To be a successful investor, you must always remember that there are many people in the stock market who are much smarter than you are.

That brings two benefits. It helps you avoid arrogance, which the market invariably punishes, often severely. And it reminds you there are plenty of portfolios worth raiding for ideas.

Everyone knows about mimicking the holdings of investment wizards, such as Warren Buffett and Carl Icahn, for stock ideas. Instead, I’d like to introduce you to someone who’s unknown: cancer-therapy researcher James Allison.

Why should you care what companies he’s in?

First, Allison is a rare genius in biotech. He helped invent an entire branch of cancer treatment called immunotherapy, and he won Nobel Prize for it in 2018. Second, coat-tailing is especially useful in biotech, which I will demonstrate in a moment. Third, Allison is one of the good guys in the world, so he’s not lending his name to companies just for a fast buck.

Before we get to six of his favorite cancer-therapy companies, let’s take a closer look at the three reasons why it makes sense to follow Allison in biotech.

1. Allison knows his corner of biotech better than anyone

The son of a medical doctor, Allison saw his mother die from lymphoma when he was 10. So it’s easy to see why he set out to pioneer scientific breakthroughs that ultimately created new cancer therapies. It all began modestly enough, with a high school correspondence course in biology from the University of Texas.

Allison’s big breakthrough (with help from several other researchers) was the discovery of CTLA-4, a T cell protein receptor which stops T cells from attacking cancer. This led to the development of a CTLA-4 antibody that lifts this brake on T cells so they can recognize and attack cancer. Therapies like this one, known as ipilimumab, are called checkpoint inhibitors. Approved in 2011 as Yervoy, this was the original cancer immunotherapy.

Immunotherapy works so well it is now the fourth pillar of cancer treatment, alongside surgery, radiation and chemotherapy.

In 2018 Allison won the Nobel Prize in Physiology or Medicine for his research. He is the chairman of the Department of Immunology at MD Anderson Cancer Center at the University of Texas. He’s also been the head of immunology programs at University of California, Berkeley, and Sloan Kettering Institute. (Fun fact: On the side Allison is an avid blues and country-and-western harmonica player who has shared the stage with Willie Nelson.)

2. Coat-tailing is a must in biotech

Cribbing ideas from smart investors is sometimes called coat-tailing. That sounds pejorative. But don’t let that stop you. No less an investor than Buffett was a shameless coat-tailer for much of his early career, and for good reason. It helps.

Coat-tailing is especially useful in a complex field like biotech. For my stock newsletter, Brush Up on Stocks, I track about a dozen of the best biotech investment shops to find names for subscribers. Looking at who owns what is about a third of my process for selecting stocks in biotech.

I also look at the science and partnerships, but coat-tailing has surely helped put me and my subscribers in 10- and 20-baggers, such as Pharmacyclics and Synageva Biopharma, two early suggestions in my stock letter that ultimately rocketed when they were bought by AbbVie ABBV, -0.15% and Alexion Pharmaceuticals ALXN, +7.40%.

More broadly, a Brush Biotech 7 portfolio I put in my stock letter in August 2017 has done really well. It was up 93% by Oct. 18, 2019, compared with flat returns for the iShares Nasdaq Biotechnology Index ETF IBB, +0.32% and SPDR S&P Biotech ETF XBI, -0.38%, and 27% gains for the S&P 500 SPX, +0.28%.

Big winners in my Brush Biotech 7 portfolio included Sarepta Therapeutics SRPT, -1.67% and Ascendis Pharma ASND, -1.33% — up 135%-266%. Those more than offset damage from the big losers, which included Radius Health RDUS, +0.74% and Pieris Pharmaceuticals PIRS, +2.91%, which are down 22%-37%. (Both are still “holds” or “buys.”)

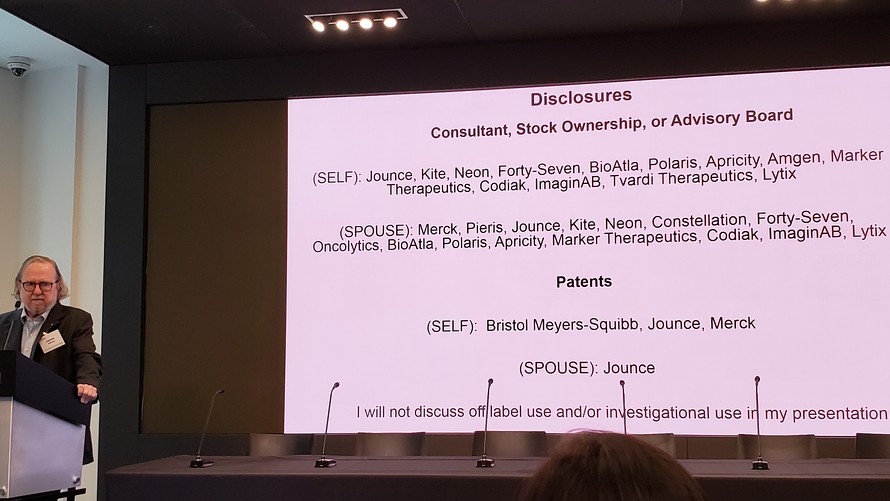

Coat-tailing is so important in biotech, I was excited to see at a recent Allison presentation in New York City that he puts up disclosure slide. I am happy to add him to the biotech experts whose positions in biotech companies I track for insights.

