Three years ago, Lou Haverty went on the trip of a lifetime.

Haverty, a 39-year-old financial analyst who lives in Philadelphia, traveled across four continents during a two-week vacation. He visited some of the world’s top destinations — Abu Dhabi; Sydney, Australia; and Singapore — and only flew in first or business class. He stayed in multi-room suites at top-tier hotels.

Whenever possible, he opened more than one card on the same day because credit agencies compile multiple credit inquiries into a single pull, reducing the impact to his credit score.

The whole experience would have cost him over $36,000. But thanks to credit-card rewards and hotel loyalty programs, he only spent around $5,000.

At the time, Haverty worked in corporate banking, and his employer began requiring employees to take a full two weeks of vacation. He saw the requirement as an opportunity to take an incredible trip. Around that same time, Haverty heard about the apartment-like first-class accommodations on Etihad Airways’ flights between Abu Dhabi and Sydney.

“Unless you’re someone who’s independently wealthy, when would you have the chance to fly first class in what was essentially a small apartment from the Middle East to Australia?” said Haverty, who now runs the website Financial Analyst Insider. So he set about creating a vacation — centered on that one flight — that would cost him as little as possible.

Don’t miss: The $3 billion mistake Americans are making with their credit cards

Here’s how he did it:

Optimizing credit-card rewards

When Haverty set out to make this trip possible, he only had two credit cards. Over the course of a year, he would open seven more. He based his approach on the expertise he developed through his line of work.

“I managed it like a portfolio,” Haverty said. “What I discovered is you could open credit cards and increase your credit score in the process if you were disciplined about it.”

Courtesy of Lou Haverty

Courtesy of Lou Haverty

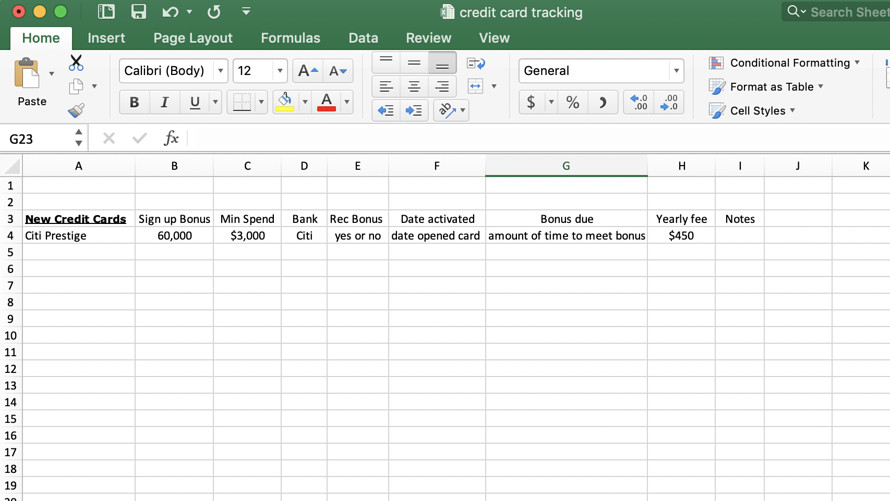

For starters, he created a spreadsheet to keep track of the cards he opened, the bonuses they offered, and the annual fees they charged. He also used the spreadsheet to remember how many credit cards he had opened from various banks, since some companies have rules limiting the number of cards a consumer can open.

Haverty timed things out so he would apply for new cards when there were large sign-up bonuses available. Whenever possible, he applied and opened more than one card on the same day; he found that credit agencies compiled the multiple credit inquiries into a single pull, reducing the impact to his credit score.

He focused his efforts on credit cards that had rewards programs with transferable points that could be used for a wide array of airlines. He also prioritized cards that offered better points-back rates, such as the Chase Ink card JPM, +2.40% (which offered 5X points at office-supply stores) and the American Express Blue Cash Everyday card AXP, +1.84% (which offered 5% back at grocery stores.)

After six or seven months, he would apply for new cards once the balances on the previous batch had been paid off.

Before closing a card, he inquired about transferring the card’s credit limit to another card from the same bank. This way he avoided reducing the amount of credit available to him.

In many cases, the credit cards waived the annual fee for the first year. When time came for the annual fee to kick in, Haverty evaluated whether a card was worth keeping. If it wasn’t, he closed it to prevent overspending.

Before closing a card, Haverty inquired about transferring the card’s credit limit to another card from the same bank. This way he avoided reducing the amount of credit available to him. Otherwise, closing these cards would worsen his credit utilization ratio — the measure of how much of their available credit a consumer has used — which is an integral part of a person’s credit score.

Overall, the credit-card strategy Haverty employed boosted his credit score by roughly 100 points over the course of a year.

‘What I discovered is you could open credit cards and increase your credit score in the process if you were disciplined about it.’

He developed two strategies to spend money quickly without putting a major dent in his bank account. The first involved using the credit cards to buy gift cards at grocery stores. “You can meet the purchase requirements on the credit cards, but give yourself extra time to spend the money as part of your regular everyday shopping rather than being forced to spend it too fast,” he said.

He especially did this when grocery stores ran promotions to get free gas for shopping.

He also bought electronics when they were on sale at stores like BJ’s Wholesale BJ, +2.07% and Costco COST, +0.95% and then resell them, either at-cost or at a slight discount on sites like Amazon. “It prevents you from buying the things you don’t need,” Haverty said.

Also see: This mother took her family on a $2,200 vacation to Disney World — for free

Making business travel pay off

He stayed in Hyatt hotels H, +1.85% as often as possible when traveling in the lead-up to his dream vacation. As a result, he earned Diamond status with Hyatt, which entitled him to a few free upgrades to suites during his vacation.

Otherwise, he used the Hyatt points he earned to help offset the cost of the hotels. There was another bonus to staying at Hyatt: He was entitled to free breakfast.

Throughout the 14-night trip, he only spent two nights at a hotel owned by a company other than Hyatt — in this case, a Hilton property in Frankfurt, Germany, during the final leg of his adventure.

Getty Images

Getty Images

The tally and final verdict

In total, Haverty spent roughly $3,400 on his accommodations, $745 on the taxes and fees for his flights that points couldn’t pay for and around $800 on dining and entertainment. All told, he estimates that he spent no more than $4,900 for this trip.

Of course, those calculations don’t take into account all the effort the endeavor required. “I wouldn’t call it a part-time job, but you have to put in time to manage something like that,” he said. “You have to treat it like a hobby.”

‘I wouldn’t call it a part time job, but you have to put in time to manage something like that.’

Nevertheless, the trip was more than worth it, he argued. He got to travel in the lap of luxury. Highlights included the culinary experiences in each of the cities he visited, riding in limos to and from the airport when he flew first class on Etihad and getting to spend time in some of the world’s most opulent airport lounges.

Haverty said it’s becoming increasingly difficult to recreate the trip in large part because banks have cut back on their credit-card rewards. For instance, Haverty took advantage of the fourth-night-free benefit with the Citi Prestige card, which reduced the cost of his hotel stays. Starting next month though, Citi C, +3.52% will only allow Prestige card holders to use the benefit twice a year, rather than on an unlimited basis.

Still, a person could cobble together a similar adventure if they tried hard enough. The key, Haverty said, is to ensure that racking up the rewards doesn’t put them in debt.

After all, what is ultimately the biggest downside to gaming rewards to earn a vacation like this? “Once you go back and have to fly economy, it makes it harder to do,” Haverty said.

Add Comment