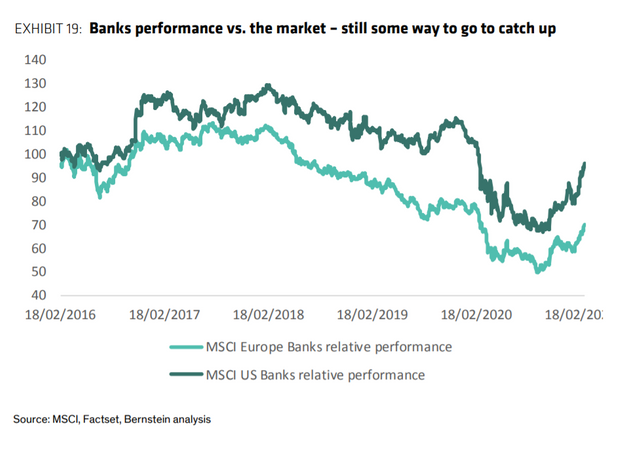

What was notable was that financials struggled — the SPDR S&P Bank ETF KBE, -1.54% ended 1.5% lower — but not to the same degree that techs thrived.

Portfolio strategists at Bernstein Research, led by Sarah McCarthy, say the two might not be yin and yang for much longer. “The momentum selloff is largely done. It is no longer as expensive, and the composition has changed due to the rotation. It no longer represents an extreme tech vs financials exposure. Momentum is now long cyclicals, with a much more balanced sector exposure,” she says.

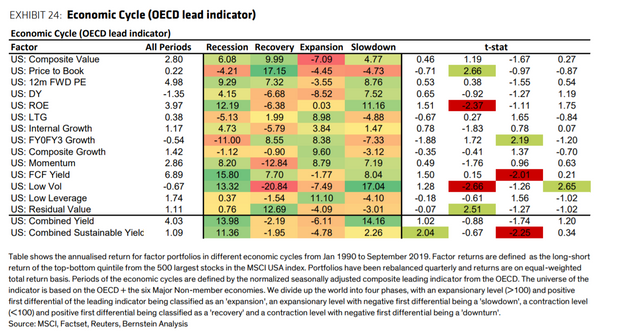

The value rally, however, can continue, being driven by continuously increasing yields and inflation expectations. Value does best in the recovery part of the cycle, and struggles in the expansion part.

McCarthy says the 2016 rally in value gives clues as to how long the current rally can last. In 2016, it ended as soon as the Federal Reserve hiked interest rates.

“Nominal yields, the yield curve and real yields steepened in the second half of 2016 in anticipation of the Fed raising rates — similar to what we are seeing now. If this is the case, then there could be a lot further to go (at the last Fed meeting, most members did not project rates increasing until beyond 2023),” she says.

Banks stocks are at the heart of the value trade, and there is further outperformance to go if they are to make up for the loss over the past 12 months, McCarthy says.

Also read: Eurozone banks are showing life after 15 rough years. Will the ECB snuff out the rally?

Add Comment