3. Allison wears a white hat

Allison comes from South Texas cowboy country, and I’d definitely group him in with the ones with the white hats. Hailed as a true American hero in the documentary “Breakthrough,” Allison deserves accolades for “doing the right thing” by doggedly pursuing cancer immunotherapy back in the 1980s when most people thought it was a fool’s errand.

He stuck with it until the world caught on and his check point inhibitors were recognized as the real deal. This happened because of his sheer drive and independent thinking. As a child, his older brother nicknamed him “diamond head,” because of his strong will. Allison is not afraid to call out the biotech patent system that blocked much of his early research as “bullshit,” in a public forum.

Why should we care, as investors, whether he’s one of the good guys? The investing world is full of crooks, scammers and head fakes. But because of Allison’s character, I’m taking his involvement in biotech companies as a sign that he actually thinks their science is viable — and he’s not just exchanging his good name for a fast buck. Allison also gets royalty streams from Bristol-Myers Squibb BMY, +0.64% and Merck MRK, +1.93% for his immunotherapy breakthroughs, so I doubt he needs to form ties with companies merely for the money.

Now here are six companies Allison either owns or has advised. To me, his association with these companies makes them interesting investments. There are three big ones, and three small ones.

Michael Brush

Michael Brush Bristol-Myers Squibb

Immunotherapies work well against cancers, but they have their shortcomings. They work only in about 60% of melanoma patients treated, and 40% of kidney cancer patients, says Allison. The numbers are much lower for glioblastoma and pancreatic cancer, and zero for prostate. To boost success rates, Bristol-Myers Squibb BMY, +0.64% has over two dozen studies on checkpoint inhibitors.

The Allison connection: This company is the home of the therapy Allison helped develop, or Yervoy (ipilimumab), and another checkpoint inhibitor called Opdivo (nivolumab). These two therapies account for 36% of the company’s revenue. In short, it owns a big piece of the immunotherapy franchise, so it has a big stake in improving it. And it will.

Amgen

This biopharma giant has an oncology division with several irons in the fire in immunotherapy. It is developing chimeric antigen receptor or Car T cell therapies; a technology called bispecific T cell engager (BiTE) to overcome cancer cell evasion of the immune system; and an immunotherapy technology called “XmAb,” developed in a partnership with Xencor XNCR, -1.81%.

At about $204 a share, Amgen AMGN, -0.74% trades close to the $165 per-share value Jefferies biotech analyst Michael Yee assigns to the company sans pipeline, which includes promising cancer therapies code-named AMG 510 and AMG 701. Amgen pays a 3% dividend yield.

The Allison connection: He has served as an adviser to Amgen’s cancer-therapy division.

Gilead Sciences

Troubled Gilead GILD, +1.09% snapped up the promising chimeric antigen receptor or Car T cell therapy company called Kite Pharma in 2017. This cell therapy uses a patient’s own immune cells to fight cancer.

At $66 a share, Gilead trades around the $65 valuation that Yee has for the business without the pipeline. That pipeline contains potentially promising therapies for the liver disease nonalcoholic steatohepatitis (NASH), and another drug candidate called filgotinib for rheumatoid arthritis, Crohn’s disease and colitis, among many others. Gilead’s shares have a 4% dividend yield.

The Allison connection: He has served on the advisory board at Kite Pharma.

Now here are three tiny companies that Allison is involved with.

Jounce Therapeutics

Jounce Therapeutics JNCE, +11.05% is a small, early-stage company that tries to identify biomarkers on tumor cells that can help doctors better match immunotherapies to cancers. It has two therapies in Phase I and II clinical development, and four in pre-clinical study.

The Allison connection: He owns the stock, and he is a co-founder along with Padmanee Sharma. She is a fellow researcher at the University of Texas MD Anderson Cancer Center as well as his wife.

Forty Seven

Forty Seven FTSV, -6.20% thinks that blocking the CD47 “don’t eat me” signaling pathway in tumors makes them vulnerable to macrophages. Those are the body’s first responders, which swallow abnormal cells and mobilize the immune system.

The company’s lead product candidate, called 5F9, is in Phase I and II trials. It has other therapies in pre-clinical development.

The Allison connection: He’s on the company’s scientific advisory board, along with Sharma at the MD Anderson Cancer Center.

Market Therapeutics

Marker Therapeutics MRKR, -1.47% (formerly called TapImmune) has technology that grows rare cancer-killing T cells that recognize antigens on tumor cells. The company’s management thinks these T cells can be injected into the body to kill cancer cells. Marker is also developing an antigen-expression technology called PolyStart, which may help the immune system recognize and destroy diseased cells.

Note: Of the three small companies mentioned here, this is the one that has the best ownership profile, according to the system I use at my stock letter.

The Allison connection: He’s on the company’s scientific advisory board, along with Sharma at the MD Anderson Cancer Center.

Allison is also a science adviser to these private companies: Neon Therapeutics, BioAlta, Apricity, Lytix and Codiak. None responded to requests for time lines on their initial public offerings. But given the Allison connection, they’re worth watching when they do come public.

At the time of publication, Michael Brush had no positions in any stocks mentioned in this column. Brush has suggested BMY, MRK, XNCR, AMGN and GILD in his stock newsletter, Brush Up on Stocks.

Add Comment